Prices

December 19, 2023

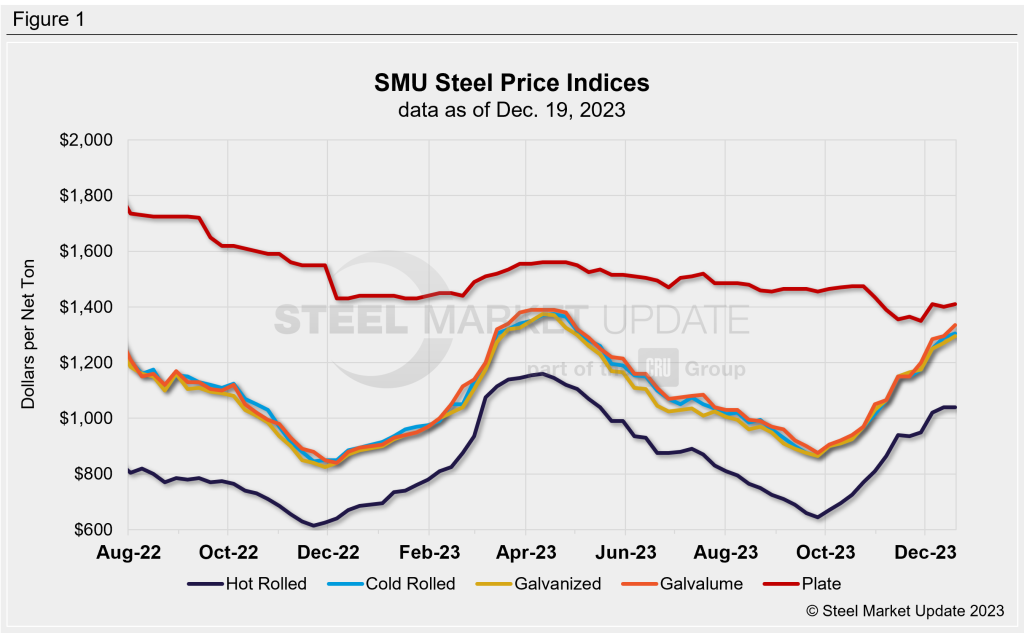

SMU price ranges: HRC unchanged, CR/coated continue to rise

Written by David Schollaert & Michael Cowden

US hot-rolled coil (HRC) prices were unchanged week over week (WoW) following a string of mostly upward moves dating back to late September.

The result: SMU’s HRC price continues to average $1,040 per ton ($52 per cwt).

Some mills continue to seek $1,100 per ton, the minimum base prices announced by Nucor and by Cleveland-Cliffs, market participants said. But certain producers in the north have cut deals in the $900s per ton for orders of thousand tons for late-January production, some said.

It was a different story for cold-rolled (CR) and coated products, where base prices continue to rise. That’s assuming you can find spot tons, with some industry sources saying they could find little to no domestic spot availability for certain light-gauge items.

SMU’s CR base price stands at $1,305 per ton on average, up $15 per ton from a week ago. Galvanized base prices average $1,295 per ton, up $25 per ton from last week. And Galvalume prices are at $1,335 per ton on average, up $40 per ton from a week earlier.

Plate prices, meanwhile, inched up $10 per ton to an average of $1,450 per ton.

Our sheet momentum indicators continue to point upward based on strength in pricing for tandem products. But we will watch for any signs of prices plateauing in the new year. Our plate price momentum indicator remains in neutral until we see more consistent and substantial gains.

Editor’s note: SMU’s offices will be closed for the holidays the week of Dec. 25. That means we will not update prices on Tuesday, Dec. 26. We will resume our normal pricing schedule on Tuesday, Jan. 2.

Hot-Rolled Coil

The SMU price range is $980–1,100 per net ton ($49–55 per cwt), with an average of $1,040 per ton ($52 per cwt) FOB mill, east of the Rockies. Both the bottom end of our range and the top end of our range were unchanged vs. one week ago. Our overall average is sideways WoW. Our price momentum indicator for HRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Hot Rolled Lead Times: 6–8 weeks

Cold-Rolled Coil

The SMU price range is $1,260–1,350 per net ton ($6300–67.50 per cwt), with an average of $1,305 per ton ($65.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $10 per ton vs. the prior week, while the top end of our range was up $20 per ton. Our overall average is up $15 per ton vs. the week prior. Our price momentum indicator for CRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Cold Rolled Lead Times: 6–12 weeks

Galvanized Coil

The SMU price range is $1,260-1,330 per ton ($63–66.50 per cwt), with an average of $1,295 per ton ($64.75 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $20 per ton vs. the prior week, while the top end of our range is up $30 per ton WoW. Our overall average is up $25 per ton vs. the week prior. Our price momentum indicator on galvanized steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,357–1,427 per ton with an average of $1,392 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-11 weeks

Galvalume Coil

The SMU price range is $1,300–1,370 per net ton ($65–68.50 per cwt), with an average of $1,335 per ton ($66.75 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $50 per ton vs. the prior week, while the top end of our range was up $30 per ton. Our overall average is up $40 per ton vs. the week prior. Our price momentum indicator on Galvalume steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,594–1,664 per ton with an average of $1,629 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-15 weeks

Plate

The SMU price range is $1,370–1,450 per net ton ($68.50–72.50 per cwt), with an average of $1,410 per ton ($70.50 per cwt) FOB mill. The lower end of our range was unchanged WoW, while the top end of our range was $20 per ton higher. Our overall average is up $10 per ton vs. one week ago. Our price momentum indicator on steel plate shifted from neutral to higher, meaning SMU expects prices will increase over the next 30 days.

Plate Lead Times: 4-7 weeks

SMU Note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert