Prices

July 12, 2022

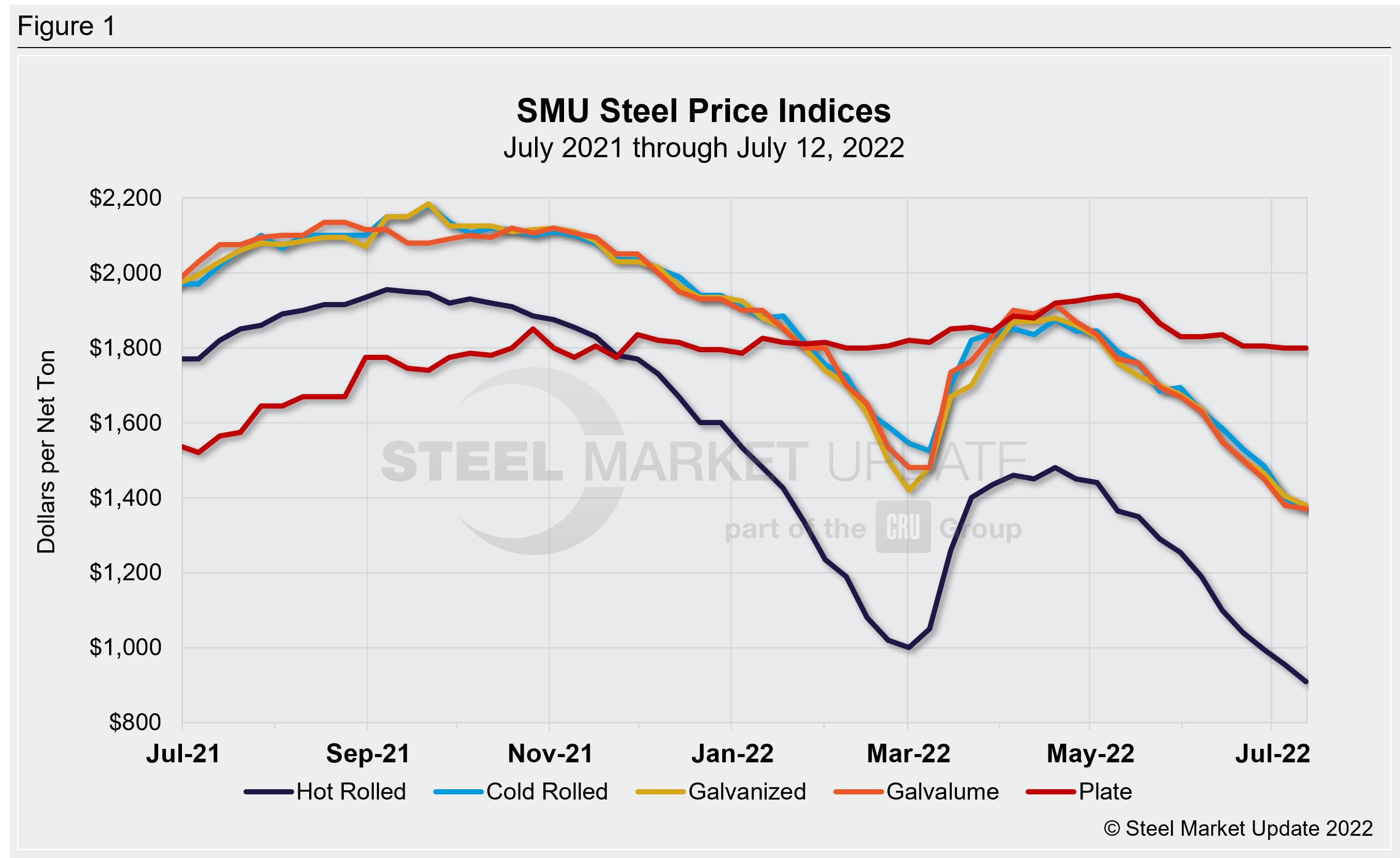

SMU Price Ranges: Sheet Down Again, But Pace of Declines Slows

Written by Brett Linton

Sheet prices continued to slide this week and plate prices to defy gravity.

If there is an upside, it’s that the pace of sheet declines has moderated slightly.

SMU’s hot-rolled coil price now stands at $910 per ton ($45.50 per cwt), down $45 per ton from $955 per ton a week ago and down $190 per ton from $1,100 per ton in mid-June.

HRC prices remain at their lowest levels since early/mid December 2020.

Cold-rolled (down $30 per ton), galvanized (down $25 per ton), Galvalume (down $10 per ton) also remained on a downward trajectory.

The silver lining: HRC prices fell $190 per ton from mid-June to mid-July. That’s less than the $265-per-ton decline seen between mid-May and mid-June.

Plate prices remain unchanged, with certain domestic mills continuing to draw a line in the sand at ~$1,860 per ton despite some sources reporting shorter lead times, a wide spread with HRC, and potential competition from imports.

SMU’s price momentum indicators remain at Lower, meaning we expect lower prices over the next 30 days.

Hot Rolled Coil: SMU price range is $840-$980 per net ton ($42.00-$49.00/cwt) with an average of $910 per ton ($45.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $70 per ton compared to one week ago, while the upper end decreased $20 per ton. Our overall average is down $45 per ton from last week. Our price momentum indicator on hot rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $1,300-$1,440 per net ton ($65.00-$72.00/cwt) with an average of $1,370 per ton ($68.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week, while the upper end decreased $60 per ton. Our overall average is down $30 per ton from one week ago. Our price momentum indicator on cold rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU price range is $1,330-$1,430 per net ton ($66.50-$71.50/cwt) with an average of $1,380 per ton ($69.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago, while the upper end decreased $60 per ton. Our overall average is down $25 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,436-$1,536 per ton with an average of $1,486 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks

Galvalume Coil: SMU price range is $1,340-$1,400 per net ton ($67.00-$70.00/cwt) with an average of $1,370 per ton ($68.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $10 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,659-$1,719 per ton with an average of $1,689 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $1,740-$1,860 per net ton ($87.00-$93.00/cwt) with an average of $1,800 per ton ($90.00/cwt) FOB mill. The lower end of our range decreased $5 per ton compared to one week ago, while the upper end increased $5 per ton. Our overall average is unchanged from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4-6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com