Plate

February 4, 2022

HRC-Plate Spreads Indicate Plate Price Correction Coming

Written by Michael Cowden

Plate prices have been remarkably steady in the face of sheet price declines of hundreds of dollars per ton.

That trend probably can’t hold for much longer, and plate prices are overdue for a correction, according to market contacts and SMU data.

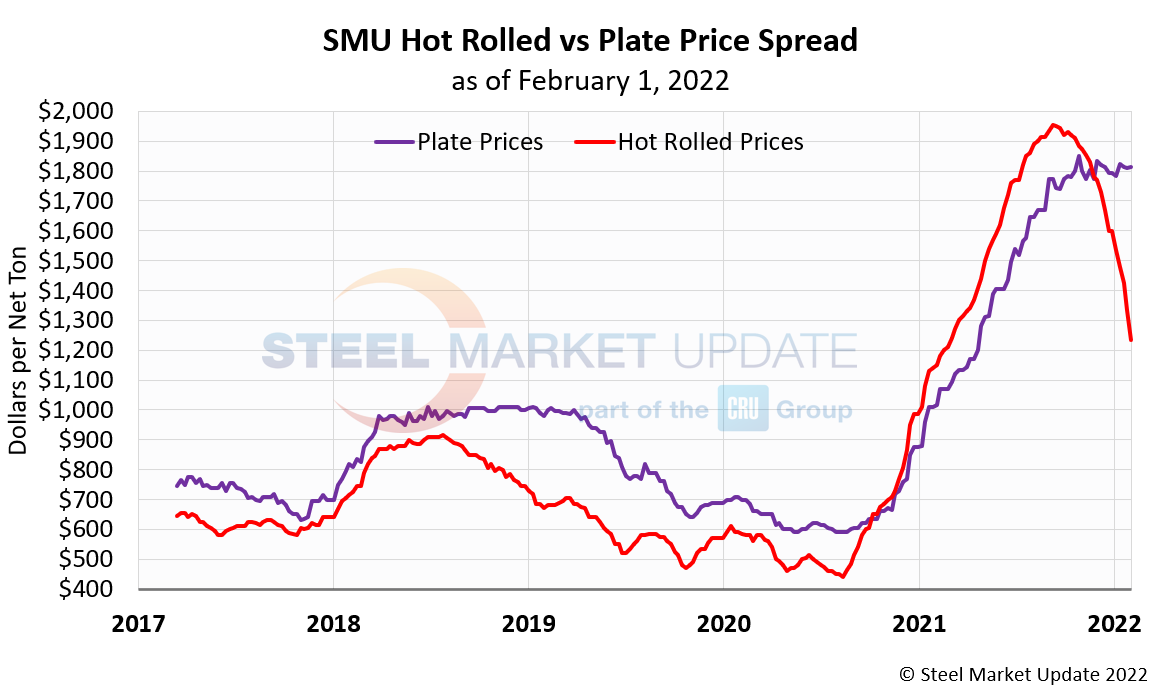

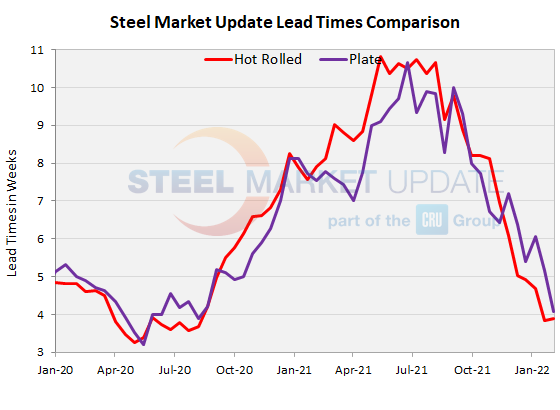

For starters, look at the chart below:

HRC prices have fallen from $1,600 per ton ($80 per cwt) at the start of the year to $1,235 per ton in our last check of the market. That’s a decline of $365 per ton, or nearly 23%. Plate prices, in contrast, have since early January bounced around in a narrow bandwidth of approximately $1,800-1,825 per ton.

Remember that HRC prices shot above plate prices last year. That’s unusual because plate typically carries a premium to sheet – as it should because it’s a value-added product and requires more time on the mill.

