Market Segment

January 22, 2023

Final Thoughts

Written by Michael Cowden

This week’s survey didn’t land quite as I expected. Some data points indicate that the price rally we’ve seen since late November will continue, but others suggest it might be running out of steam.

For starters, if you’re an SMU subscriber, you can find our latest market survey results here. If you aren’t, this data is reason to consider signing up. It’s a good snapshot of the market and provides useful context around price moves.

Let’s start with prices.

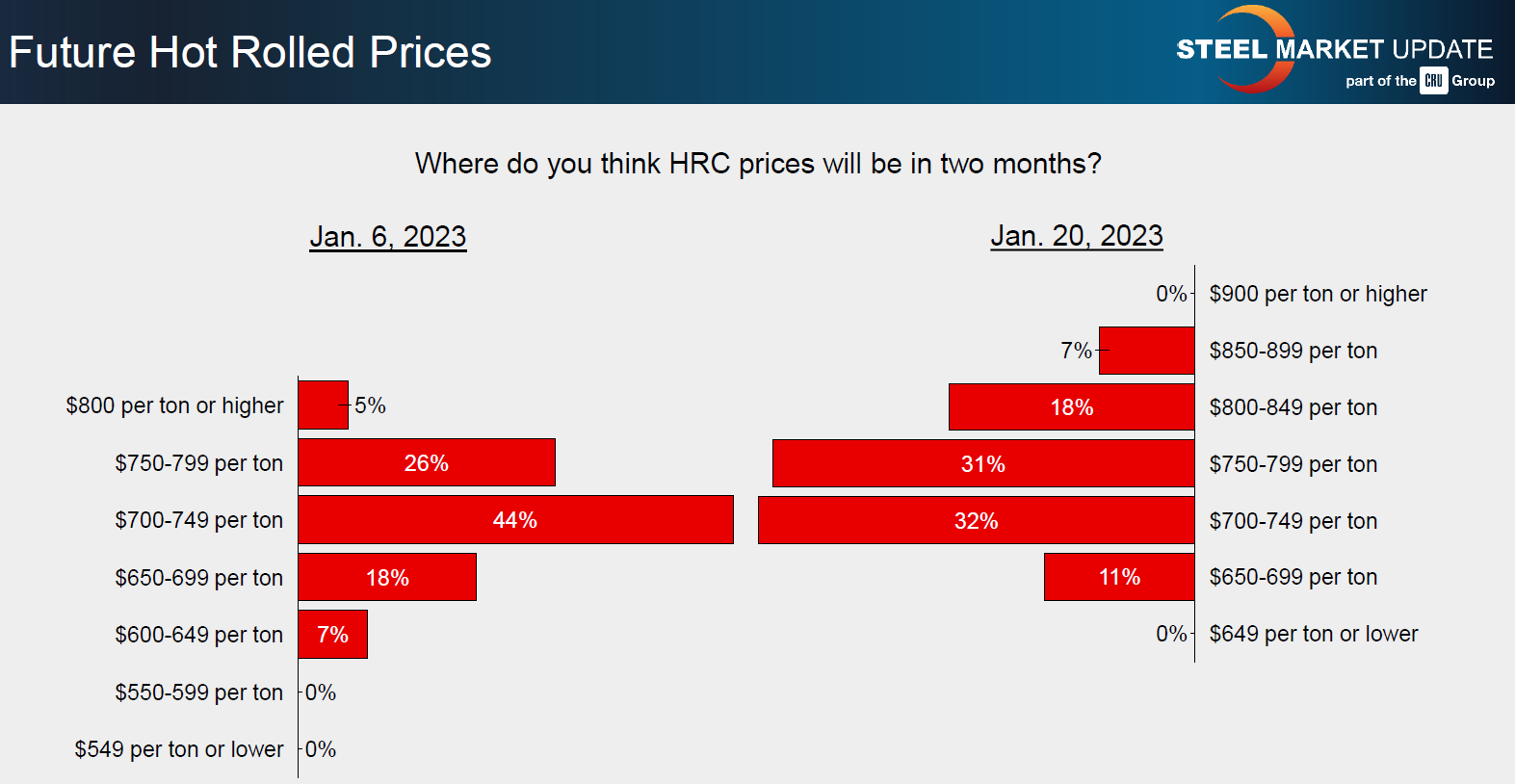

As I noted in this column on Tuesday, an increasing number of survey respondents think hot-rolled coil prices will go above $800 per ton ($40 per cwt) – 25% now compared to only 5% two weeks ago.

