Market Data

February 19, 2023

Final Thoughts

Written by Michael Cowden

Sheet prices continue to push higher even as buyers contacted by Steel Market Update remain divided about the state of demand.

Hot-rolled coil lead times now stand at 5.41 weeks, up from 4.94 weeks in our prior survey and marking the first time this year that HRC lead times have broken out significantly above five weeks.

HRC lead times are now at their highest point since mid-April 2021 – when the market was still gripped by panic that followed Russia’s invasion of Ukraine.

Domestic mills, meanwhile, are seeking HRC prices of at least $900 per ton ($45 per cwt) – or nearly $300 per ton higher than where hot band prices were before producers began rolling out waves of price hikes in late November.

This month alone we’ve had two rounds of $50-per-ton price hikes. We haven’t seen such rapid-fire price hikes since the early days of the Ukraine war.

This time, however, there is no panic driving lead times and prices higher. Instead, it’s a culmination of smaller events that collectively have had a big impact: new capacity ramping up more slowly than expected, production issues at a Mexican steelmaker, and little relief from imports on the horizon.

Some are making the case that there is increasing “discipline” among sheet mills, which are significantly more consolidated than they used to be. They would say that evidence of that discipline came in the form of so many mills announcing base prices of $900 per ton over a period of 48 hours last Monday-Tuesday.

If discipline is behind the rise, it’s worth asking whether we might see sheet pricing become more like plate pricing – stable and higher within a narrow bandwidth. We’ve also seen comparatively little volatility in rebar, which like plate, is more consolidated than sheet.

