Government/Policy

February 28, 2023

US Raises Tariffs on Russian Pig Iron, Scrap, DRI Up to 70%

Written by Michael Cowden

The Biden administration has hit Russian pig iron as well as other steel and metal products with tariffs of up to 70%.

The move was made with less fanfare than the 200% tariffs on Russian aluminum announced in a presidential proclamation last week.

The tariffs were included in an annex attached to that proclamation. The full annex is listed here. The tariffs apply not only to pig iron but also materials as diverse as ferrous scrap, direct-reduced iron (DRI), and stainless pipe and tube. They are set to take effect April 1.

Recall that on Friday, the Biden administration announced that the 200% duties on Russian aluminum products would take effect on March 10.

The higher tariffs on Russian pig iron, aluminum, and other metal products come after the Biden administration last year stripped Russia of what’s known as “permanent normal trade relations” following its invasion of Ukraine.

That move put Russia and Belarus into the same trade category as international pariahs such as North Korea. The main impact was sharply increased tariffs on Russian steel (roughly 20-40%) and aluminum – but not on pig iron, which saw duties increased to a meager $1.11 per metric ton.

Before the war, Russia and Ukraine had supplied approximately two-thirds of US pig iron requirements. Brazil supplied roughly another one-third.

Even though the tariff increase on Russian pig iron last year was minimal, Russia had been a non-factor in the US pig iron market. In fact, Russia has shipped no pig iron to the US since May 2022.

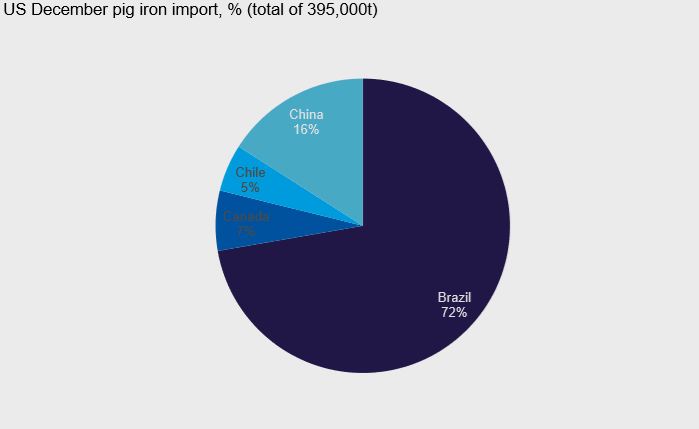

The domestic market now leans more heavily than ever on Brazil, which accounted 72% of US pig iron imports in December, the last month for which government figures are available. China (16%), Canada (7%), and Chile (5%) made up for the rest.

The higher duties on steel announced last year had also already had a big impact.

The US imported 1.47 million metric tons of steel from Russia in 2021, making it the fifth largest supplier of foreign steel to the domestic market, according to Commerce Department figures. The bulk of that steel, 1.29 million tons, was semi-finished products, a category that includes slab.

An example of the tariffs’ impact: The US imported 111,653 metric tons of semi-finished goods, likely slab, from Russia last June. It has imported no semi-finished and almost no finished steel from Russia since then.

All told, the US imported only 421,832 metric tons from Russia in 2022, down 71% from 2021’s total, and down 91% from 4.26 million metric tons in 2014.

The sharp declines over the last decade have stemmed from several waves of import restrictions.

An agreement suspending duties on hot-rolled coil was scrapped in 2014 under the Obama administration following Russia’s invasion of Crimea earlier that year.

Imports declined further after the application of Section 232 tariffs of 25% under the Trump administration – a measure that applied to semi-finished slab as well as finished steel. That policy has been continued by the Biden administration.

By Michael Cowden, michael@steelmarketupdate.com