Prices

November 9, 2023

HRC Futures: Utilizing Futures Spreads

Written by Logan Davis

Several past columns in SMU have included comments about the futures forward curve, using terms like contango and backwardation. This week, we wanted to take time to discuss why these concepts matter, and what to look for in the forward curve to take advantage price relationships in the market.

The concepts may make more sense in terms of day-to-day operations of a steel company. Let us say that a company has a view that, despite recent price declines, the steel market will rebound over the next few months. In that scenario, it is plausible to think that the company may intentionally build inventories now, to be ready for future sales volumes. This strategy would require several things in terms of the company’s readiness: 1) the company must have storage space for the additional material, 2) the company would require either available credit or cash reserves to purchase the material today. Enter the bull calendar spread…

A bull calendar spread in the steel market is a trading strategy that involves taking a bullish view on steel prices but with a focus on the difference in price between two futures contracts with different expiration dates. In this strategy, the trader simultaneously goes long (buys) a near-term steel futures contract and goes short (sells) a later-term steel futures contract.

When trading futures, one of the caveats often discussed is margin risk, or the potential for a capital call. There are two types of margin: initial margin requirement and maintenance margin requirement.

• Initial Margin: the amount of capital that a futures trader must deposit in their trading account when they initiate a futures position. It acts as a form of collateral or security to cover potential losses that may occur if the trade goes against the trader.

• Maintenance Margin: the minimum account balance that a trader must maintain in their trading account to keep their futures positions open. It is typically lower than the initial margin requirement.

The initial margin requirement varies based upon the commodity but is generally set by the exchange as a percentage of the total contract value. To demonstrate this, take the current price per ton in December hot-rolled coil (HRC) futures ($1,025) times the size of the contract (20 tons) to calculate the total contract value ($20,500). The current initial margin requirement for a December-March HRC spread is $1,000 per contract or ~5% of the contract value ($1,000/$20,500). In the example above, a company purchasing physical steel would need to pay (or have credit) to purchase the total value of the steel. By using a futures spread, the company is required to put up ~5% of the total value, and then be able to meet any maintenance margin calls that occur.

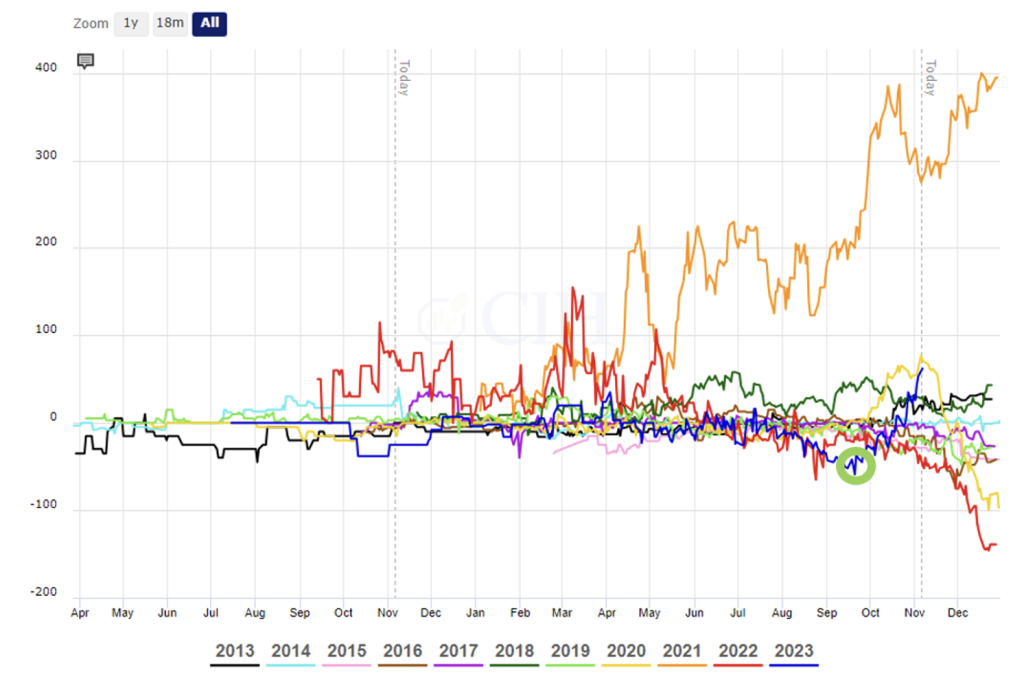

With that understanding of the leverage component in futures, we will look at the past and current spread market. As recently as early October, the forward curve was in a historically significant contango, meaning that deferred prices were higher than the nearby contracts. Below, you see a stacked graph of the December-March Futures spread for the last 10 years. I have circled the level of the spread in Mid-September.

