Market Data

January 5, 2023

Final Thoughts

Written by Michael Cowden

Sheet prices started out the year modestly higher. That’s what you’d expect given that Q1 is typically a busy and that scrap prices usually rise over the winter months.

The question now is whether prices, which have been moving upward since Thanksgiving, continue to increase or whether the current upswing might prove to be a “head fake”.

Preliminary results from our latest market survey – we’ll release full results tomorrow – indicate that the reality is somewhere in the middle.

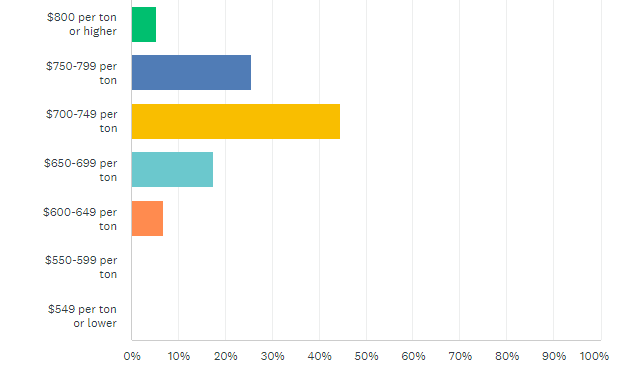

Take a look at the chart below:

Most people, approximately 59%, think that prices will peak in February or March. A few bulls (~17%) think prices won’t peak until April or later. But they’re offset by a sizeable minority of bears (~24%) who think that prices have already peaked or will later this month.

What did people have to say when we asked when and why steel prices would peak? Below are a few responses I found interesting. (We get a lot of replies, so apologies if I didn’t include yours.)

“If domestic mills have production discipline the market is there’s. Imports cannot affect 1st quarter as arrivals are late 1st quarter at the soonest. And imports are not attractive due to future uncertainty and no significant price advantages over domestic supply.”

“Restocking and strong automotive will help prop up prices, but otherwise weak demand in construction and excess capacity will not allow prices to run up for too long.”

“There will be some more movement upwards with scrap heading higher and seasonal restocking, but it’ll be limited.”

“Mills don’t typically lower prices a month after the first increase. I don’t think demand will be strong, so I think the peak may come early in Feb.”

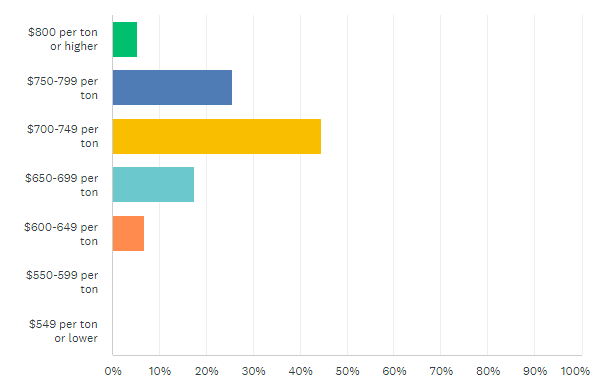

We also asked people where they thought hot-rolled coil prices would be two months from now. Here are the results:

About 45% think HRC prices in early March will be $700-740 per ton ($35-37.45 per cwt), roughly 26% forecast $750-799 per ton. A notable number of bears (24%) think prices will remain in the $600s per ton. (SMU’s HRC price stands at $695 per ton this week.) Only a very bullish minority (5%) think we’ll see HRC above $800 per ton two months hence.

Here are some notable comments from survey respondents on their HRC price predictions:

“January demand and scrap prices will keep prices above $700.”

“I expect $50/ton per month of increases, so it could go up $100/ton within two months.”

“I think there are enough macro concerns to really limit the upside here. I don’t expect much movement above $750/ton.”

“Not much higher than $800/ton. But slightly above.”

Tampa Steel Conference

Our survey asks you about steel prices two months from now. I hope to see you sooner than that.

Namely, a month from now at our Tampa Steel Conference.

Nearly 300 people have registered from companies across the metals supply chain. We’re anticipating another 100-200 will register between now and when the conference opens on February 5.

We have a great line of speakers, including senior executives from mills from across North America. Don’t miss out! Learn more about the event and register here.

By Michael Cowden, Michael@SteelMarketUpdate.com