Market Data

February 14, 2023

SMU Price Ranges: Sheet Marches Upward on Price Hikes

Written by Michael Cowden

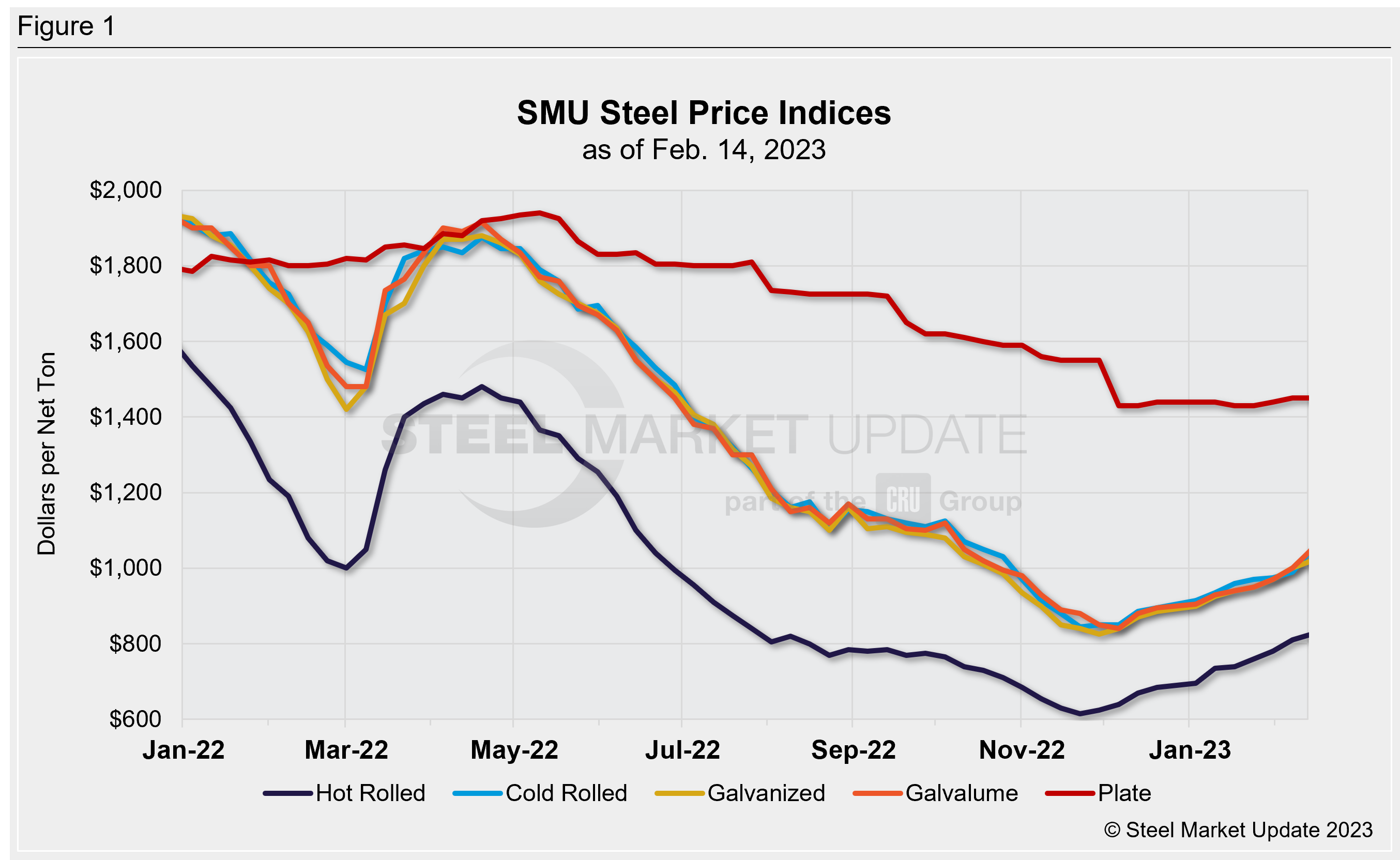

Sheet prices rose again this week as a blitz of $50-per-ton ($2.50/cwt) price hikes spurred the market higher.

Steel Market Update’s hot-rolled coil price now stands at $825 per ton, up $15 per ton from last week and nearing the highest levels we’ve seen since late July.

The difference: HRC prices were on their way to the $600s per ton last summer. Now the question is how high they’ll rise and whether mills can achieve the $900-per-ton base prices they announced on Monday and Tuesday.

Cold-rolled (up $60 per ton), galvanized (up $15 per ton), and Galvalume (up $50 per ton) also recorded gains. Plate prices, in contrast, remain unchanged.

It’s too early for our price ranges to fully reflect the increases announced this week. But most sources we contacted expect the price gains to continue.

Some reported uneven demand, others reported solid demand. Despite differences on that front, a consensus appears to have emerged: Production disruptions at a Mexican producer, combined with new capacity being slow to ramp up, have resulted in tighter-than-expected supply. And there is no near-term relief likely from imports.

Much focus has now turned to inventories. If service center inventories prove to be low, it could result in the current cycle extending for longer than expected.

In the meantime, all our sheet momentum indicators continue to point toward upward. Our plate momentum remains at neutral.

Hot-Rolled Coil: The SMU price range is $790–860 per net ton ($39.50–43.00/cwt), with an average of $825 per ton ($41.25/cwt) FOB mill, east of the Rockies. The bottom end of our range increased by $10 per ton, while the top end rose $20 per ton vs. one week ago. Our overall average is up $15 per ton week on week (WoW). Our price momentum indicator on hot-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Hot-Rolled Lead Times: 4–7 weeks

Cold-Rolled Coil: The SMU price range is $1,000–1,100 per net ton ($50.00–55.00/cwt) with an average of $1,050 per ton ($52.50/cwt) FOB mill, east of the Rockies. The bottom end rose $40 per ton, while the top end of our range icrease $80 per ton compared to one week ago. Our overall average is up $60 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Cold-Rolled Lead Times: 5–9 weeks

Galvanized Coil: The SMU price range is $980–1,060 per net ton ($49.00–53.00/cwt) with an average of $1,020 per ton ($51.00/cwt) FOB mill, east of the Rockies. The lower end of the range was unchanged WoW while the top end of our range increased $40 per ton vs. one week ago. Our overall average is up $20 per ton from one week ago. Our price momentum indicator on galvanized steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,077–1,157 per ton with an average of $1,117 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–9 weeks

Galvalume Coil: The SMU price range is $1,000–1,100 per net ton ($50.00-55.00/cwt) with an average of $1,050 per ton ($52.50/cwt) FOB mill, east of the Rockies. The lower end of the range rose $20 per ton vs. the week prior, while the top end of our range was up $80 per ton compared to one week ago. Our overall average is up $50 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,294–1,394 per ton with an average of $1,344 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7–8 weeks

Plate: The SMU price range is $1,420–1,480 per net ton ($71.00–74.00/cwt) with an average of $1,450 per ton ($72.50/cwt) FOB mill. Both the lower end of the range and the top end of our range were unchanged compared to one week ago. Our overall average was sideways WoW. Our price momentum indicator on steel plate is Neutral, meaning we are still unsure whether prices will remain stable, or move up or down over the next 30 days.

Plate Lead Times: 4–7 weeks

SMU Note: Below is a graphic showing our hot-rolled, cold-rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By Michael Cowden, michael@steelmarketupdate.com