Analysis

March 7, 2023

Final Thoughts

Written by Michael Cowden

We’ve just seen the biggest week-over-week increase in hot-rolled coil prices since the frenzy following Russia’s invasion of Ukraine last year.

SMU’s hot-rolled coil (HRC) price is up $140 per ton ($7 per cwt) week over week. That’s our biggest such gain since prices jumped $210 per ton in mid-March of last year at the height of the war panic.

Chatter this week centered on whether the price spike we’re seeing now is sustainable or whether it might resemble what we saw last year.

Recall that HRC prices last year rose from ~$1,000 per ton from late February/early March to nearly $1,500 per ton by mid/late April – only to fall back to ~$1000 per ton in late June. (You can chart that out for yourself using our pricing tool.)

Market Chatter

Below is a sampling of comments from survey respondents on whether prices would hold at four-digit levels.

First, the short-term outlook:

“Mills appear to be aligned and demand appears to be steady. No indications that pricing will slip at this time.”

“It will hold through Q2. I just booked May at the highest price point this year. The mill only offered 48-hour validity.”

“Near term, there will be some stickiness to the high spot price. Mills will get their number with whomever they can, especially those that need the spot market.”

“I just do not see that buyers have a choice. With upcoming mill maintenance outages and less steel coming in from Canada and Mexico, things are tighter than they should be.”

The longer term consensus is less bullish:

“It will peak in April, then stabilize before settling back at lower levels as new capacity ramps up and the short squeeze abates.”

“$1,200 seems likely at this point. Once the market pulls back (most likely soon), the bloom will be off the rose.”

“$1,300/ton – top out in late April. Offshore steel will begin to roll in and put downward pressure on pricing.”

“Futures market is trading over $1,200 (for April and May), so there is room to go up. Peak will be late June lead time or July, when auto slows a bit and contract pricing starts to catch spot prices.”

One thing worth noting: Nucor and ArcelorMittal announced new minimum base prices of $1,150 per ton last Friday. Some of our survey respondents clearly think more increases are coming.

Greed or Need?

That aside, let’s get back to the hypothesis that prices might continue to rise sharply over the next few weeks but come back to earth over the next few months. Let’s start with the obvious reason why prices are up sharply now.

There were four waves of increases: (1) up $50 Feb. 2-3, $850 base HRC; (2) up $50 on Feb. 13-14, $900 base HRC; (3) up $100 on Feb. 21-22, $1,000 base HRC; (4) gets a little tricky – Cliffs up $100, target $1,100 ton HRC on Feb. 27, Nucor up $150, target base $1,150 HRC on March 3. That’s all in our price increase calendar.

There was no one Black Swan this time. Instead, there were a lot of “mini swans,” as one market contact put it: spring maintenance, new capacity being slow to ramp up, etc. I know some of you think the sharp gains stem from mill greed. But let’s also consider the case for mill need, which might explain why there was such a concerted rush to increase prices last month.

CRU-linked contracts, as most of you know, are often based often on the prior month’s spot price. The average CRU spot price for January, which determined February contract numbers, was $716 per ton. And the average CRU spot price for February, which will determine March contract prices, was $803 per ton.

Our average price for prime scrap was $455 per gross ton in February, up $30 per gross ton from January. February started off with expectations that scrap would be up another ~$20-30 per gross ton.

More recently, we’ve heard up $50-100 per gross ton. I’m not going to guess where scrap will land. Suffice it to say, that’s a lot more than the “soft sideways” I’d heard at times in early February from folks predicting March scrap prices.

For the sake of argument, let’s say March scrap is $505-655 per gross ton, or ~$565-$620 per short ton. Let’s also assume that conversion costs are $150-200 per short ton. That get’s us to a theoretical breakeven point of $715-820 per short ton.

It’s also worth noting here that capacity utilization fell this week. As we learned from Section 232, mills strongly prefer to run at or above ~80% to be efficient – so it’s possible conversion costs are running to the high side of that $150-200/ton range.

Might some mills have seen that their contract tons were getting uncomfortably close to breakeven? That might explain why we saw not only near weekly increases but also the increases jumping from ~$50 per ton per week early in February to $100 per ton per week (or more) later in the month.

2H Blues?