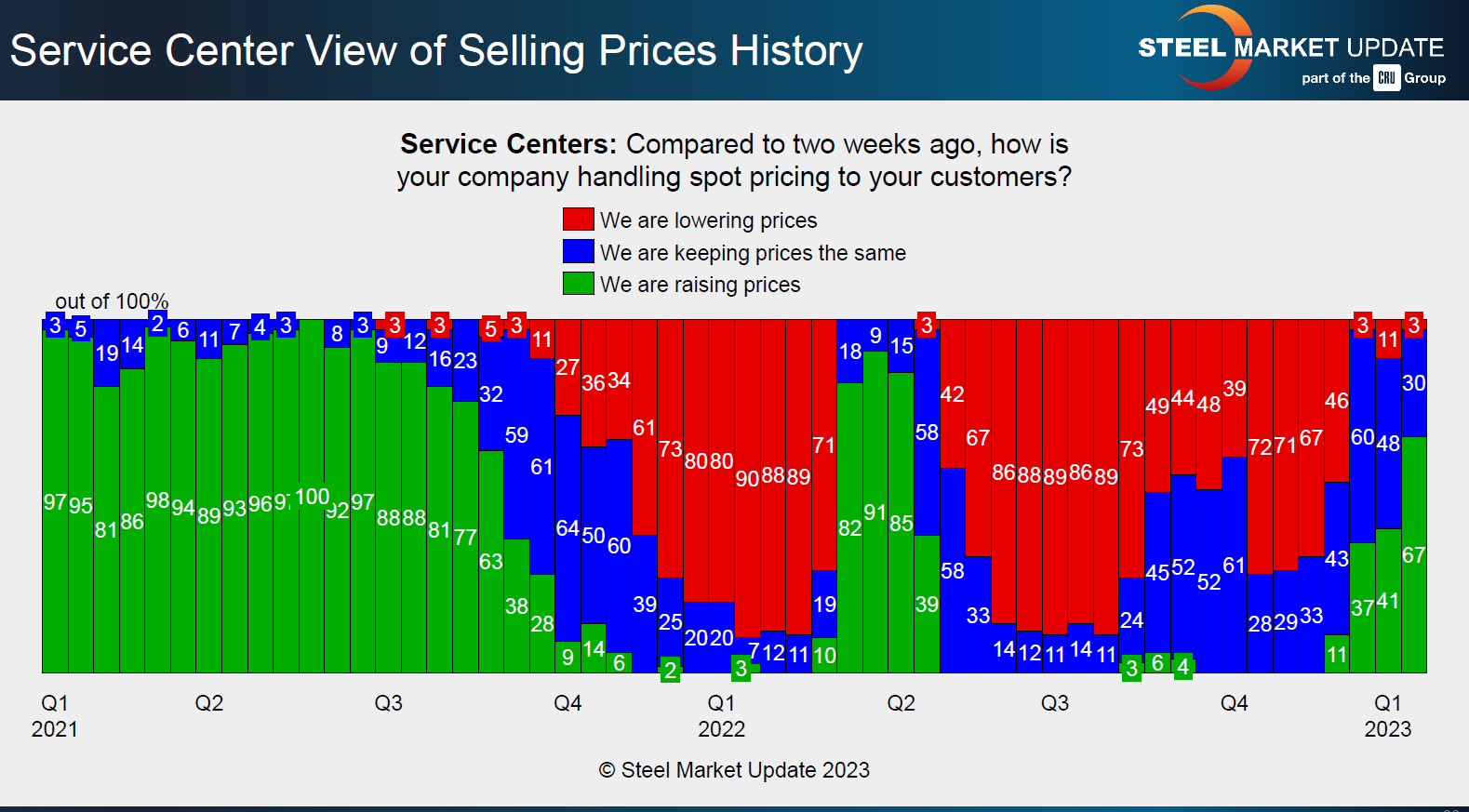

And we continue to see higher prices gaining traction downstream:

