Analysis

May 1, 2022

Final Thoughts

Written by Michael Cowden

The steel market has adapted to the shock of the war in Ukraine – and it’s become clearer with each passing week that a steeper price decline than we have seen to date might be in store.

I wrote on Thursday that the headline data from our latest survey indicated the market had peaked. I pointed to falling lead times, mills willing to negotiate lower prices (especially for hot-rolled coil), and wide spreads between US HRC prices and those abroad (especially in Asia).

We’ve now crunched all the numbers for our full survey results, and an even clearer picture of a steel market correction is coming into view.

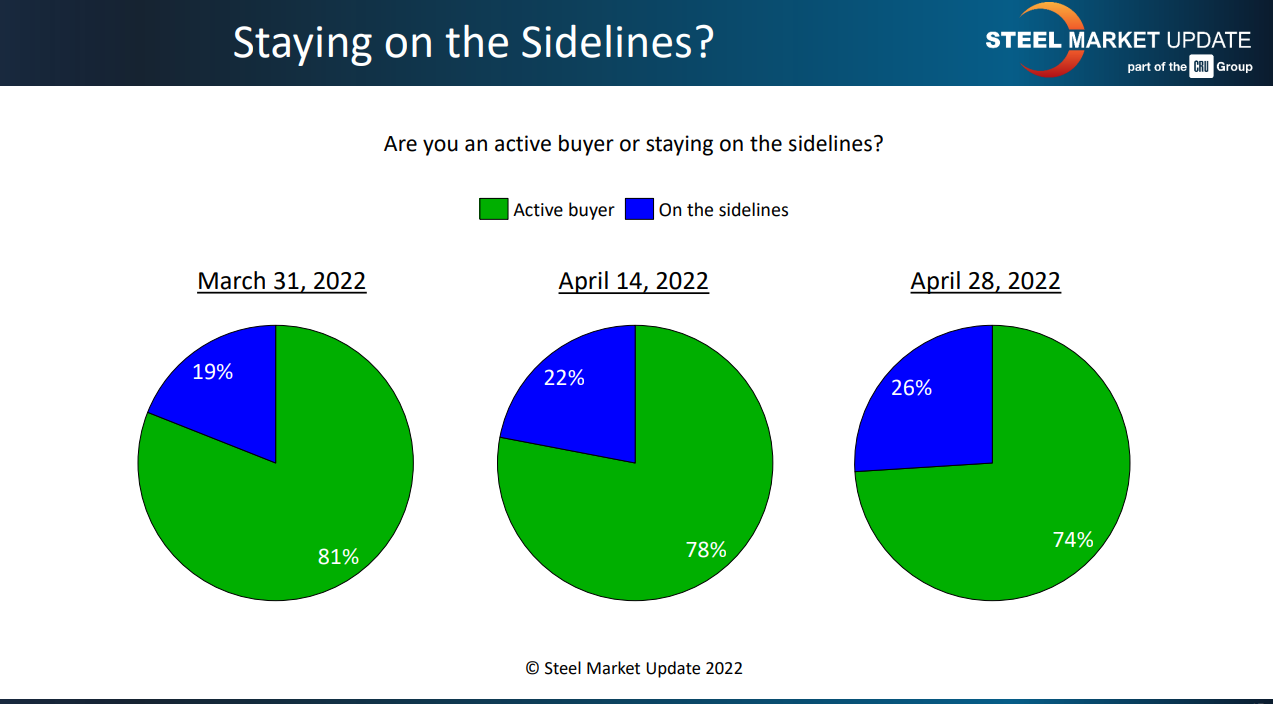

We have seen more buyers every week since at least late March on the sidelines:

Buyers often move to the sidelines when prices are falling or when they aren’t sure which way prices will go.

We recorded lower prices for all sheet products last week. The declines were modest. They often are at first.

Why do I think that trend might continue, especially with most people reporting that overall demand is still good?

I like to keep a close eye on what’s happening at the margins because that’s often an early indicator of where the rest of the market is heading.

I have been saying for about a month now in presentations, in webinars and in articles to keep an eye on service center resale prices. I said that because service center resale prices often stall out or fall well before prices at the mill level do.

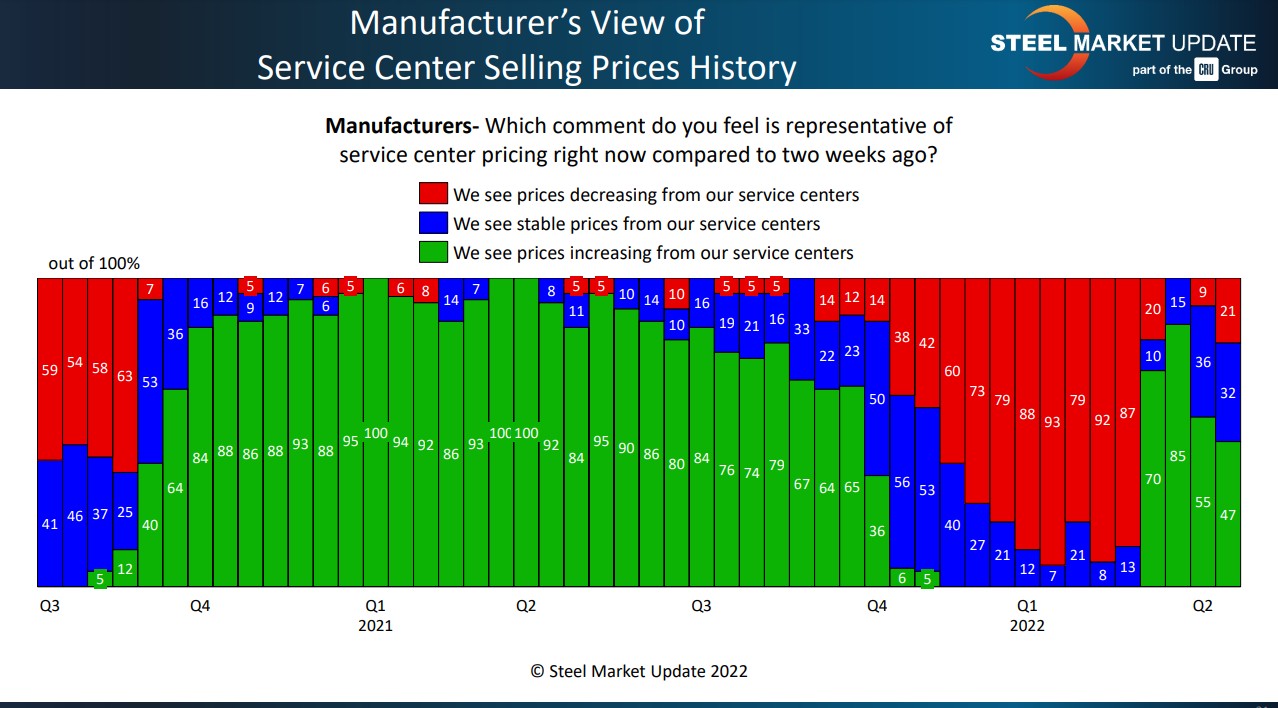

Look at the chart below. For the first time since the outbreak of the war, most manufacturers, 53%, are reporting stable (blue) or lower (red) prices from service centers.

I said last month that one survey did not a trend make. But we now have two surveys showing similar results. I think it’s fair to say that service centers keeping prices flat or lowering them is not just a trend but an accelerating one.

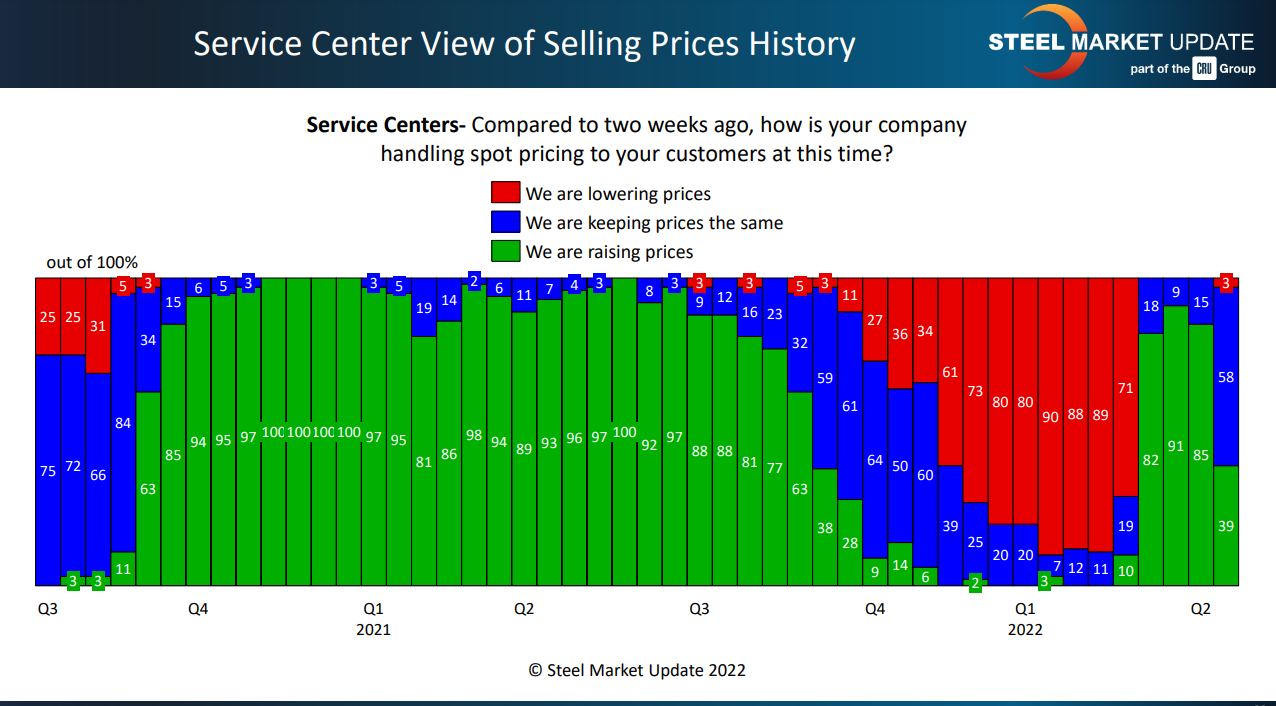

Keep in mind that at SMU we try to tackle the same question from multiple angles. It’s not just manufacturers saying that service centers are less aggressive now on pricing. Service centers are saying that too. Only 39% report increasing prices – a sharp change from last month:

What happened? Lewis Leibowitz in his column outlines the macro reasons: declining US GDP, inflation at home and abroad, snarled supply chains, and the war.

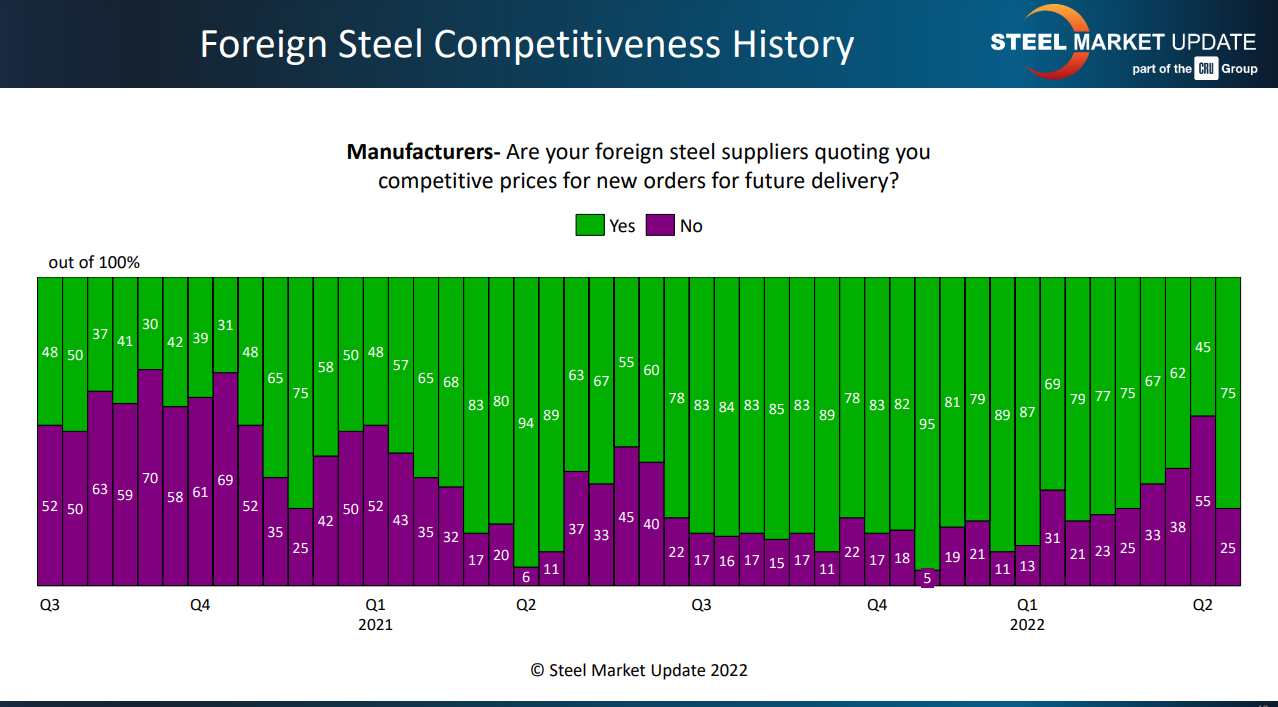

As far as the data we collect, it looks like more manufacturers are being offered competitive prices for imports. Recall that US steel prices briefly fell below those in the rest of the world but are now again the highest – and by a wide margin when compared to prices in Asia.

Will manufacturers act on those offers? I wouldn’t be surprised if they do. I also wouldn’t be surprised if US steelmakers cut prices to fend off imports. That’s a formula for volatility over the summer months.

I know there are hopes all along the supply chain – from producers on down – that prices will be stable. But in practice, US steel prices rarely are. They’re either rising or falling, with only short periods of stability in between.

I was talking to someone in the steel industry who used to work in the oil sector. He recalled how the population of Odessa, Texas, would boom or bust depending on the price of oil. I said that things must be booming with oil above $100 per barrel. He said he never felt comfortable when oil prices crossed the $100 threshold. Because once they did, you knew it wouldn’t be long before a correction came.

The steel price equivalent of $100 per barrel oil might have been $700 per ton or so in the past. Steel prices have been so volatile since 2020 that I’m not sure what that number is now. Costs are higher, a lot higher. So is $1,400 per ton the new $700 per ton? If it is, watch out.

By Michael Cowden, Michael@SteelMarketUpdate.com