Analysis

February 1, 2022

Final Thoughts

Written by Michael Cowden

Steel prices continue to fall very, very quickly. Where they’ll bottom and when remains unclear.

I wrote in an in-print magazine article last month that I hesitated to put pen to paper for fear that any prices I wrote would be out of date by the time the article was on the page. My fear now is that any prices I type now will be out of date by the time you read this on your screen.

Spreads remain wide as prices inflect downward. And the gap between where prices are now and where respondents think they will be at the end of the first quarter is equally wide.

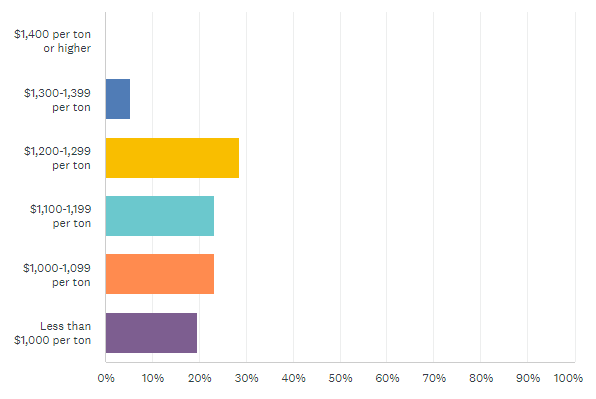

We asked people where they thought hot-rolled coil (HRC) prices would end next month. Not surprisingly, nearly everyone predicted they would be lower than they are now:

More than half think prices will end the first quarter between $1,100 per ton and $1,299 per ton. That would mean the days of weekly declines of $100 per ton, as we saw this week, are numbered.

A sizeable minority think prices will be $1,099 per ton or lower. And nearly 20% think that prices will fall below $1,000 per ton.

A triple-digit price makes sense if we return to a “cost plus” pricing model. And $800s-900s per ton would still be well above historic norms. But it’s still a little jarring to see such predictions when we haven’t seen steel hot-rolled coil prices below $1,000 per ton since late 2020, according to SMU’s interactive pricing tool.

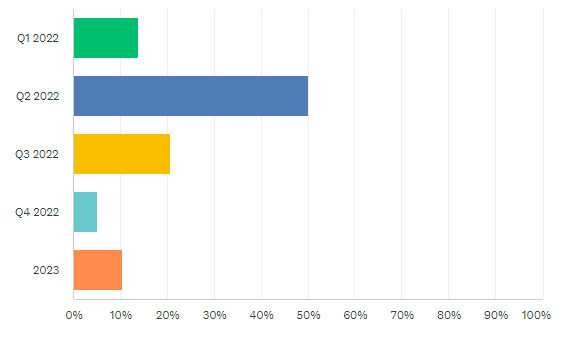

Responses were less varied on when HRC prices will find a floor:

Half of survey respondents think HRC prices would bottom in Q2. And a few optimists, nearly 15%, predict they would bottom out this quarter. In other words, most think we will have a steep but swift correction.

Survey respondents offered a range of reasons for what might be driving the declines. Some of them are familiar: new capacity, the need for U.S. prices to normalize with world prices, and the tendency of domestic mills to overcorrect both on the way up and on the way down. (Recall that U.S. HRC prices fell below Chinese HRC prices in the summer of 2020.)

They also offer some familiar reasons for why they might bottom in Q2: major upcoming blast furnace outages, the potential for a “dead-cat bounce” if buyers run inventories down too low and come back to the market to restock at the same time, and the potential for mill price hikes to at least tap the brakes on current declines.

I personally think that U.S. prices will fall hard as EAF mills revert back to a cost-plus model (dragging integrated pricing down in the process) and as domestic producers fight with imports for market share. Steel buyers, assuming prices will go down forever, will let inventories get to lean. And then prices will pop once they come back to buy again. Whether that will be a “dead-cat bounce” or the beginning of a sustained upswing will depend on underlying demand.

But enough of me opining and paraphrasing what other people are saying. Here is what contributors to our survey think in their own words, which represent a lot more collective wisdom than anything I might muster:

“The slide should continue. But one has to assume that mills will stop before we get below $1,000/ton.”

“Prices will decrease by a few hundred dollars until they bottom out in the 2nd quarter.”

“The mills are not displaying price discipline yet. However, two announced blast furnace relines during Q1 may help bolster the hot roll price.”

“It will drop to whatever level the mills allow it to drop.”

“As fast as prices are falling, I think the mills will try a stop-gap increase to stop the fall.”

“I don’t expect the massive day-to-day and week-to-week slides to continue. But I do expect softness from the buy side into Q2.”

“Mills will try hard to halt the slide before having to sell late 4th quarter tons.”

“This industry always overcorrects. There is high potential for a dead-cat bounce.”

“Buying has completely stopped. It won’t take long for inventories to be corrected.”

“End 1st Qtr, 1st part of 2nd Qtr. Market should settle by then.”

“Prices are falling faster than advertised.”

“The world market has started turning around from the bottom.”

“European pricing will serve as a backstop to prevent prices from falling further.”

“Most will have chewed through their high inventories and need to buy again during the second quarter.”

“Domestic mills will cut back, and imports will slow for end of 2nd quarter.”

“I’m hoping that it will take just a few months because the economy is not bad.”

“The minis are racing to the old norm of scrap plus a ‘normal’ markup before they take any production off.”

“This will be the point when it will be a bit more difficult for tariff-affected countries to offer competitive pricing. Domestic supply vs. demand will be relatively balanced until new capacity kicks into gear.”

“Demand should be decent in Q2, so a floor will be established.”

“Inventories will rebalance. Imports trend down in Q2, production will adjust somewhat, and distributors will cut inventories too much while demand pops.”

“Orders will improve driven by an increase in auto production, a rebuild of service center inventory levels and some seasonality for construction.”

“Ultimately, they (mills) will get pressed too low, and the outages that are scheduled will pull down capacity.”

“Inventory carriers will start buying more in about a month.”

“Who knows.”

A cynic might say that last one is decades of industry experience distilled into its purest form.

By Michael Cowden, Michael@SteelMarketUpdate.com