Approximately, two-thirds of service centers reported they are increasing prices in tandem with mills, up from only 11% late in the fourth quarter.

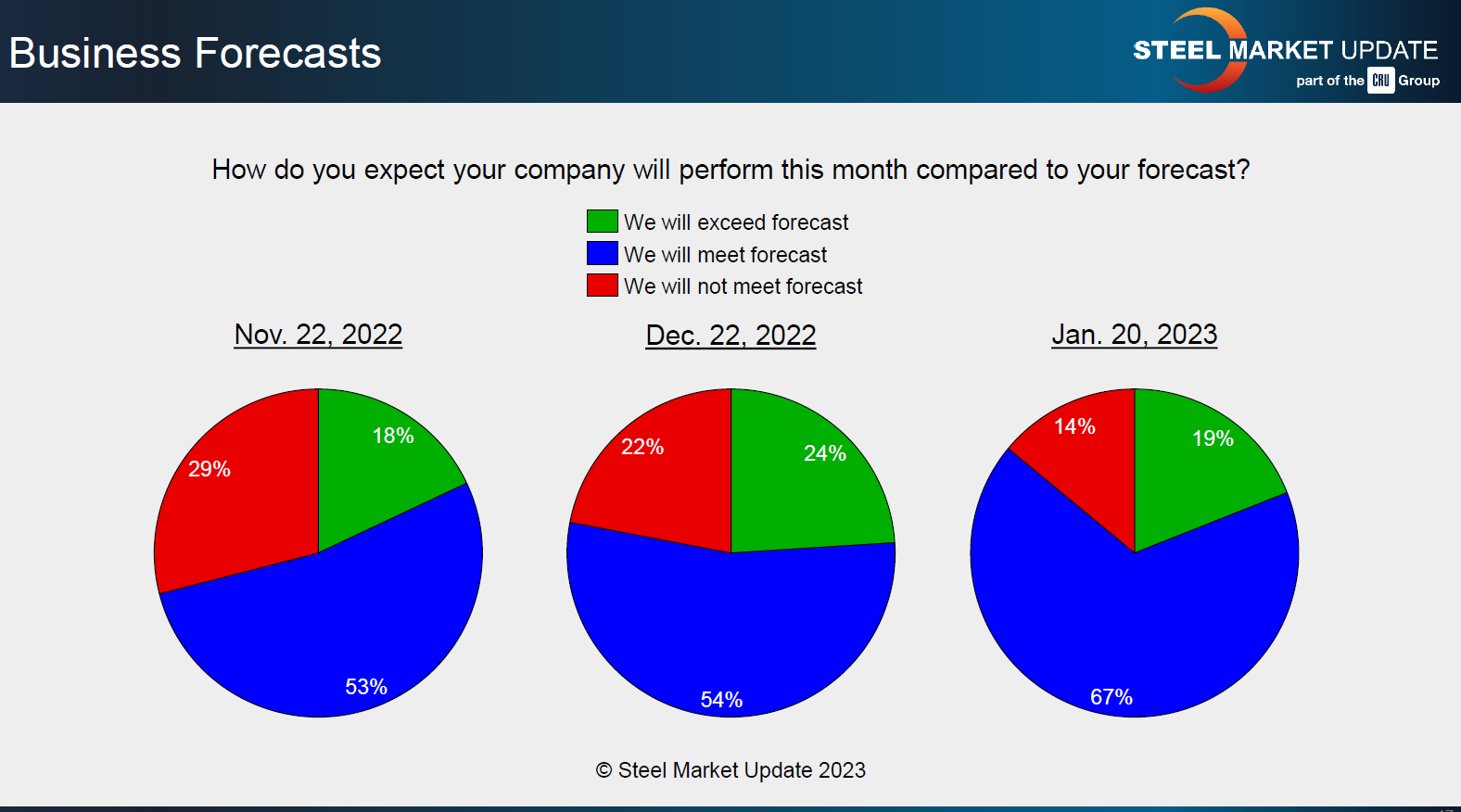

The price upswing at both the mill and service center level is supported by continued confidence among survey respondents that they will meet or exceed forecasts:

Eighty-six percent of survey respondents think they will meet or exceed forecasts this month, up from 78% in December and up from 71% in November.

The strong price outlook for hot-rolled coil in particular is supported by our mill price negotiations results. Only 38% of mills are willing to consider lower prices for hot band. We haven’t seen such a firm line in the sand since the outbreak of the war in Ukraine, when mills refused to negotiate lower steel prices on fears that raw material costs (notably for pig iron) could explode higher.

So full steam ahead for sheet for the rest of in Q1? Maybe. But it’s not a slam dunk.

Unlike last March, the mill negotiation and lead time results aren’t the same across all products.

When it comes to galvanized material, about half of mills are still willing to negotiate lower tags, according to our survey. I wasn’t expecting that result amid another wave of mill price increase announcements. Is the galvanized side a little weaker than hot rolled, or was our survey result just noise?

I might dismiss it as just noise if we weren’t also seeing a similar result in lead times. Hot-rolled coil lead times are 4.98 weeks now, roughly unchanged from 4.95 weeks when we did our first full survey of 2023 in early January. Galvanized lead times, however, are 6.10 weeks, down 0.57 weeks from 6.67 weeks at the beginning of the month.

We captured some concern about lead times in commentary provided by survey respondents. “Lead times, lead times, lead times. They remain short, and that is quite troublesome,” one said. “The one real catalyst for higher prices is a rebound in scrap. That is the only thing that could offset ‘OK’ demand and short lead times,” added another.

I’m not going to fret too much about lead times now. But it’s something to keep an eye on. Prices and lead times have been moving up together along with sentiment since late Q4. But if lead times start to falter, that’s cause for concern. We saw that very clearly in the summer of 2021. Lead times were already plunging even as prices continued to move up on strong sentiment. That sugar high of sentiment, however, only lasts so long. Remember all that talk of $2,000-ton HRC and how well that aged?

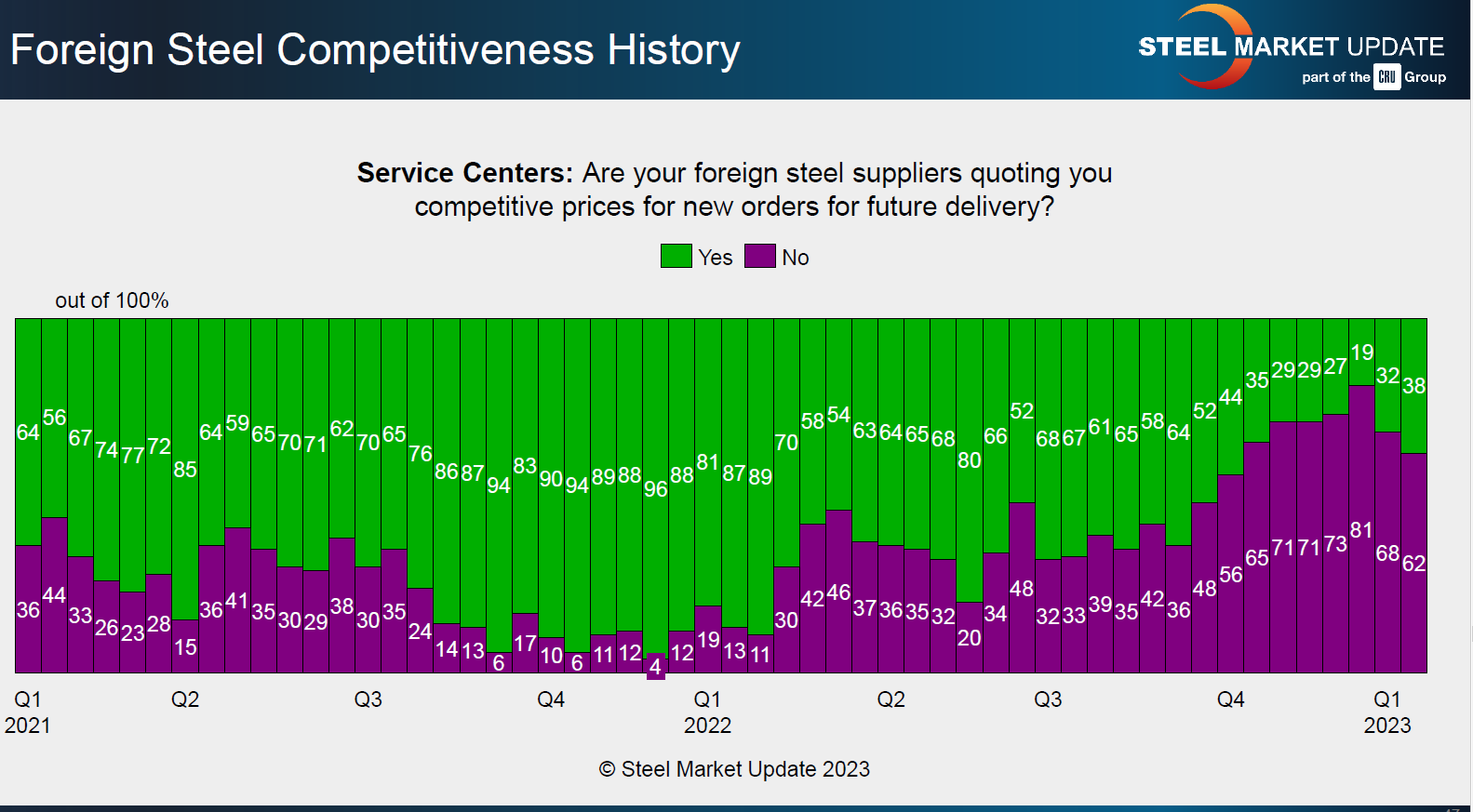

Also, we continue to see an uptick in the number of service centers respondents who are reporting that foreign steel suppliers are quoting competitive prices:

Thirty-eight percent is low by the standards of the last couple of years. It is, however, notably higher than the 19% we saw in late Q4 when US HRC prices hit a 2022 low of $615 per ton.

The number of trading companies responding to our surveys isn’t as high as I’d like it to be. The limited data we have suggests that traders are having more luck making competitive offers for offshore coated products than for foreign hot band. “We have seen a few offers on imports, and nothing is impressive,” one survey respondent said. But, added another: “The current (mill) increases have pushed us back to imports.”

Recall that Cliffs announced a $50-per-ton price increase and targeted hot-rolled coil prices of $800 per ton. ArcelorMittal followed the increase amount but did not provide new base prices.