What happens in late Q2 and early 2H? Recall late Q2 is when Nucor has said the Gallatin expansion will ramp up. It’s also when some of you say long US lead times now might prove costly. Because they reduce the risk of ordering imports, which could be arriving in greater volumes around then.

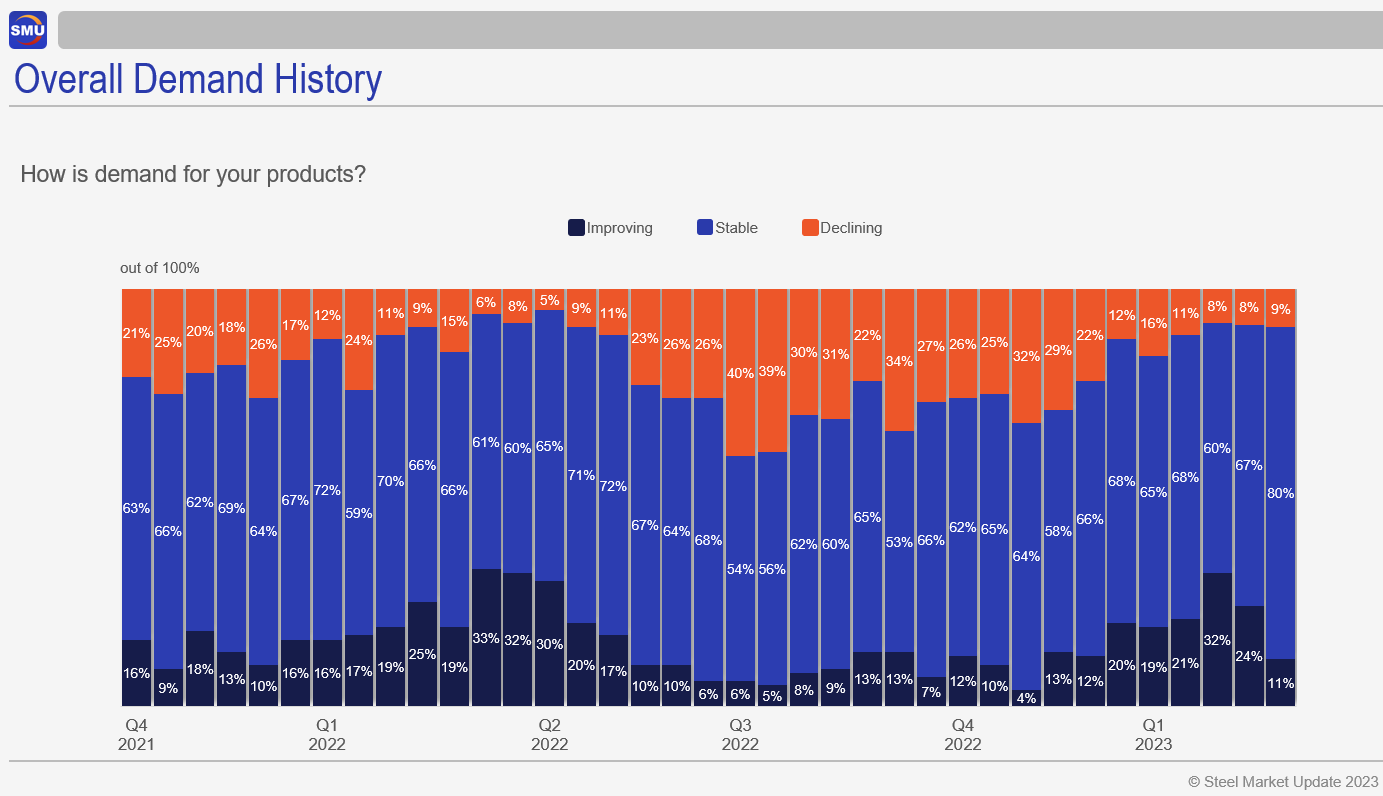

Also, while demand is by no means bad, we’ve seen some moderation over the last month or so.

Take the survey result below:

Only 9% report declining demand. That’s a good result and on par with numbers we’ve seen since the beginning of the year. But the number of people reporting improving demand has fallen from 32% in early February to 11% in early March.