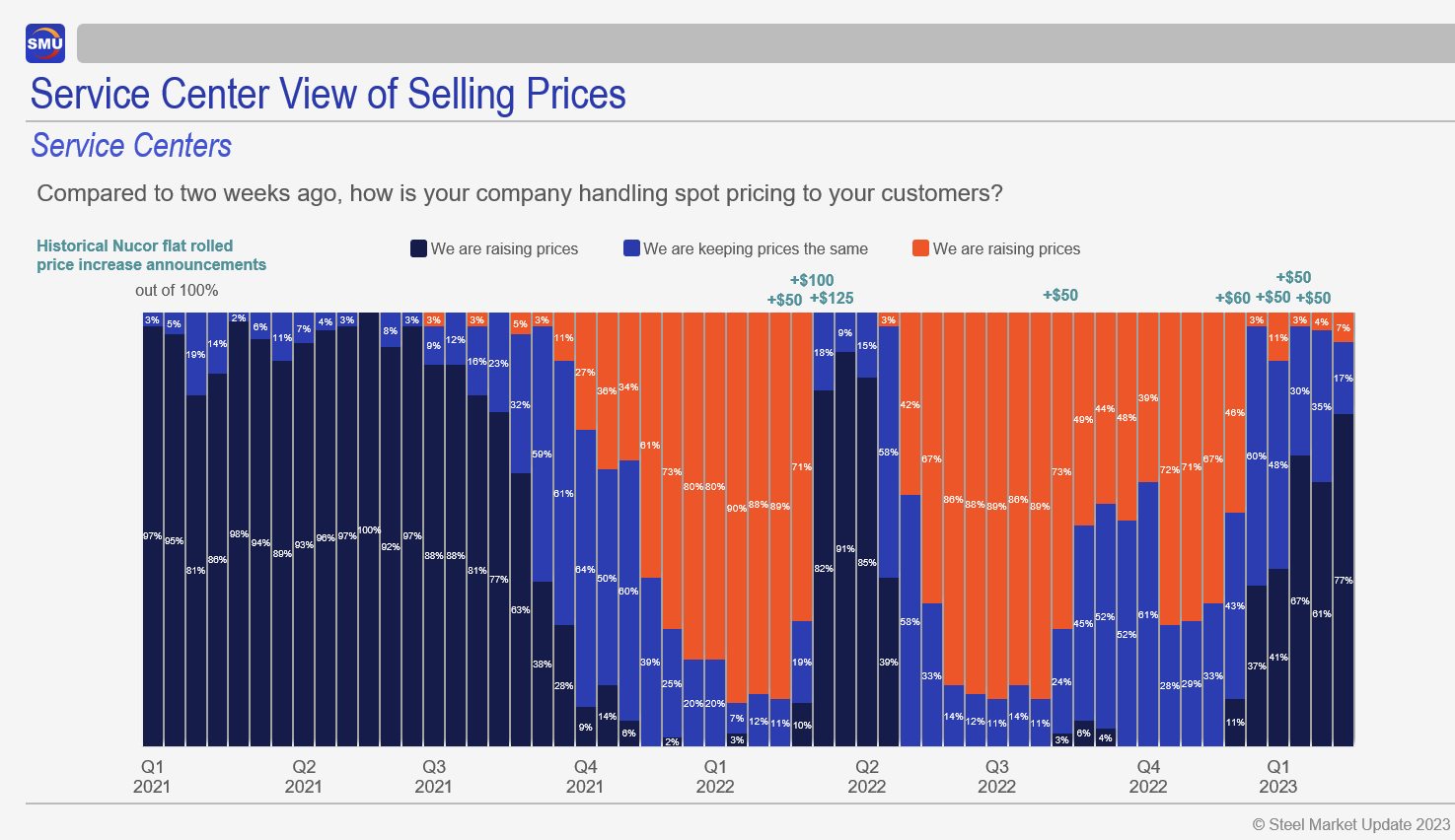

In the meantime, nearly 80% of service center sources polled in our latest survey said that they were increasing prices to their downstream customers.

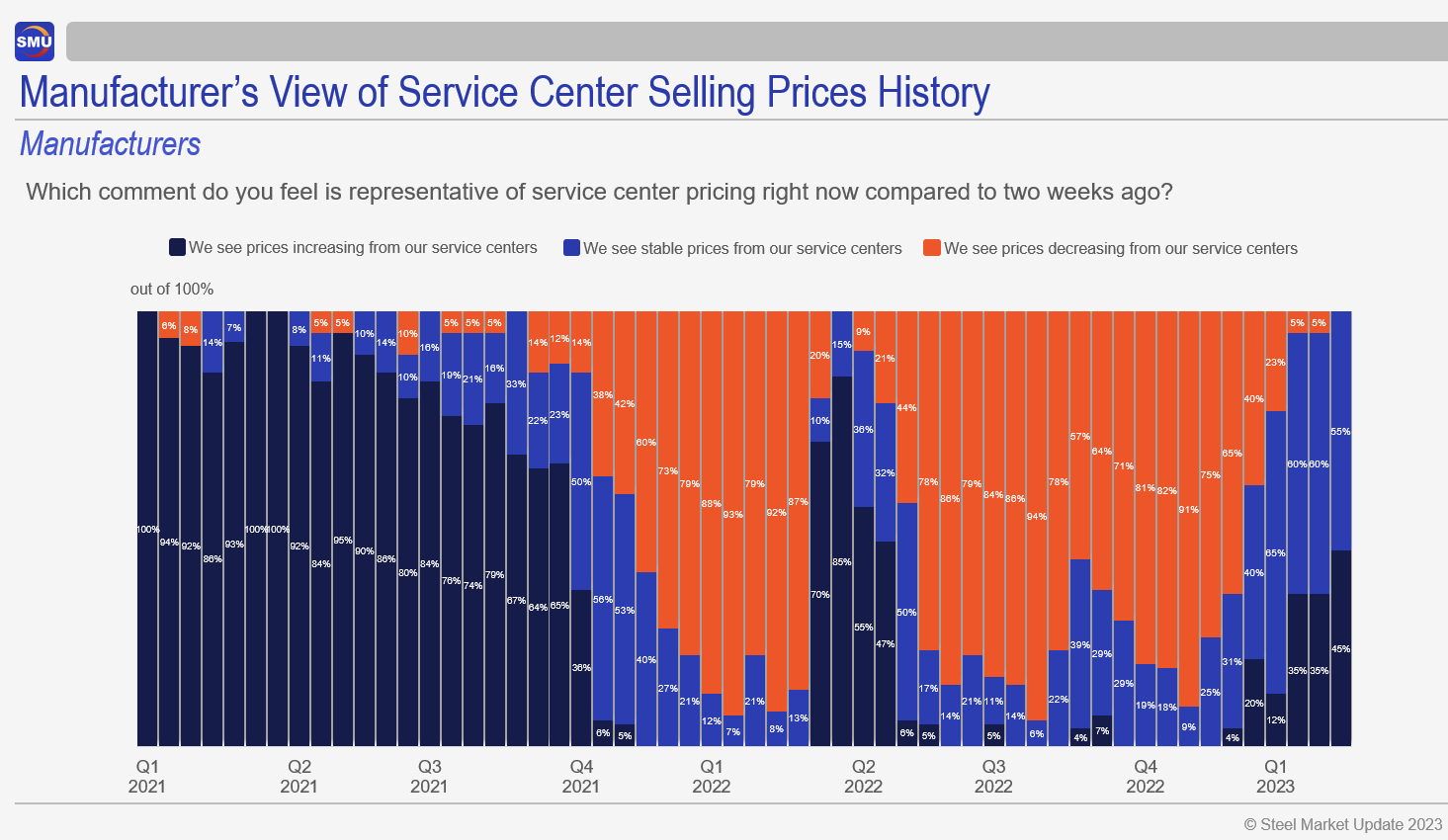

We ask the same question of manufacturers to keep service center respondents honest. We also ask it because they might see the impact of higher prices on a slight lag compared to service centers.

