Government/Policy

April 2, 2023

Final Thoughts

Written by Michael Cowden

This pre-holiday steel market feels a little like the one before Thanksgiving – albeit at approximately double the price.

Back in November, hot-rolled coil prices had crashed to around $600 per ton ($30 per cwt), and there were questions about whether and when mills might push to increase prices to more sustainable levels.

Now, HR prices are roughly unchanged week over week, the first time we’ve seen a flattish trend since early January.

Recall the first quarter saw steadily extending HR lead times and prices shooting from $685 per ton at the start of the year, to $1,145 per ton in our last check of the market.

I wouldn’t be shocked if we saw, as we did in late November, a round of price increases following the holidays. I also wouldn’t be shocked if we then saw prices erode should imports arrive in greater volumes in late spring and summer.

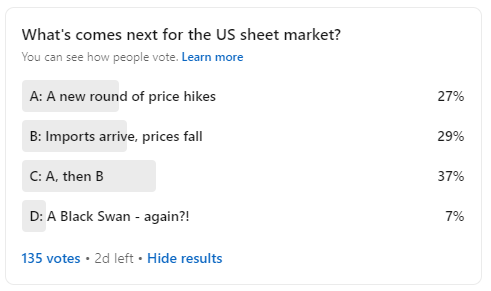

To gauge what some of you felt, I conducted the following (very scientific) poll on LinkedIn.

There was no clear winner. But the option garnering the most votes was (C), that we’ll see another round of price hikes – and then prices rolling over in response to imports.

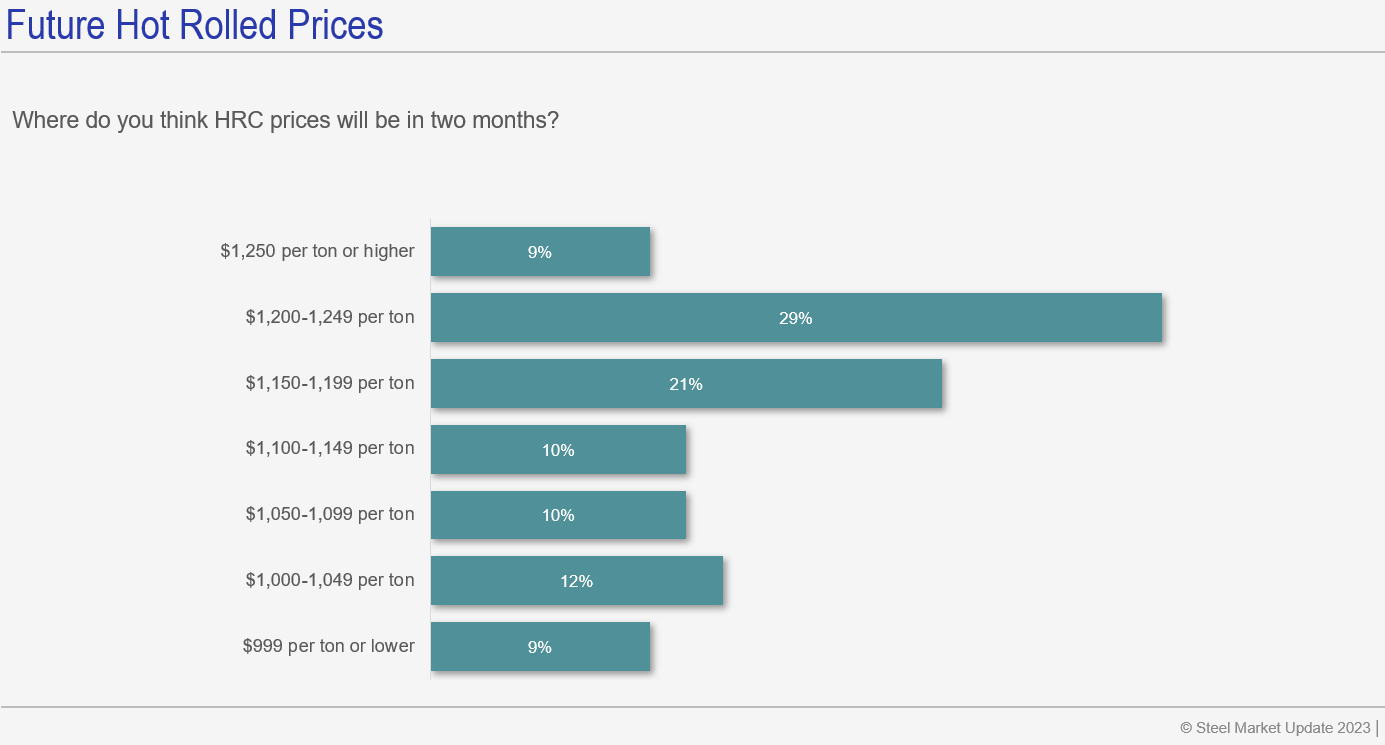

That’s consistent with what we saw in our latest steel market survey. Nealy 60% of survey respondents think that HR prices will move higher in the short term:

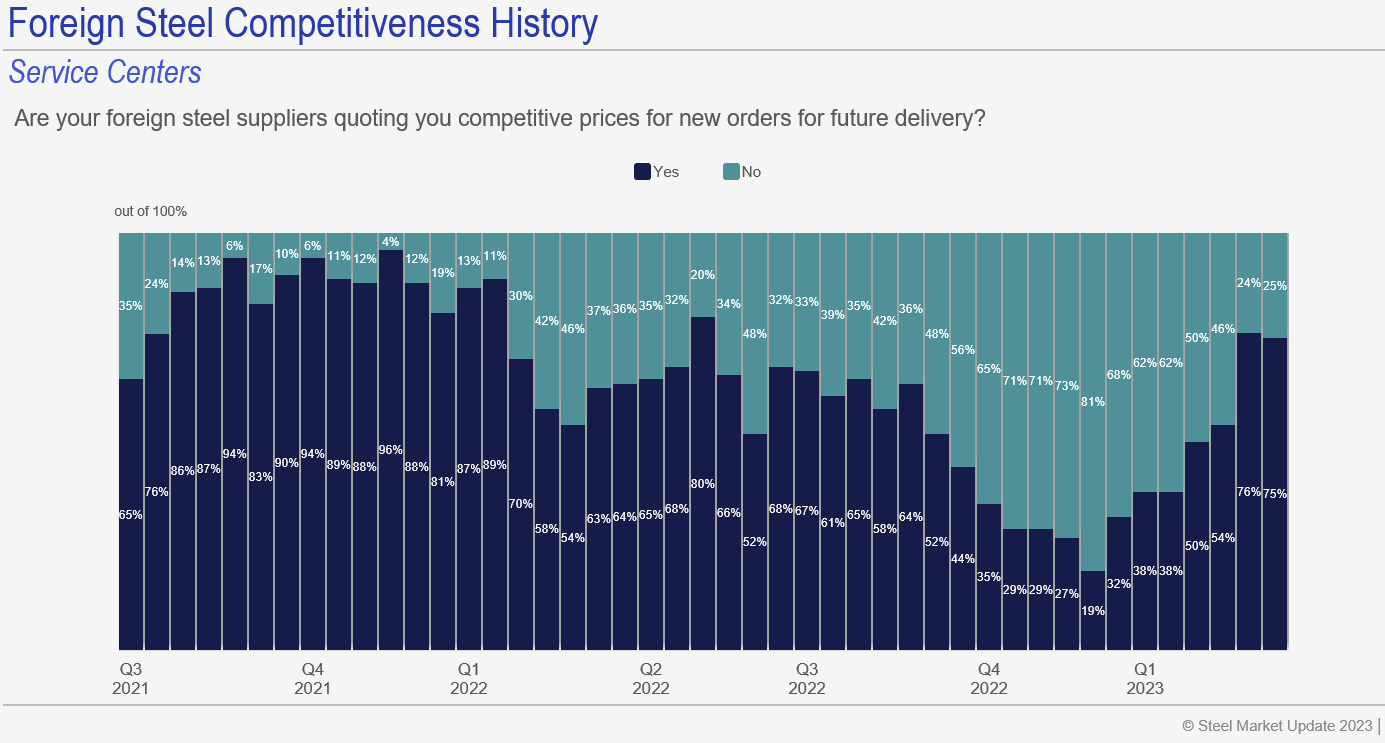

At the same time, more than 70% of service center respondents find imports competitive:

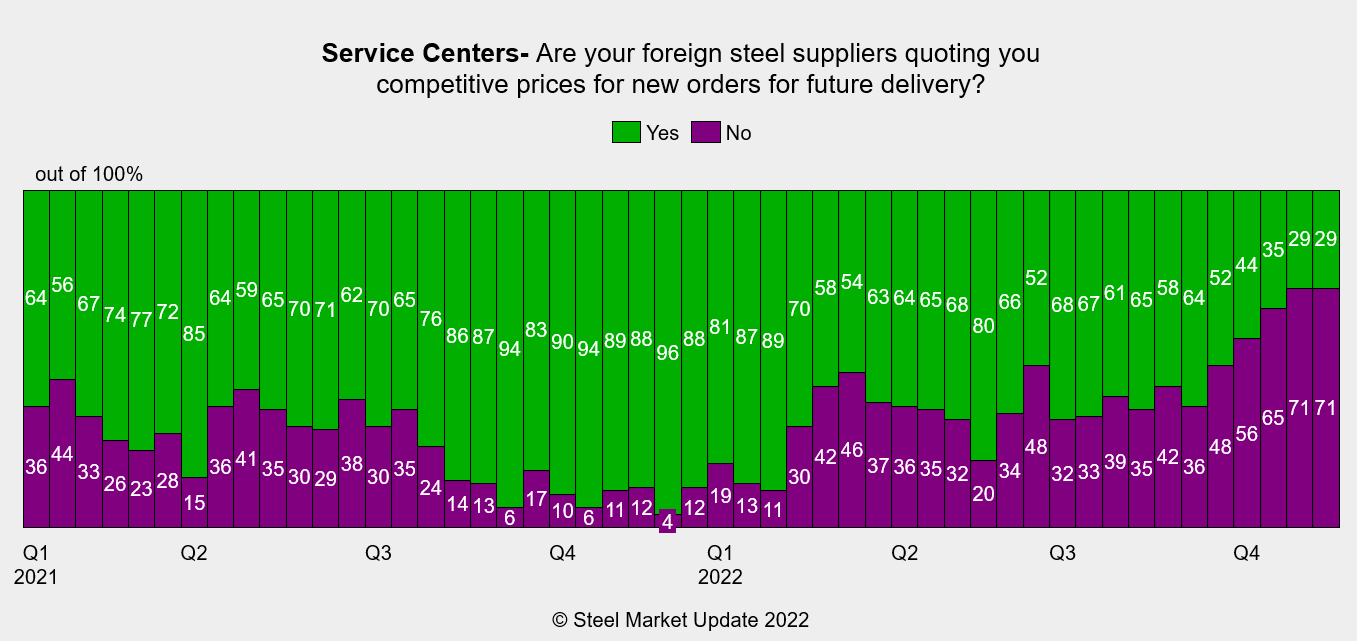

As far as imports go, that’s a mirror image of what we saw in our steel market survey released just before Thanksgiving. Back then, more than 70% of service center respondents said imports were not competitive:

(Editor’s note: We updated our survey earlier this year, thus the differing color schemes.)

That November result turned out to be an advance indicator of the low import volumes we saw in Q1, something that contributed to the higher prices we saw then. I wouldn’t be surprised if our current result proves to be an advanced indicator of higher import volumes in Q2/Q3.