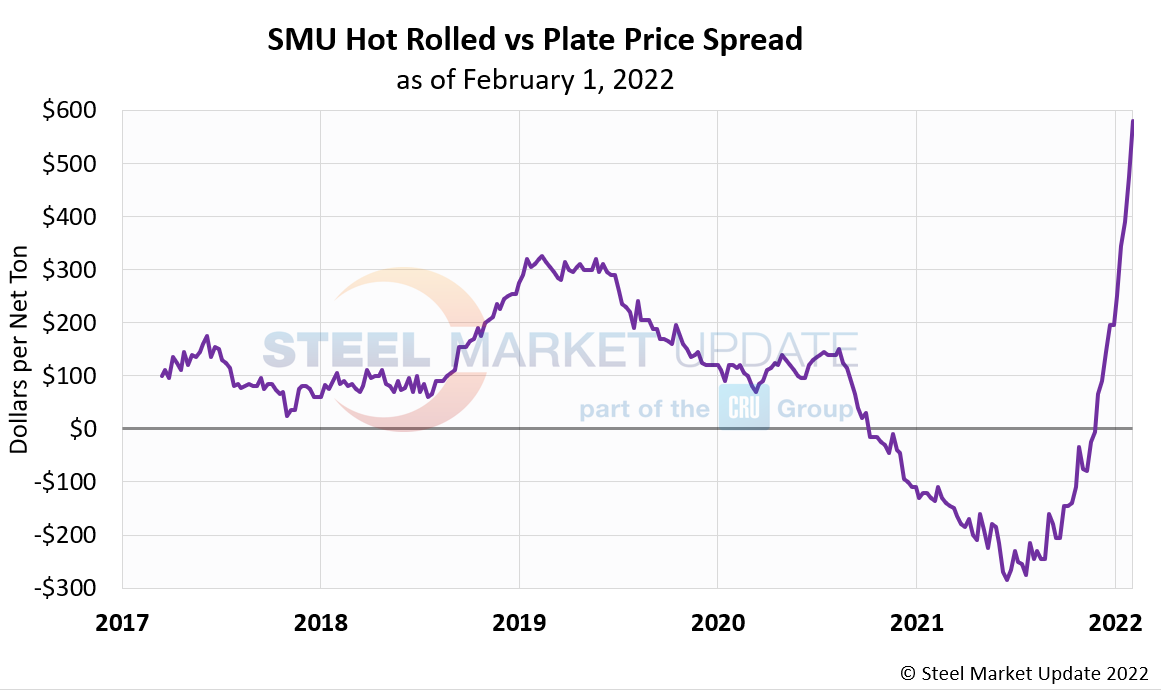

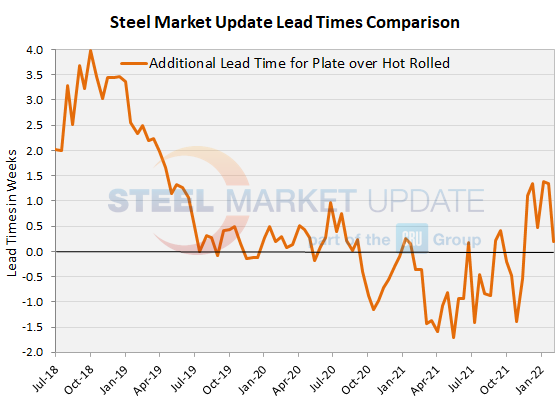

Plate mills fought hard to get their prices on par with and then above coil prices. And they’ve clearly succeeded. Spreads between sheet and plate have ballooned:

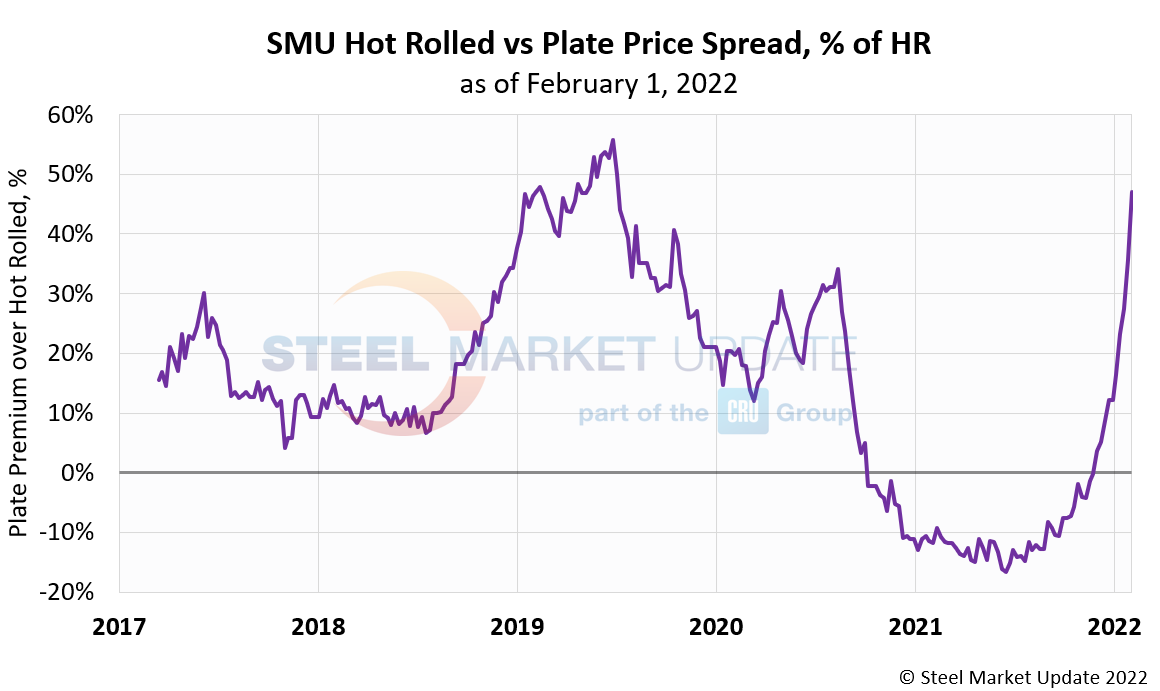

HRC carrying a nearly $300 per ton premium over plate last year was not sustainable. But plate carrying a premium of nearly $600 per ton over sheet is not sustainable either. You can see that that premium is typically in the range of $100-300 per ton.

Or here is another way to look at it:

Another telling factor is lead times. Hot-rolled coil lead times are approximately 3-4 weeks. They have stabilized around that level if for no other reason than that’s about as low as they can go. Plate lead times in contrast have continued to decline. Recall that sheet lead times fell months ahead of sheet price declines beginning in earnest. Is there any reason why plate prices wouldn’t follow lead times down as well?

So that’s the numbers. And they present a strong case for a plate price correction. Is that also what people out in the market are saying?

Yes, mostly. Plate mills might be holding prices steady. But the huge gap between sheet and plate prices means that buyers are using sheet instead of plate whenever possible. That’s the opposite of last year, when HRC was on its way to nearly $2,000 per ton and when product substitution toward plate was accelerating.

We’ve heard anecdotally that plate mills are having a hard time booking out March order books. And some buyers have told us they don’t think plate mills entirely realize how much additional demand they saw last year because of product substitution – and how much they might be losing this year for the same reason.

“That’s a pretty big swing,” one service center executive said of the sheet-plate differential. “They (plate mills) were getting a tremendous amount of business from that (HRC product substitution).”

“Now that prices have flip-flopped the other way, plate numbers will drop radically from March-April,” he predicted. “No one has dropped the number yet, but I know the plate mills have a lot of tonnage available.”

A second service center source echoed that sentiment: “Seems like the mills are starting to realize that the game is up.”

But not everyone agrees. “I tried negotiating a deal with tons with two mills – no budging, no deals. Plate prices are not coming down anytime soon,” a third service center exec said.

That commentary roughly squares with our survey data indicating that plate mills are still less willing to negotiate lower prices compared to sheet mills.

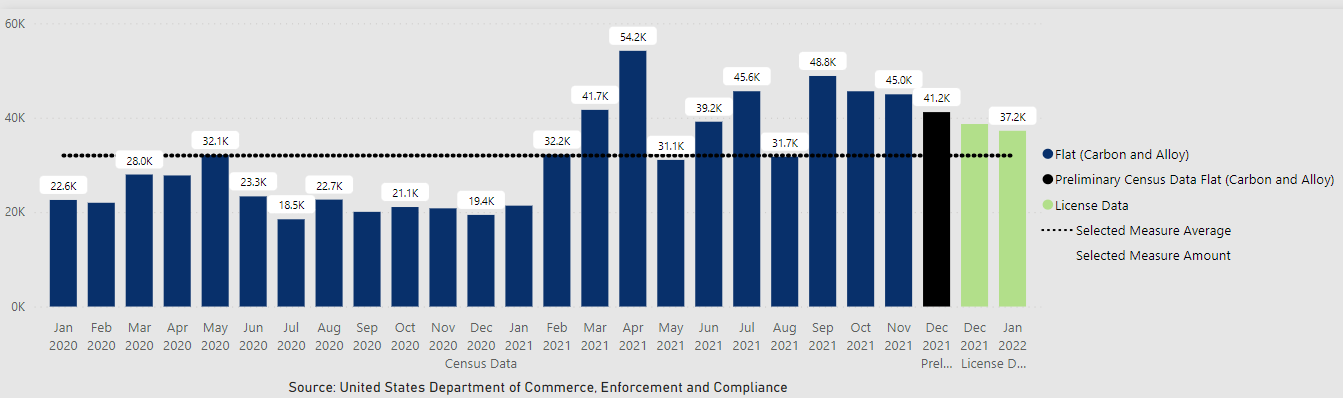

But it’s probably only a matter of time. Some sources said that imported plate was available hundreds of dollars per ton below domestic prices. And plate imports – as the government data below indicates – have been running higher than usual for the last year. (Note that government data is reported in metric tonnes.)

So to recap: Predicting exactly when a price will fall is always tricky. But we think it’s fair to say that all of the pieces that might lead to a big decline are already in place.

By Michael Cowden, Michael@SteelMarketUpdate.com