About half of manufacturer respondents report that they are seeing higher prices from service centers. The other half say prices are stable. The important point: None say they are seeing lower prices from service centers.

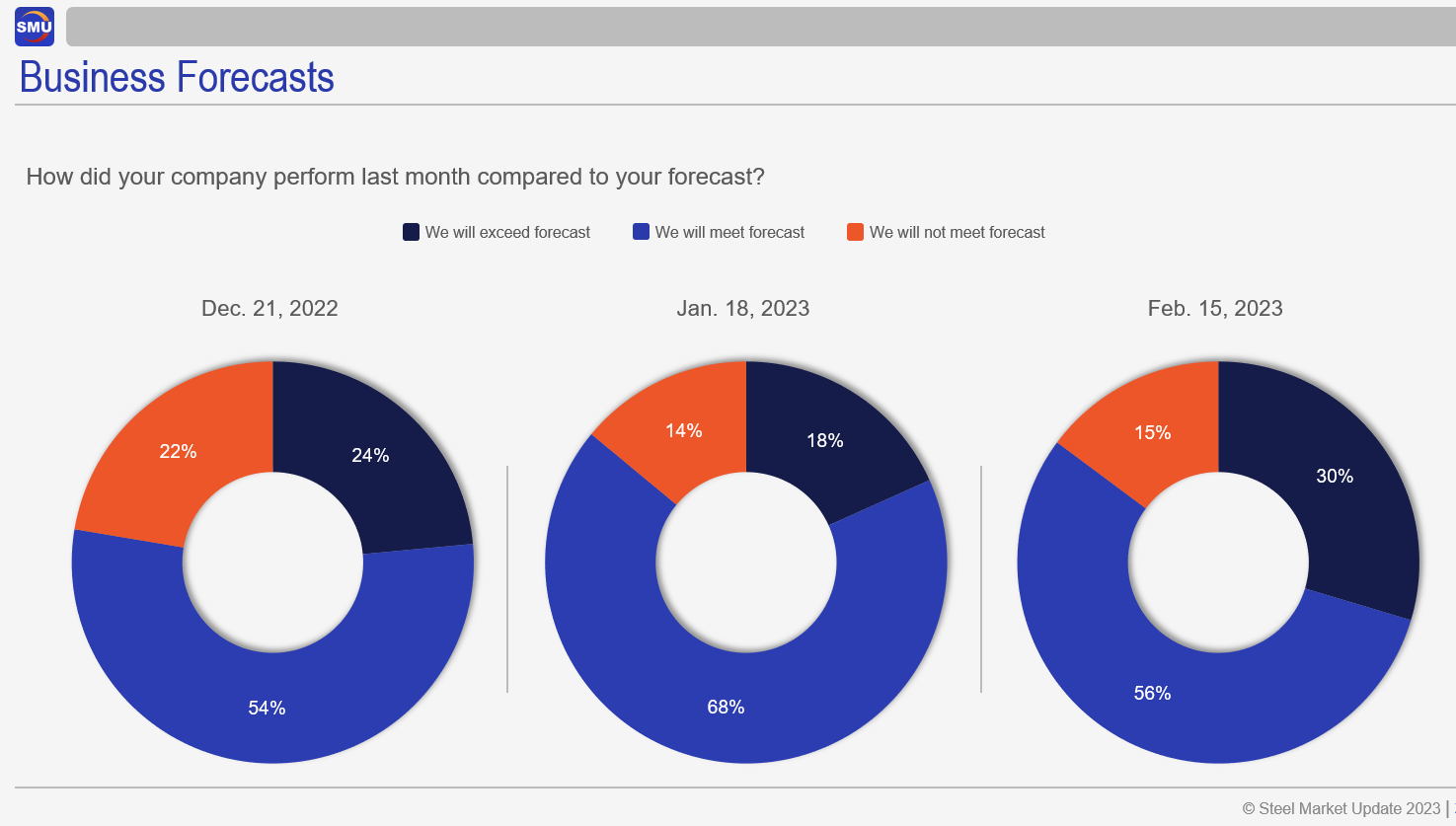

The good news: Most respondents continue to report that they are meeting or exceeding forecast.