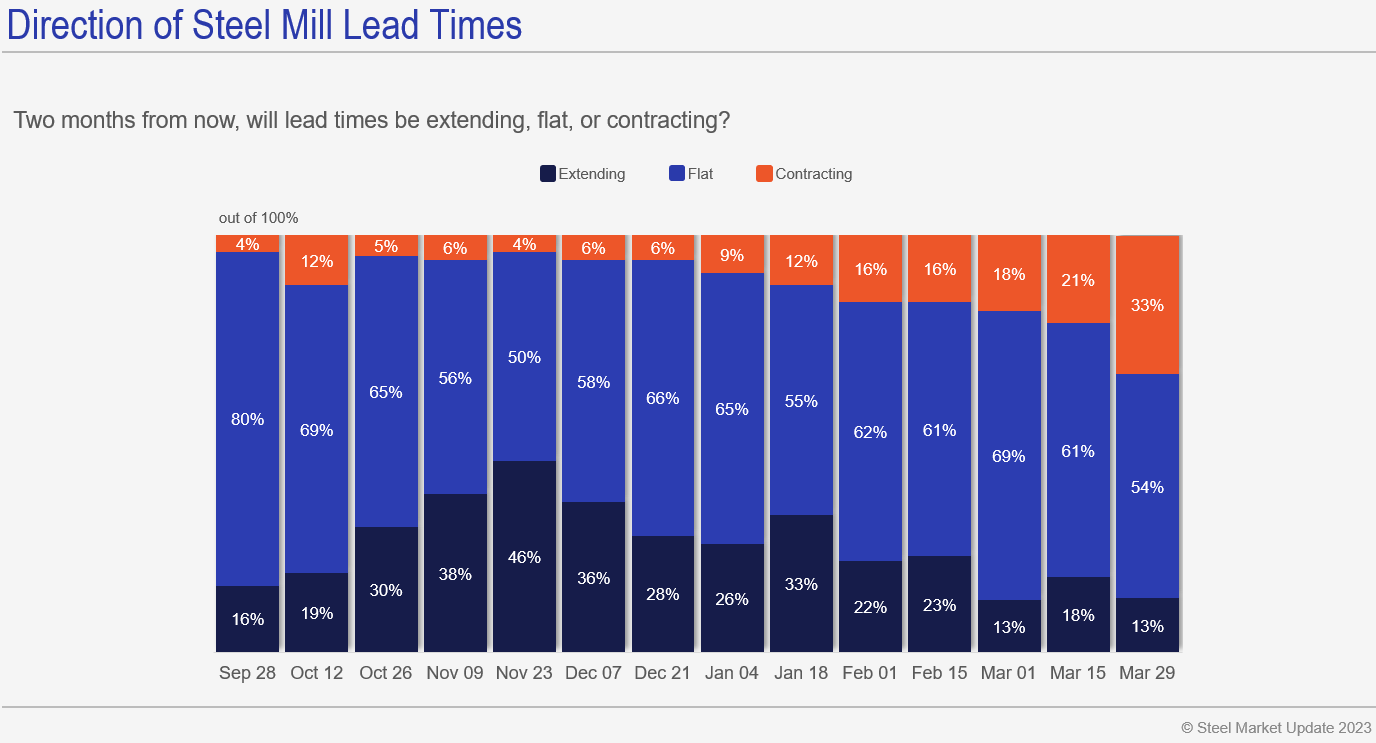

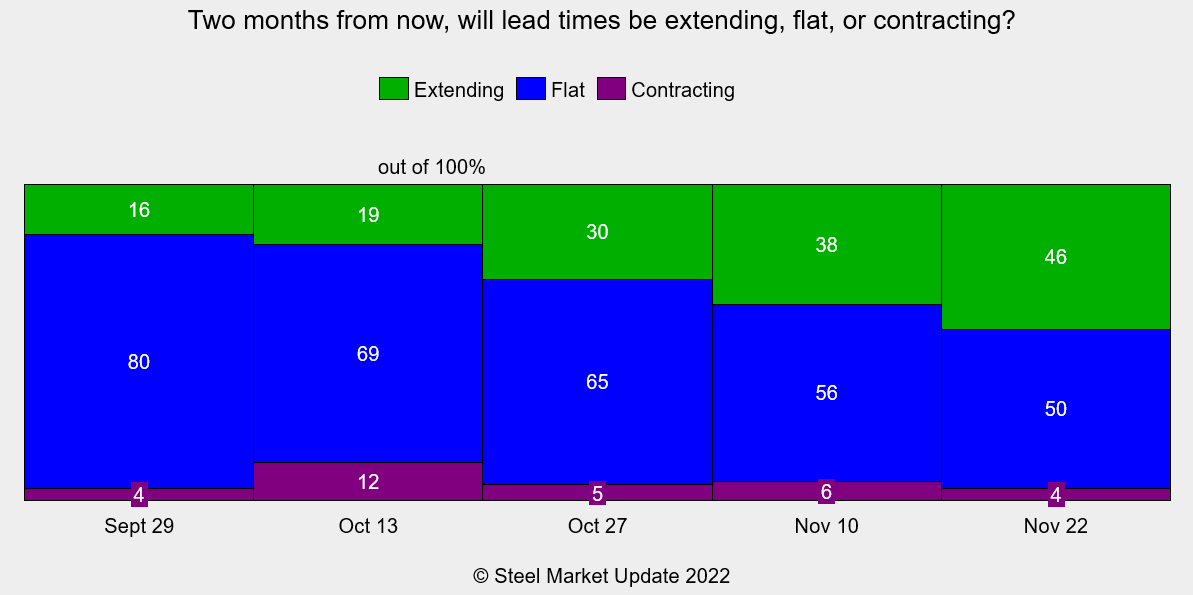

I’d also keep an eye on lead time expectations. About 33% of respondents to our latest survey think lead times will contract over the coming months.

That, too, is a mirror image of what we saw before Thanksgiving. Then, despite the lowest prices of the year, more than 45% of respondents expected to see lead times extend.

The lead time expectations in November turned out to be a good advance indicator of prices rising in Q1. Could expectations of lower lead times portend a moderation in prices?

Side note: I was glad to see only a small minority predicted that we’d see another Black Swan.

No doubt the banking crisis and resulting limits on credit will have an impact on steel demand. That’s not great. But for a hot minute last month, it seemed like people were predicting another Great Financial Crisis.

Personally, I don’t see a good reason for another GFC – unless enough people think there is one, in which case it becomes a self-fulfilling prophecy. (Are we descended from primates, or are we lemmings with opposable thumbs?)

Let’s hope the Black Swans have all gathered in the NCAA. My bracket busted back when Purdue lost to Fair Dickinson. If your bracket is still intact, give me a shout. Because you have a crystal ball, and I’d like to know your thoughts on steel.

By Michael Cowden, michael@steelmarketupdate.com