Analysis

January 6, 2024

Final thoughts

Written by Michael Cowden

I’d have been surprised if anyone told me just last week that the January scrap market might move lower.

What we saw on Friday were offers. Not settlements. And no doubt there are still some twists and turns in store before we can say for sure which way scrap will go.

A scrappy surprise

Again, I’m not going to predict where things will settle. But to say that a potential drop in scrap prices this month would come as a surprise would be an understatement.

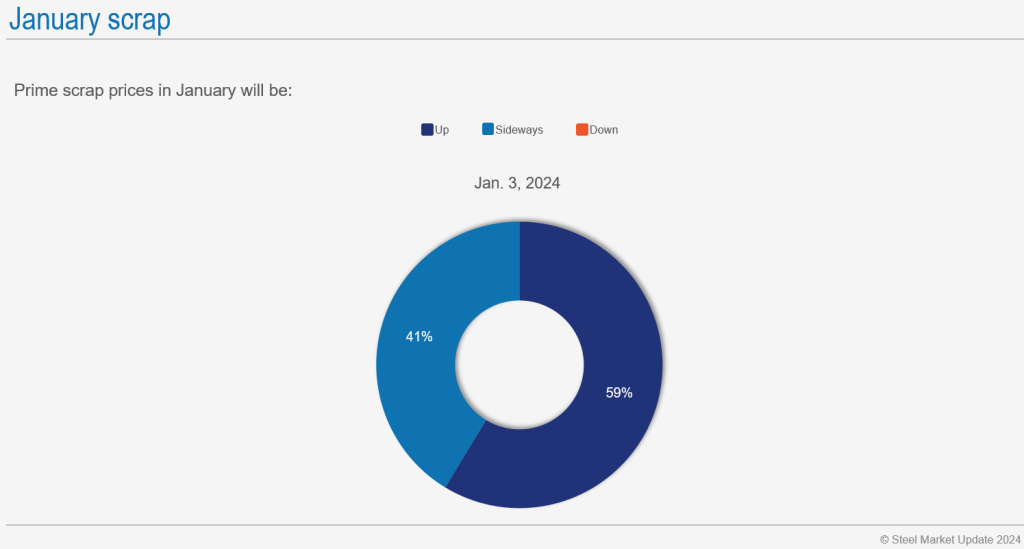

About 60% of respondents to SMU’s most recent survey predicted that prime scrap would be up. Roughly 40% said prime would be sideways. None predicted down:

That said, the commentary we received was not exactly bullish. Here is a sampling:

- “Up but just marginally. Typical winter logistics issues, but less.”

- “After a stronger-than-normal December, it will flatten out.”

- “Peak before a downward trend.”

- “Down February through … May?”

So while almost no one expected prime scrap to go down in January, there seemed to be something of a consensus that prime prices were at or near a peak following big gains in December.

On second thought, maybe I shouldn’t have been so surprised that scrap didn’t come out of the gate fast in 2024. We saw futures start out last week strong ahead of a Cleveland-Cliffs sheet price increase on Wednesday only to reverse course by the end of the week.

Are we near a peak?

A closer look at our survey data is also less bullish than I would have expected for the beginning of the year, which is traditionally expected to be stronger as buyers restock ahead of the busier spring months.

Case in point: As we reported on Thursday, sheet and plate lead times were down. That wasn’t a huge surprise. It might have reflected a typical holiday lull.

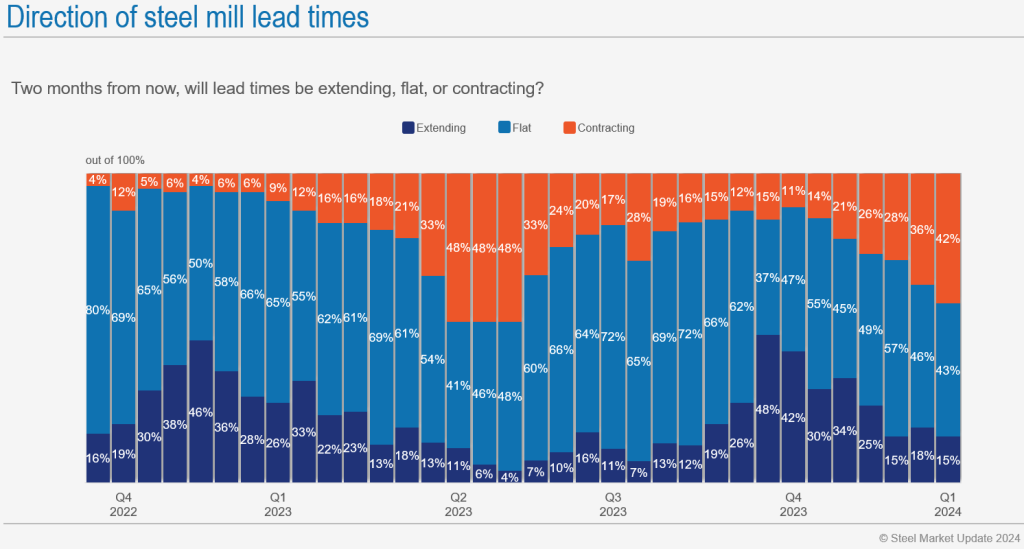

What surprised me was this: How many survey respondents (42%) predicting that lead times would be contracting two months from now:

Compare that to the start of 2023. Then, only 9% predicted that lead times would be contracting by early March. We didn’t see more than 40% of respondents predicting shorter lead times last year until April – just before a sheet price correction got underway.

