Plate

November 7, 2023

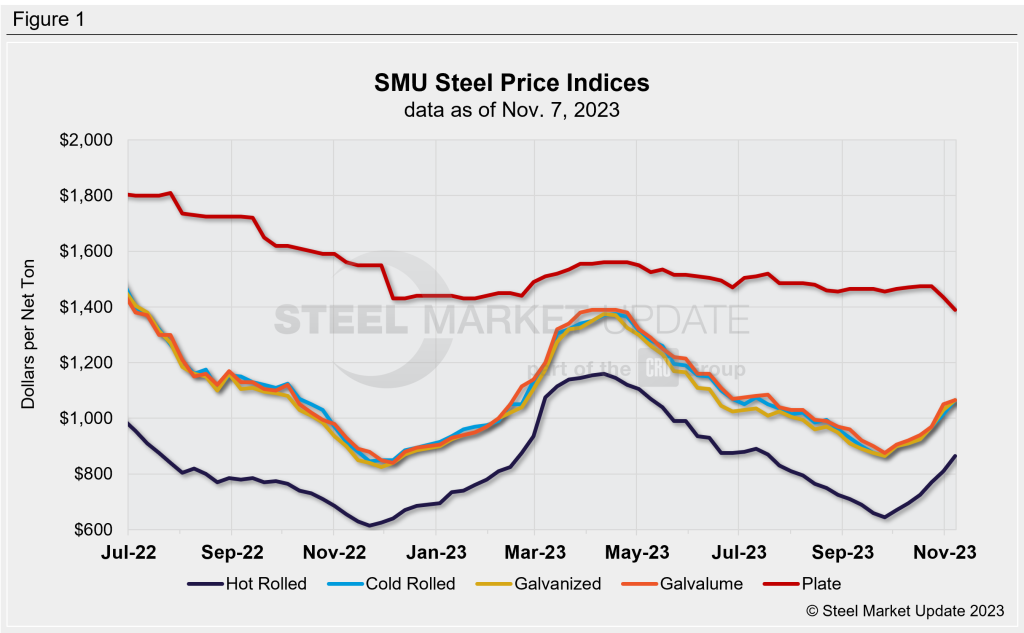

SMU Price Ranges: Sheet Skyrockets, Plate Stumbles

Written by David Schollaert & Michael Cowden

Spot prices for steel sheet continued to shoot upward this week, which brought yet another round of price hikes.

The wave of domestic mill prices hikes – with Cliffs now seeking $1,000 per ton ($50 per cwt), up $100/ton from just a week ago – combined with long lead times have squeezed the spot market.

Market participants said few mills had spot tonnage available for December. And that’s true not only for cold-rolled and coated products but also for hot-rolled coil. If mills do have spot available before the end of the year, they intend to charge a premium for them, sources said.

The result: SMU’s hot-rolled coil price stands at $865 per ton on average, up $55 per ton from last week and up $195 per ton from a month ago.

That’s the first time we’ve recorded HRC prices rising more than $50 per ton since late February, when they were on their way to a spring peak of $1,160 per ton.

Base prices for cold-rolled (up $65/ton week on week), galvanized (up $35 per ton WoW), and Galvalume (up $15 per ton WoW) also continued to move higher.

Plate prices, meanwhile, fell again following Nucor’s $140-per-ton price cut. SMU’s plate price now stands at $1,390, down $45 per ton from last week and down $75 per ton from early October.

Our sheet price momentum indicators continue to point upward. Our plate price momentum indicator remains pointed downward.

Hot-Rolled Coil

The SMU price range is $830–900 per net ton ($41.50–45.00 per cwt), with an average of $865 per ton ($43.25 per cwt) FOB mill, east of the Rockies. The bottom end of our range increased $60 per ton vs. one week ago, while the top end of the range moved up $50 per ton compared to the prior week. Our overall average is up $55 per ton WoW. Our price momentum indicator for HRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Hot Rolled Lead Times: 4–9 weeks

Cold-Rolled Coil

The SMU price range is $1,030–1,100 per net ton ($51.50–55.00 per cwt), with an average of $1,065 per ton ($53.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $70 per ton WoW, while the top end was $30 per ton higher compared to a week ago. Our overall average is up $50 per ton WoW. Our price momentum indicator for CRC continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Cold Rolled Lead Times: 6–10 weeks

Galvanized Coil

The SMU price range is $1,030–1,100 per net ton ($51.50–55.00 per cwt), with an average of $1,065 per ton ($53.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $30 per ton vs. last week, while the top end of our range was also up $40 per ton WoW. Thus, our overall average is up $35 per ton vs. the prior week. Our price momentum indicator on galvanized steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,127–1,197 per ton with an average of $1,162 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-10 weeks

Galvalume Coil

The SMU price range is $1,030–1,100 per net ton ($51.50–55.00 per cwt), with an average of $1,065 per ton ($53.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was up $30 per ton vs. last week, while the top end of the range was unchanged WoW. Our overall average was up $15 per ton compared to one week ago. Our price momentum indicator on Galvalume steel continues to point higher, meaning SMU expects prices will increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,324–1,394 per ton with an average of $1,359 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-12 weeks

Plate

The SMU price range is $1,360–1,420 per net ton ($68.00–71.00 per cwt), with an average of $1,390 per ton ($69.50 per cwt) FOB mill. The lower end of our range was down $20 per ton WoW, while the top end of our range was down $70 per ton compared to the week prior. Our overall average is down $45 per ton vs. one week ago. Our price momentum indicator on steel plate shifted from neutral to lower, meaning SMU expects prices will decrease over the next 30 days.

Plate Lead Times: 4-9 weeks

SMU Note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert