Market Data

January 4, 2024

SMU survey: Lead times contract but remain at healthy levels

Written by Laura Miller

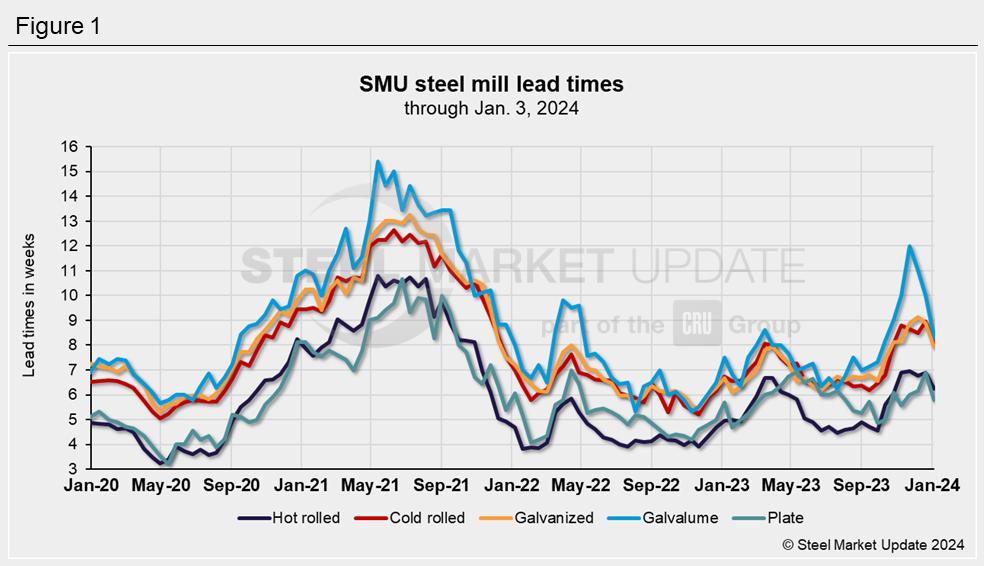

Steel mill lead times pulled back across the board this week but are still said to be at healthy levels, according to SMU’s market survey this week.

Buyers have not reported production times this short since October for sheet products and early November for plate.

Steel mill lead times this week

Hot-rolled coil lead times were reported by buyers in SMU’s survey this week to be between 4 and 9 weeks. The average of 6.26 weeks was 0.63 weeks shorter than our last market check on Dec. 21, 2023. To compare, HRC lead times were 5.0 weeks in the first week of 2023.

Buyers reported lead times for cold-rolled coil ranging from 6 to 10 weeks. This week’s average of 8.00 weeks was a contraction of almost a week from 8.94 weeks in our last market check. At this time last year, CRC lead times averaged 6.7 weeks.

Lead times for galvanized sheet were said to be between 6 and 10 weeks in this week’s check of the market. The average of 7.93 weeks is also nearly a week shorter than the 8.88-week lead time reported during the week of Dec. 21. Galv lead times were 6.7 weeks during the same week of 2023.

After being extended in our previous five market checks, lead times for Galvalume sheet saw a large pullback this week, with the average of 8.33 weeks contracting by 1.67 weeks from two weeks earlier. Buyers reported Galvalume lead times from 6 and 12 weeks. The average lead time remains stretched compared to the 7.5-week lead time seen in the first week of 2023.

Note that our data for Galvalume is more volatile due to the smaller sample and market size. If you are a buyer of Galvalume and would like to share your lead time and pricing data with SMU, please contact david@steelmarketupdate.com.

Plate buyers reported a lead time range of 4 to 8 weeks this week. The average of 5.80 weeks contracted by 1.09 weeks from two weeks prior and is the shortest plate lead time since mid-November. Plate’s average lead time is comparable to the 5.7 weeks reported at the start of 2023.

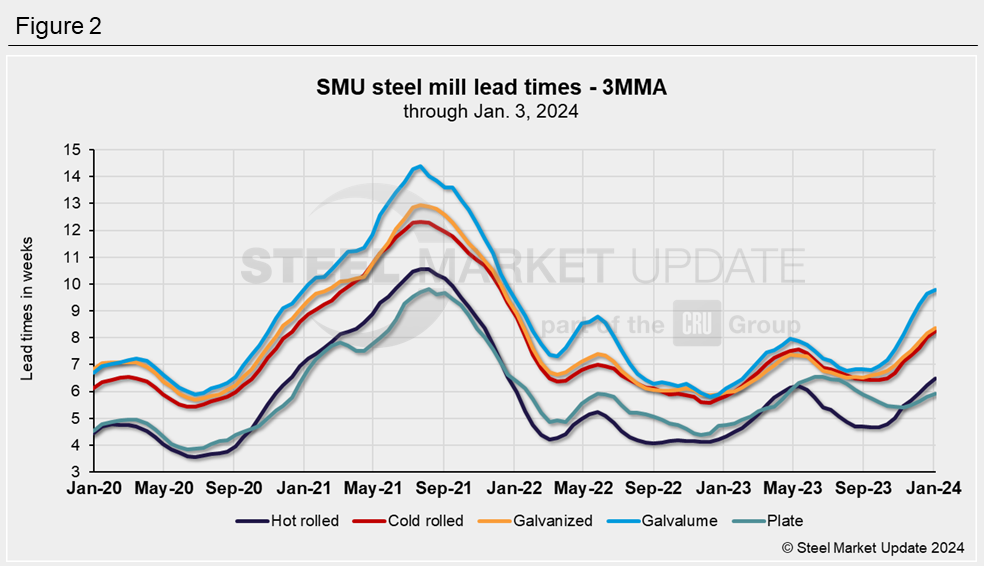

3MMA lead times

To smooth out the variability in SMU’s biweekly readings, we can look at lead times on a three-month moving average (3MMA) basis.

Lead times for all flat-rolled steel products tracked by SMU continue to trend upward, based on their 3MMAs (Figure 2).

The 3MMAs were calculated this week to be 6.5 weeks for hot rolled, 8.2 weeks for cold rolled, 8.4 weeks for galvanized, 9.8 weeks for Galvalume, and 5.9 weeks for plate.

SMU’s survey results

Half of buyers in SMU’s survey this week said they believe current lead time levels are ‘slightly longer than normal,’ while 40% categorized them as ‘normal.’

Buyers were split on whether lead times will be flat from current levels (43%) or contracting (42%) two months from now.

Here are a few comments from survey respondents on whether lead times will be extending, flat, or contracting two months from now:

“Mills are in no rush to catch up but can’t let the slag continue for long. Customers are tight and will be pressuring for throughput.” – Service center predicting flat lead times

“Inventory will start to budge, and more foreign material will be arriving.” – Service center foreseeing contracting lead times

“Expecting lead times to come down in March with more spot availability.” – Service center predicting contracting lead times

“Behind imports and domestic capacity coming on, we see things retreating.” – Manufacturer expecting contracting lead times

“Mills will curtail working against themselves by offering shorter lead times.” – Manufacturer foreseeing flat lead times

“Having returned to 4-6 weeks, they will flatten out.” – Manufacturer expecting flat lead time times

“They will gradually move back to under five weeks for HRC.” – Supplier forecasting contracting lead times

One manufacturer noted the election cycle and market concerns as reasons for predicting contracting lead times.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.