Analysis

April 19, 2022

Final Thoughts

Written by Michael Cowden

I’m writing this Final Thoughts from our first in-person Steel 101 workshop in more than two years.

It’s great to see everyone here in Memphis, Tenn. It turns out everyone has legs and feet. We are not all disembodied heads on Zoom or Teams.

It’s also great to see so many people at Steel 101. We sold out. When times are bad for steel, training is often among the first things to be cut. That’s not the case in 2022.

![]()

Yes, the pandemic is still with us. Yes, we are faced with a war in Ukraine that shows little signs of ending anytime soon. But these are not bad times for steel.

I remember being told years ago – let’s call it the “before times”: before Section 232, before Covid, before the war in Ukraine – that it cost integrated mills about $600 per ton ($30 per cwt) to make hot-rolled coil. And that the newer electric-arc furnace (EAF) sheet mills could make coil for as little as $400 per ton ($20 per cwt).

When HRC went below $600 per ton, integrated mills started losing money and cutting back on things like training.

We did shift our price momentum indicators to neutral last week. Because there are some signs that this market is peaking out. Last week we saw HRC prices edge down from $1,460 per ton to $1,450 per ton. A lot might have been made of the decrease with prices edging back up $30 pet ton this week, presently at $1,480 per ton. But these shifts are practically nothing given how high we’re starting from.

Let’s also bring back a little historical perspective. Remember the Sparrows Point steel mill near Baltimore? It was once part of the once mighty Bethlehem Steel. It closed in 2012 when RG Steel filed for bankruptcy. It has since been razed and turned into a distribution center.

HRC prices fell below $600 per ton twice that year – in July and then in October. If prices a decade ago were as high as they are now, would Sparrows Point have survived? My vote is ‘yes’.

I also remember writing a lot a decade ago about whether this or that mill would be able to make its next debt payment, or whether the next note due might be the straw that broke the camel’s back. I even remember waiting on digital court records to be updated on rumors that bankruptcy filings from other mills might be imminent.

That’s not something we’ve been doing in recent years. Mills’ balance sheets are in the best shape they’ve been in years, maybe decades. But – and there is always a but – it’s important not to be complacent.

So here is that but. I took a close look at our most recent survey data. And a few items caught my eye.

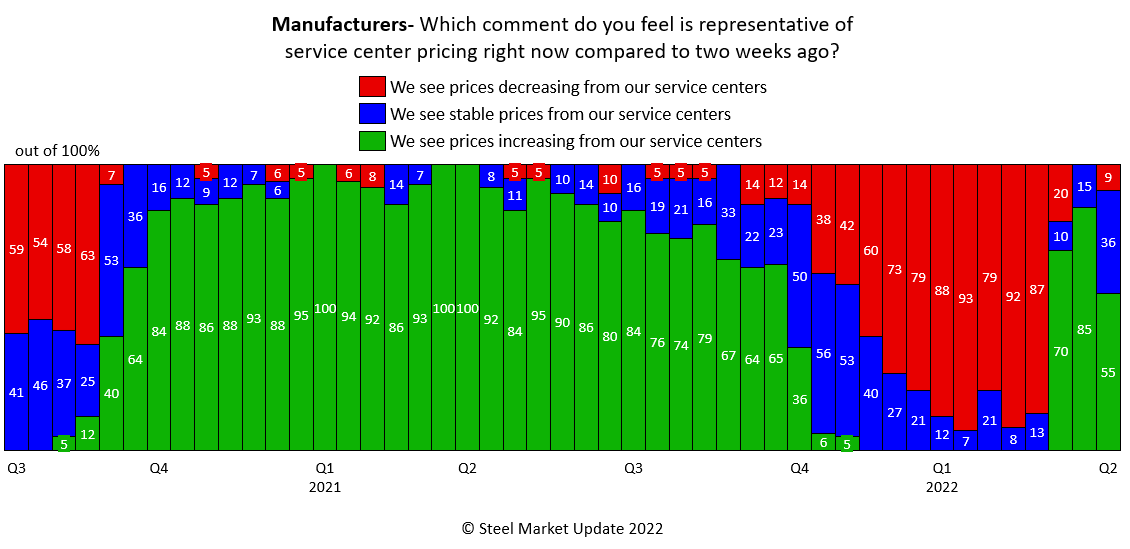

Take a look at right-hand side of the chart below.

Most manufacturer respondents, 55%, reported back to us that service centers continue to raise resale prices. That’s what you would expect – and what has been the case since the outbreak of the war in Ukraine, which resulted in steel prices going up nearly 50% in the weeks that followed.

In the last survey, 45% reported that service centers were keeping prices even or even lowering them. I don’t want to call a trend based on one week of survey data. But it’s worth keeping an eye on that slide in the weeks ahead.

Why? Look back at 2021. In the first half of the year, almost all manufacturers said that service centers were raising resale prices. They were passing along higher costs in tandem with mills, which were aggressively raising prices.

But you can see that in the third quarter, more manufacturers reported that service centers were holding prices even or even lowering them. That is notable because mills at the time were still pushing prices up fast – recall that we didn’t peak until $1,955 per ton in September or start falling in earnest until the fourth quarter.

In other words, resale prices, like lead times are an important leading indicator. And that indicator – if this trend continues – is a red light.

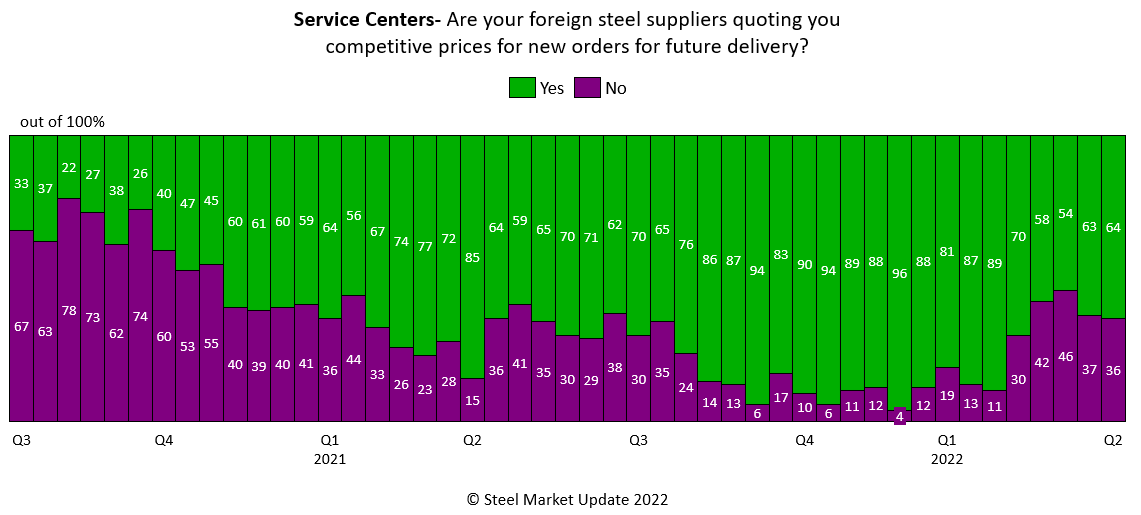

Another slide I like to keep tabs on is whether service centers are finding current import offers attractive:

Again, take a look at the right-hand side. I wouldn’t say this one is flashing red at the moment. But you can see that more service centers are reporting to us that they are finding import offers competitive again.

And this makes sense given some of the other data we’ve flagged in recent issues. Prices shot up in the US and the Europe because of the war in Ukraine. But prices in Asia didn’t rise by nearly much.

Could we see more coated product coming in from East and Southeast Asia over the summer as a result? I wouldn’t bet against that possibility. Could we see domestic mills slash prices to compete against those imports? I wouldn’t bet against that possibility either.

By Michael Cowden, Michael@SteelMarketUpdate.com