Here is what some of our readers had to say about their expectations for lead times:

- “Having returned to 4-6 weeks, they will flatten out.”

- “They will gradually move back to under five weeks for HRC.”

- “Expecting lead times to come down in March with more spot available.”

- “Inventory will start to budge, and more foreign will be arriving.”

- “Between imports and domestic capacity coming on, we see things retreating.”

It’s a similar theme when it comes to predictions for finished steel prices. Expectations now compared to those at the beginning of 2023 are very different.

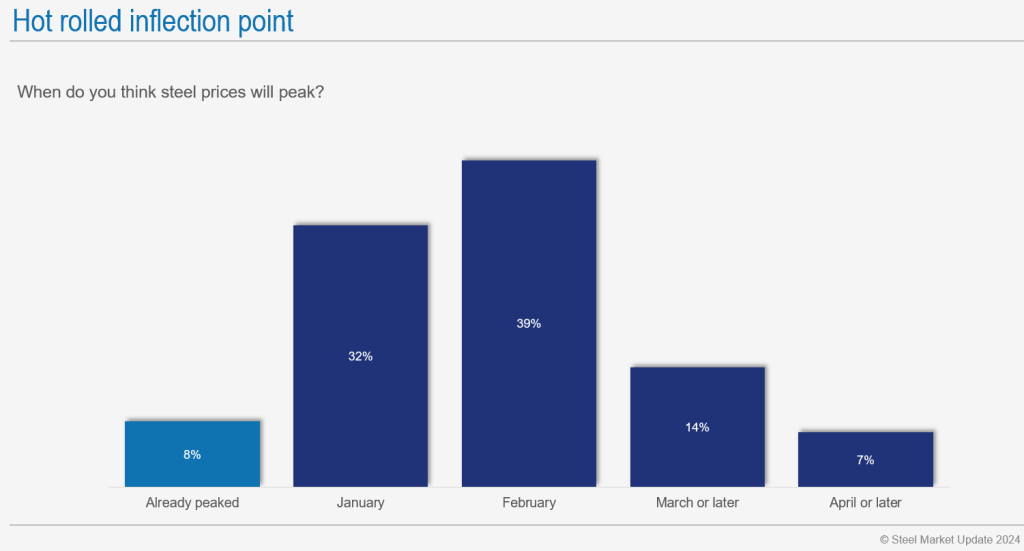

Nearly 80% of survey respondents now think prices have already peaked, or will later this month or next:

That’s a departure from this time last year, when about 50% of respondents thought HRC prices would peak in Jan.-Feb. while another roughly 50% thought they wouldn’t peak until March, April, or later.

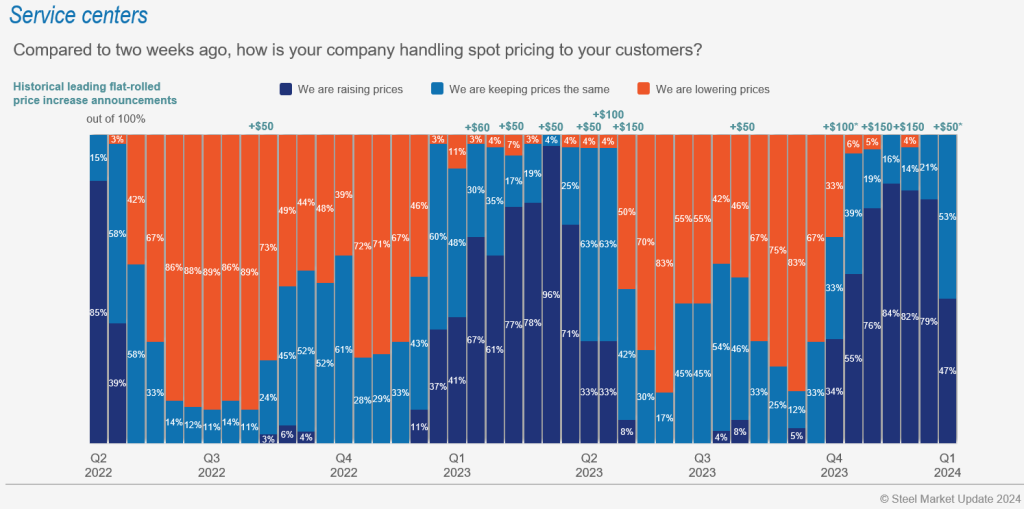

Another big change: A narrow majority of service centers (53%) now tell us that they are keeping prices flat:

Compare that to Q4’23, when most service centers (~80% or more in the latter part of the quarter) told us that they were raising prices.