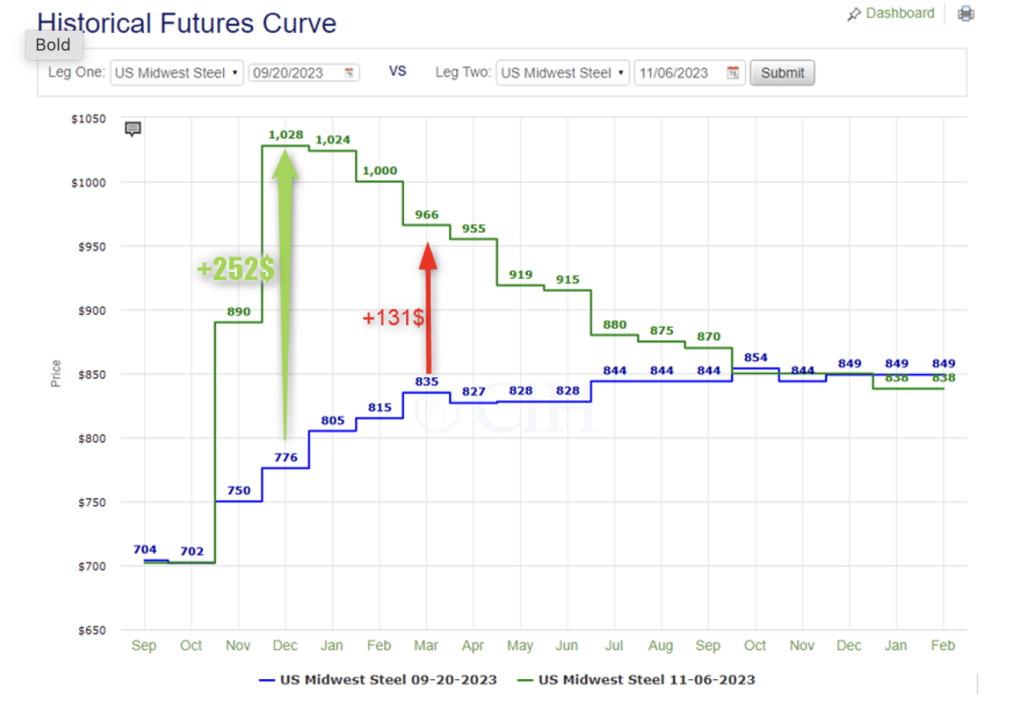

The spread traded as low as -$59/ton. Fast forward a few weeks, add in some progress in labor talks with the UAW and geopolitical escalation in the Middle East, and those relationships have changed dramatically in a very short period. On Thursday, that spread is trading +$62/ton. To show this in a different way, we can look at the futures curve from Sept. 20, 2023, (blue) as compared to Nov. 6, 2023, (green).

You can see that the shape of the curve has changed dramatically, resulting in an increase in the December 23 contract of ~$250 and increase in the March 2024 contract of ~$130. The results for the Dec’23/Mar’24 bull calendar spread is a profit of ~$120 to our hypothetical steel company. This profit can now be applied toward a more expensive physical steel, as the rebound that was anticipated by our company has been realized in the marketplace.

Utilizing futures calendar spreads is a strategy that can be used by steel companies to take advantage of the structure of the futures curve. Keep in mind, they can either be bullish, long nearby, short deferred-like the example above-or bearish- short the nearby and long the deferred. Strategies like this can enhance a company’s ability to capitalize on the market structure and their biases, especially when the constraints like storage capacity and cash flows disallow a similar physical transaction.

There is a risk of loss in futures trading. Past performance is not indicative of future results. © 2023 Commodity & Ingredient Hedging, LLC. All rights reserved.