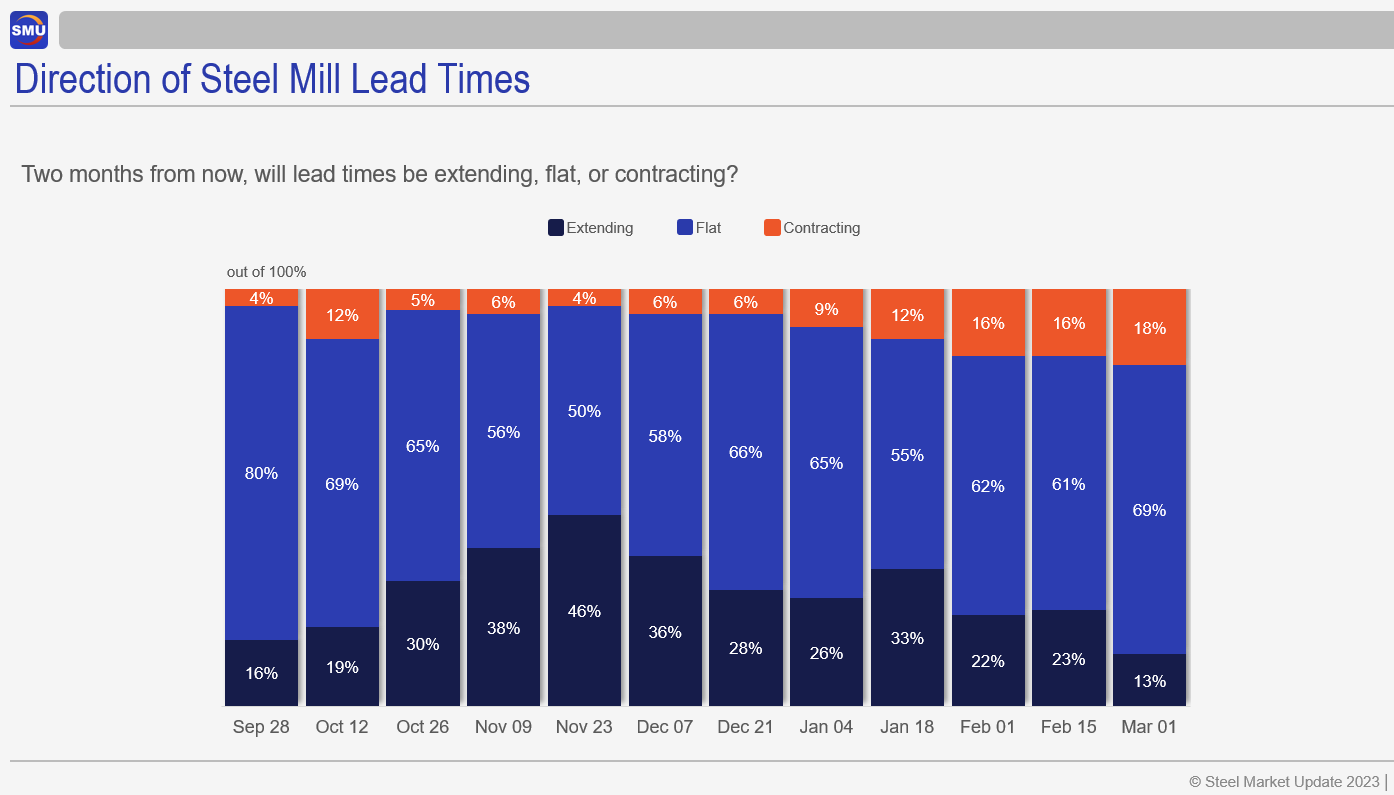

Also, look where our readers expect lead times to be two months from now. I like this question. Because you could make the case that it was one of the early indications of the current price rally. There was a sharp rise in November in the number of people (46%) predicting that lead times would be extending in two months.

That number has since fallen to only 13%. Don’t get me wrong. Lead times are extended now. And I wouldn’t be surprised to see them continue to extend over the short term. But if our survey respondents are correct, we should expect lead times to be flat or contracting in May.

Could that be a sign that this will be a 1H rally that runs out of steam in the second? It looks that way to me. That said, I’ve been plenty wrong before. So I’m happy to entertain any ideas on why this one might keep going past Independence Day.

By Michael Cowden, michael@steelmarketupdate.com