That supports the most obvious explanation – that lead times are longer and prices are higher because of better demand. Still, I think it’s also worth asking what role inflation might be playing in all of this. Do expectations of higher prices mean that demand is better or that the supply chain is baking in a degree of (re)inflation?

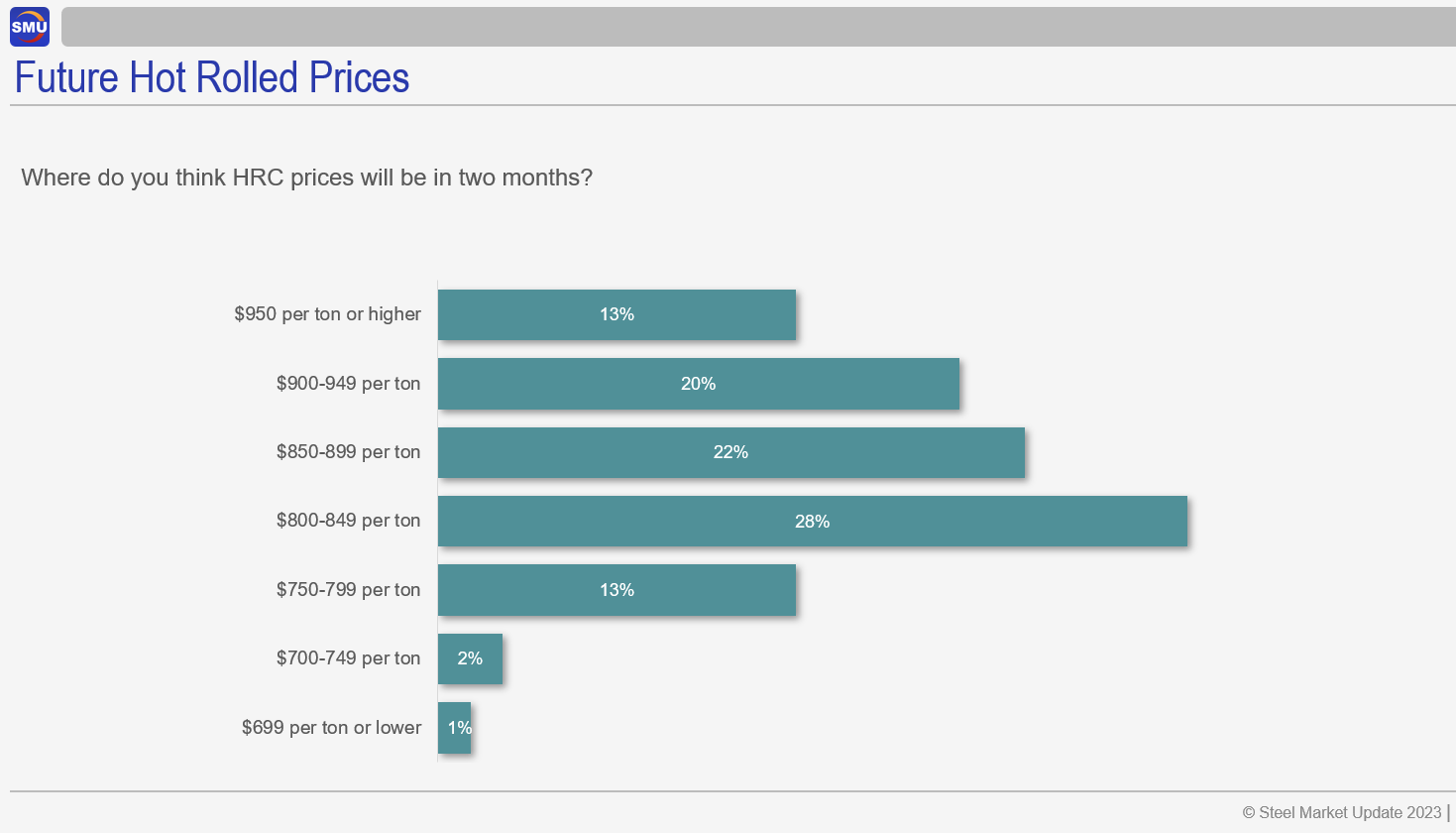

Here’s another part I’m still trying to figure out. A third of respondents to our latest survey think that prices might go even higher than $900 per ton:

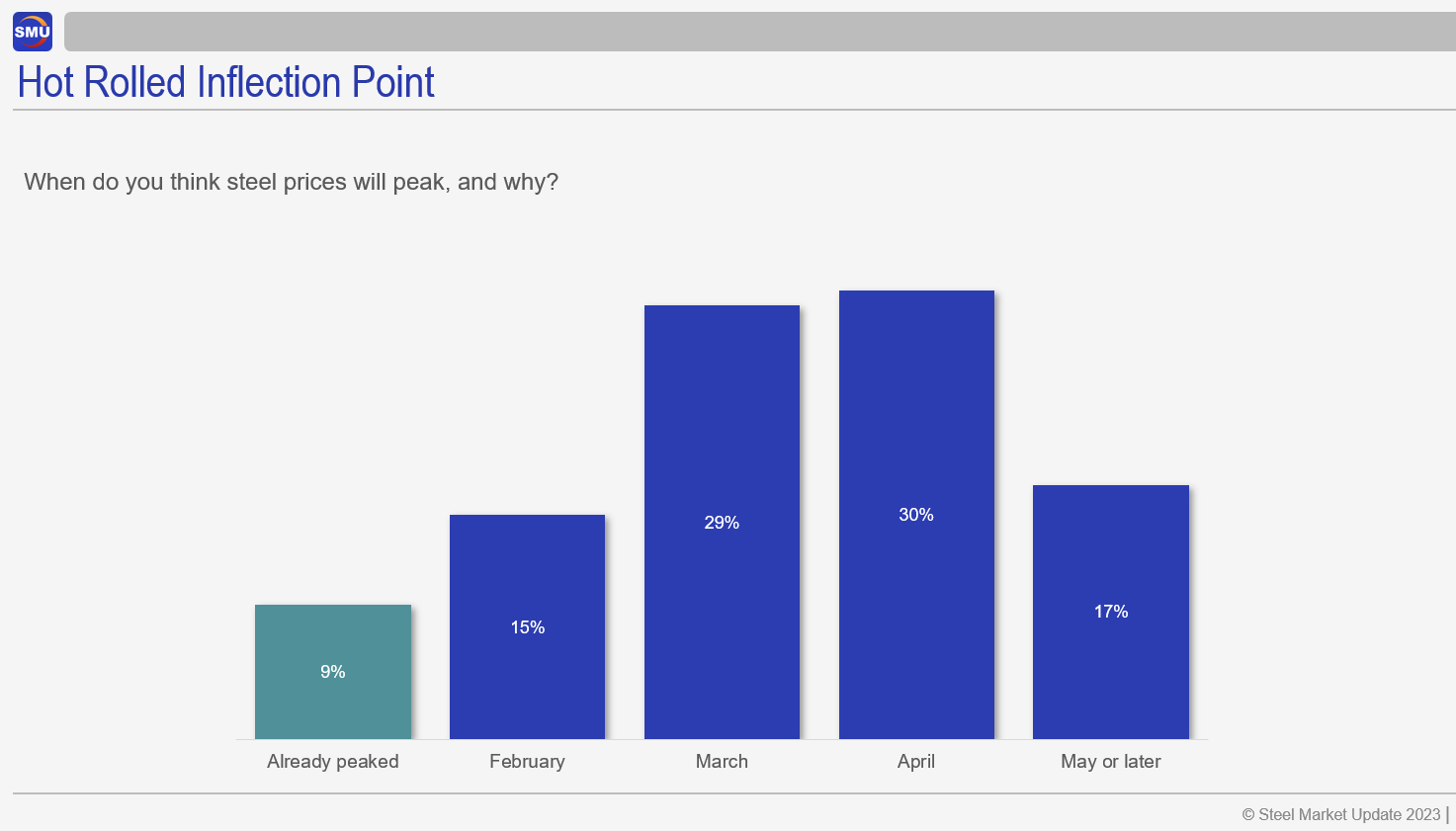

But more than half continue to say that prices will peak this month or next – or that they have already peaked:

I won’t weigh in on whether that camp is right or whether the 47% who think that prices won’t peak until April, May, or later are correct.

I think this is worth highlighting in the meantime: If people think prices are near a peak, then they’re unlikely to go out and order imports. The fear: Overseas material, which can take months to arrive, could be above domestic prices by the time it hits US ports.

Short term, that line of thinking functions almost like a trade case. It effectively keeps imports lower, which might help to extend the current domestic price rally.

By Michael Cowden, michael@steelmarketupdate.com