Market Segment

January 23, 2022

NLMK USA Q4 Sales Down on Expectations of Lower Prices

Written by Michael Cowden

NLMK USA sales slipped in the fourth quarter on expectations of lower steel prices driving buyers to the sidelines.

It was not only lower consumer activity that pushed NLMK USA sales volumes and prices lower, so too did the tariff-rate quota (TRQ) agreement with the European Union – which is expected to result in additional price declines.

![]() That’s according to a fourth-quarter trading update released by its parent company, Russia-based NLMK Group.

That’s according to a fourth-quarter trading update released by its parent company, Russia-based NLMK Group.

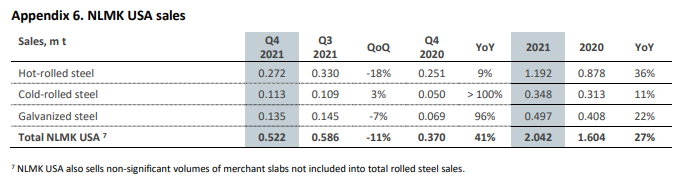

All told, NLMK USA sales were down 11% in the fourth quarter of 2021 compared to the third quarter.

The sober fourth-quarter result comes after a third quarter in which NLMK USA posted increased sales on tight supplies in the U.S. and the highest domestic prices ever recorded. Those trends that have since reversed.

NLMK Group said average flat product prices in the U.S. were down 1% in the fourth quarter compared to the third.

SMU data indicates that trend will accelerate in future quarters because the pace of price declines has accelerated in 2022.

U.S. hot-rolled coil prices averaged $1,425 per ton ($71.25 per cwt) when this article was filed, down 11% from $1,600 per ton in late December and down 27% from a 2021 high – recorded in early September – of $1,955 per ton. Lead times have also fallen sharply.

HRC lead times now average 3.83 weeks, down 22% from 4.92 weeks a month ago and down 61% from 9.79 weeks in early September, according to SMU’s interactive pricing tool. Lead times are a leading indicator of price moves.

Sales volumes for all products made by NLMK USA are below. Note that NLMK operates an electric arc furnace (EAF) steel mill in Portage, Ind., a hot strip mill and cold reduction mill in Farrell, Pa., and a coating facility in Sharon, Pa.

On the semifinished side, NLMK shipped 555,000 metric tonnes of slabs to its U.S. and Danish (NLMK Dansteel) subsidiaries in the fourth quarter of 2021, up 88% from 296,000 tonnes in the third quarter and up nearly fourfold from 146,000 tonnes in the fourth quarter of 2020, according to figures in the trading update. The company does not break out slab export data specifically for NLMK USA.

NLMK USA is not self-sufficient when it comes to slabs and so supplements the slabs it melts at Portage with imports. Most of those imported slabs come from its Russian parent company or from Brazil, which is subject to a Section 232 quota instead of the 25% tariff that most nations face.

NLMK Group, one of the largest steelmakers in Russia, typically issues a trading update with sales and production volumes ahead of complete earnings results.

Steel earnings season gets underway in earnest on Monday when Fort Wayne, Ind.-based Steel Dynamics Inc. (SDI) releases its fourth-quarter earnings after the close of markets. SDI will be followed by Charlotte, N.C.-based Nucor Corp., North America’s largest steelmaker, on Thursday, and by Pittsburgh-based U.S. Steel on Friday.

By Michael Cowden, Michael@SteelMarketUpdate.com