In my experience, if you ask a service center why they’re not increasing prices, they’ll tell you that they’re following the lead of their mill suppliers. And we have seen sheet prices flatten out over the last month, according to our pricing tool.

If other mills follow Cliffs and increase prices, then perhaps we’ll see more service centers raising price in tandem with mills in our next survey. But they don’t follow, or if scrap slides or goes sideways, it’s hard to see that increase announcement as a slam dunk.

Imports on the rise?

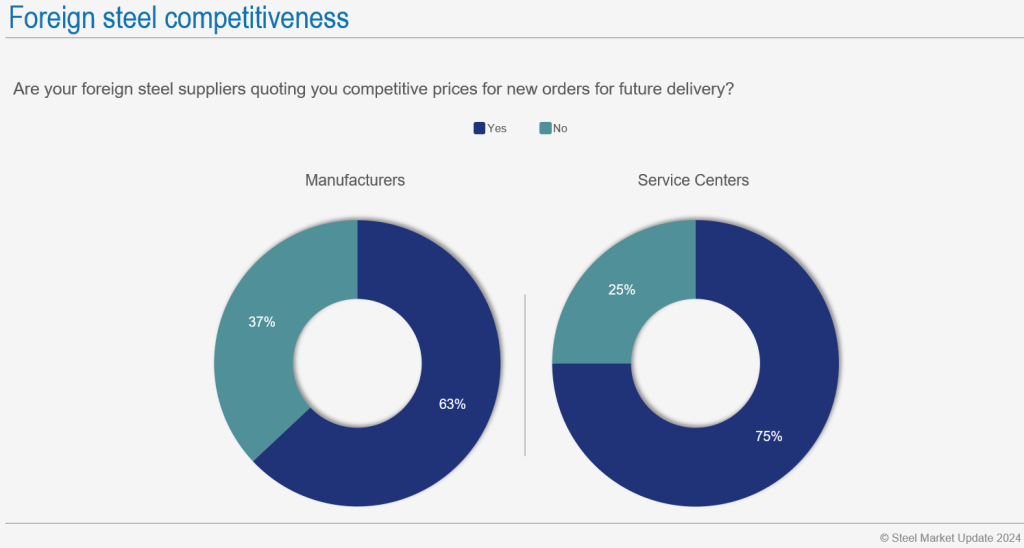

Another thing to keep an eye on is imports:

Large majorities of both manufacturer and service center buyers continue to tell us that they find import pricing attractive.

We saw imports increase in December. How many tons might arrive in the first quarter? It’s too early to say. But it’s worth keeping a close eye on government license data going forward.

Business is still good

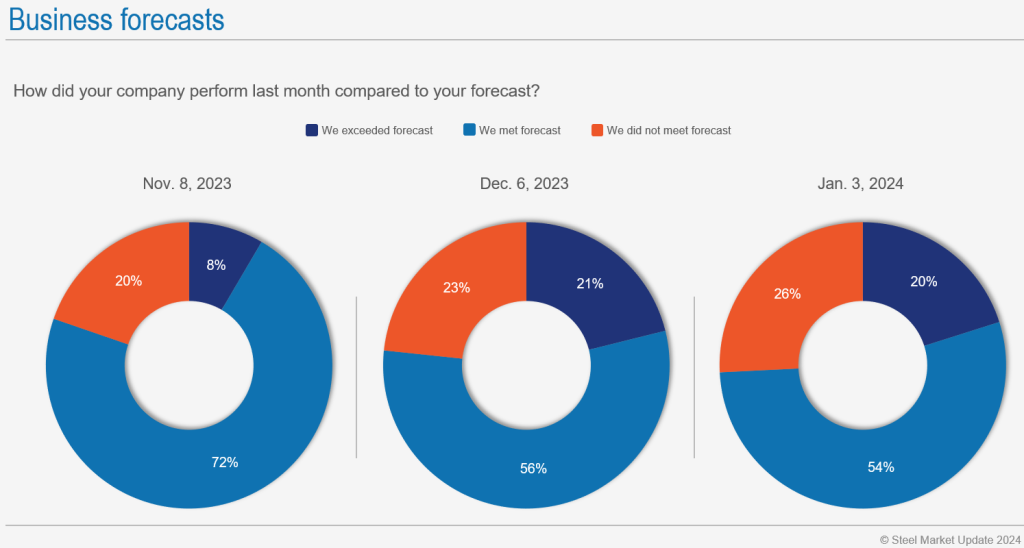

The saving grace remains that most respondents (74%) continued to tell us that they met or exceeded forecast last month – a consistent trend throughout Q4’23:

We can worry about the prospect of shorter lead times, steel and scrap prices potentially peaking, and higher import volumes. But if business is as expected or better, these are concerns companies can probably take in stride.

Tampa Steel Conference

Get a better handle on what’s in store for 2024 at our Tampa Steel Conference, where we’ll have three industry analysts – Alex Hacking of Citi, Josh Spoores of CRU, and Timna Tanners of Wolfe Research – providing their take on the current steel market.

The event is coming up in just three weeks. Nearly 400 people have already registered, putting us on track to beat last year’s record attendance. So don’t delay, register today!