Prices

May 17, 2022

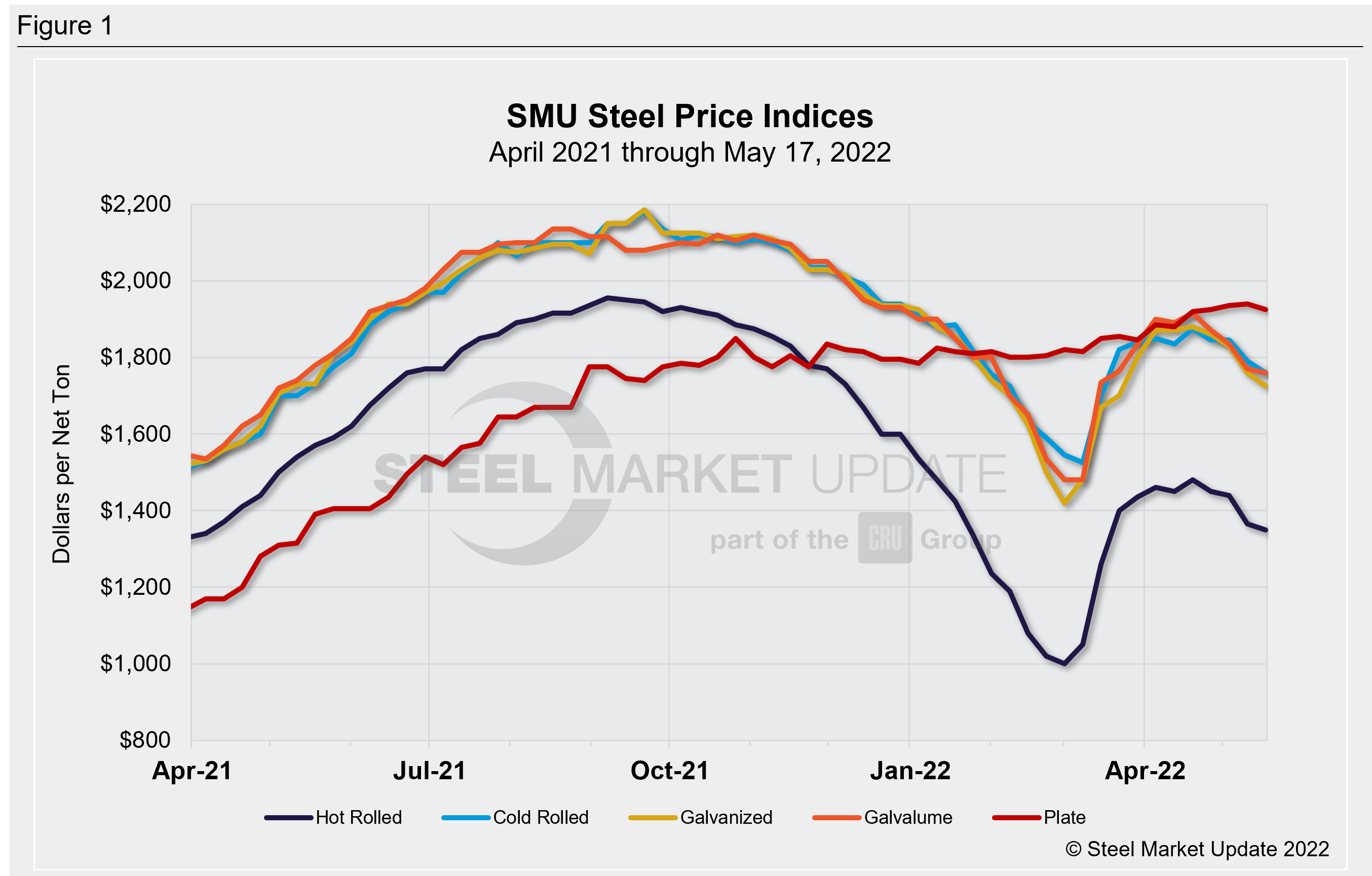

SMU Price Ranges: Sheet Slides as Summer Arrives Early for Steel

Written by Brett Linton

Sheet prices slipped again this week on what some sources described as a summertime market that has arrived a few weeks earlier than usual.

SMU’s hot-rolled coil price was down $15 per ton week-over-week (WoW) to an average of $1,350 per ton ($67.50 per cwt).

Other sheet products also fell, with cold-rolled down $30 per ton, galvanized base prices down $35 per ton, and Galvalume down $10 per ton. Even plate lost a modest $15 per ton.

While some sources said that they and their customers remained busy, others said that they had noticed a marked slowdown in business over the last few weeks.

Market participants cited various reasons for a potential slowdown. Several pointed to macroeconomic concerns such as inflation, a 1.4% decline in Q1 GDP, and increased fears of a recession. Another key theme that emerged from calls with market contacts: Buyers have moved to the sidelines amid falling prices. And some think that HRC prices could fall back to pre-war levels of $1,000 per ton or lower.

Also, some mills were said to be lowering sheet prices to make imports less attractive to buyers in Q3 and Q4. Doing so might be necessary to counter lower prices out of Asia, which has been hit hard by China’s zero Covid policy and perhaps by Russian steel being rerouted away from traditional customers in the West.

Our price momentum indicator remains at Lower for sheet products. Our plate momentum indicator is at Neutral because plate mills continue to hold the line around $1,900 per ton. That said, somes sources noted that service center resale prices for plate have moved lower.

Hot Rolled Coil: SMU price range is $1,300-$1,400 per net ton ($65.00-$70.00/cwt) with an average of $1,350 per ton ($67.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago, while the upper end declined $20 per ton. Our overall average is down $15 per ton from last week. Our price momentum indicator on hot rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-8 weeks

Cold Rolled Coil: SMU price range is $1,700-$1,820 per net ton ($85.00-$91.00/cwt) with an average of $1,760 per ton ($88.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to last week, while the upper end declined $40 per ton. Our overall average is down $30 compared to one week ago. Our price momentum indicator on cold rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 5-10 weeks

Galvanized Coil: SMU price range is $1,650-$1,800 per net ton ($82.50-$90.00/cwt) with an average of $1,725 per ton ($86.25/cwt) FOB mill, east of the Rockies. The lower end of our range declined $70 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $35 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,756-$1,906 per ton with an average of $1,831 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-9 weeks

Galvalume Coil: SMU price range is $1,720-$1,800 per net ton ($86.00-$90.00/cwt) with an average of $1,760 per ton ($88.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $10 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,039-$2,119 per ton with an average of $2,079 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-9 weeks

Plate: SMU price range is $1,890-$1,960 per net ton ($94.50-$98.00/cwt) with an average of $1,925 per ton ($96.25/cwt) FOB mill. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end declined $10 per ton. Our overall average is down $15 per ton from last week. Our price momentum indicator on plate steel continues to point to Neutral until the market establishes a clear direction.

Plate Lead Times: 4-7 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com