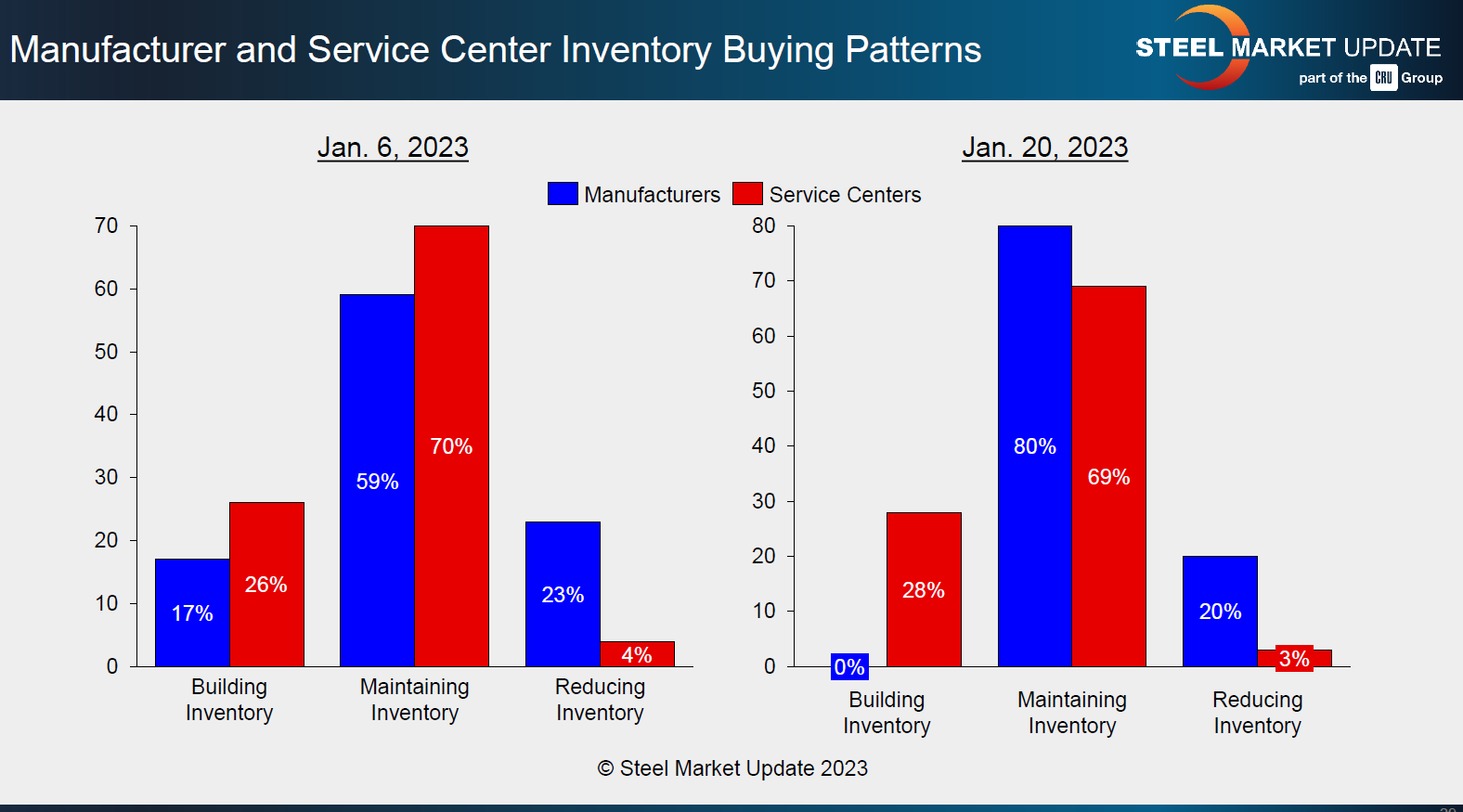

Another unusual trend: There appears to be a disconnect between how service centers and manufacturers are managing inventories:

Twenty-eight percent of service center respondents to our survey said they were building inventories. Only 3% said they were reducing them. That’s not much changed from results earlier in the month. What is changed is that no manufacturers reported back that they were building inventories, and 20% said they were cutting stocks.

What explains that: Do service centers risk being overinventoried because of momentum-driven buys in late Q4 and early Q1? Are manufacturers seeing a softer-than-expected Q1 or 1H and managing their inventories accordingly? Or is it something else entirely?

Let us know what you think! You can reach me at the email below. Or, better still, contact us if you’d like to participate in our surveys at Info@SteelMarketUpdate.com

By Michael Cowden, Michael@SteelMarketUpdate.com