Analysis

January 13, 2022

Final Thoughts

Written by Michael Cowden

The bubble is bursting. Not just any bubble. We’re talking the bubble that is ridiculously wide spreads between hot-rolled coil prices and base prices for cold rolled and coated products.

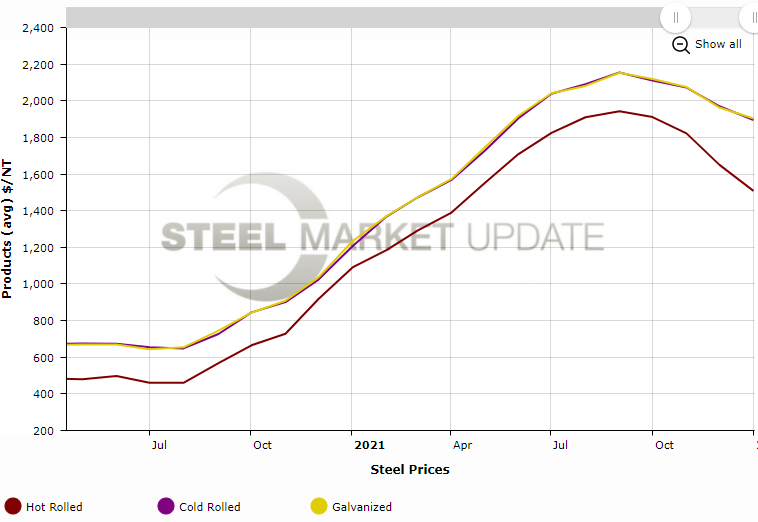

Case in point: SMU’s hot-rolled coil price stands at $1,480 per ton, and our cold-rolled and galvanized base prices are at $1,880 per ton – resulting in a spread of $400 per ton.

That’s just nuts. That spread averaged approximately $300 per ton in December. And it’s double the roughly $200 per ton we recorded in January of 2021, according to SMU’s interactive pricing tool (which also allows you to recreate the chart below).

I wrote last year, when the market was rising fast, that this week’s cold rolled price was next week’s hot rolled price. And I’m willing to bet that the reverse is true in a falling market – this week’s hot rolled price might be next week’s cold rolled price.

We’re already seeing it happen. Hot-rolled coil prices averaged a little over $1,800 per ton as recently as November. That’s around the low end of our cold-rolled and galvanized base price ranges now.

Speaking of those ranges, I know some of you have been saying they’re way too wide.

Some people said that numbers around $2,000 per ton were a mistake. They said we must have been mistakenly included extras and freight. Others said that there was nothing available from domestic mills in the $1,800s per ton – that we must have been confusing domestic prices and import offers.

Recall that spreads tend to balloon when the market is inflecting. That’s just as true on the way down as it is on the way up. Prices gravitated toward the high end of our ranges on the way up, and they’re probably going to move toward the low end on the way down. And so my assumption is that those too-wide spreads are going to narrow, and fast.

As best as I can tell, prices in the $1,800s per ton for cold rolled and galvanized base started in the Gulf Coast and other coastal areas more exposed to import competition. Some producers wanted to fend off imports and keep their customers competitive – and it’s not like they were losing money at ~$1,800 per ton. So there might not have been much resistance to offering a lower price if necessary. Keep in mind $1,800 per ton or so is still more than $1,000 per ton above where cold-rolled and galvanized base prices were in late 2019 and early 2020 – before the pandemic disrupted supply, demand and traditional pricing structures.

What might have started out in coastal regions has spread inland. We’re now hearing that galvanized base prices are available in the mid to low $1800s per ton from multiple domestic mills in the North and away from the coasts.

“Bubbles burst, and I think we’re seeing the bubble burst here,” one service center executive said. “It’s pretty serious. The mills just don’t have orders, and the imports just keeping coming.”

He noted that some companies along the coasts had shifted from ordering ~80-90% domestic material to ordering ~80-90% foreign because U.S. prices had become untenable for them. I asked where the imports were coming in from. His response: Where aren’t they coming in from?

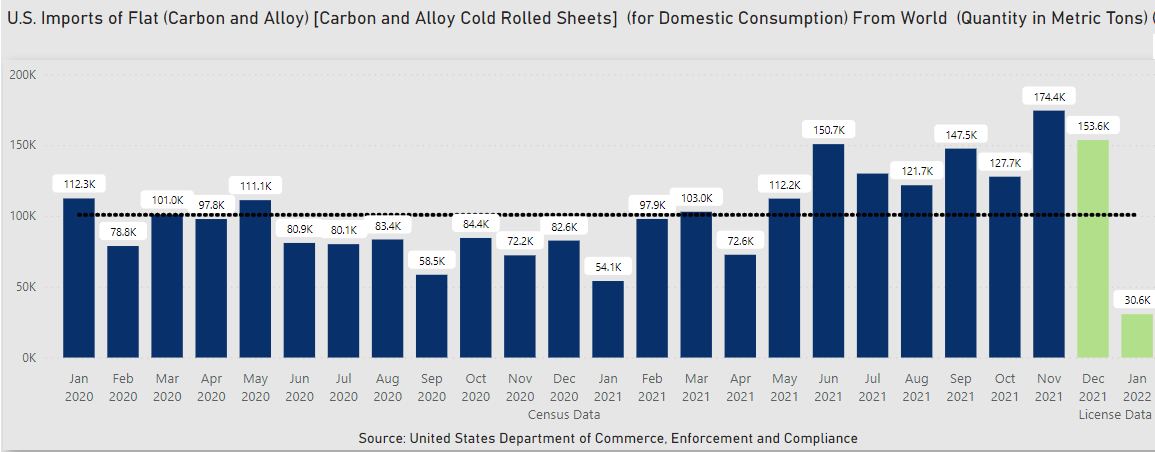

Look at the license data for December for cold-rolled coil. There is of course a lot coming in from Canada (~34k metric tonnes). But there always is given how interlinked North American supply chains are.

There is even more coming in from Russia (~40k metric tonnes). I can’t think of the last time Russia sent more cold rolled to the U.S. than Canada. And it’s all the more notable given that Russia in most months going back to January 2020 sent no cold rolled to domestic ports.

And Russia is hardly alone in shipping more cold rolled to the U.S. Nearly 20,000 tonnes were licensed to come in from Turkey in December, 13,000 tonnes from Taiwan, 11,000 tonnes from Belgium. You get the picture.

And it’s not like November was a shabby month for cold rolled imports either. They totaled approximately 174,400 tonnes, according to preliminary data – nearly 75% above a monthly average of about 100,000 tonnes over the last two years.

Just to be clear, I’m not saying this will be catastrophic for domestic mills. To bring this back to hot rolled terms, in just about any other year, U.S. mills would have been thrilled to see prices above $700 per ton – and we’re double that even after falling nearly $500 per ton from a 2021 peak of $1,955 per ton.

It’s the service centers I’m worried about. Inventories are high, and I know people who bought hot rolled late last year at $1,800 per ton – or roughly where some galvanized base prices are now. And if you think prices for prime product are falling fast, don’t look at the excess prime and secondary markets – where they appear to be falling even faster. (Anecdotally at least. SMU does not officially track excess prime and secondary prices.)

What is driving that trend?

“When prices are skyrocketing, people aren’t as picky and they are willing to take imperfections – and the secondary market slows way down,” another service center executive said. “But now people will say, ‘That doesn’t meet spec’ – and mills don’t want to sit on inventory.”

What is a service center to do in such a situation?

“Obviously we are trying to sell as fast as we can. But I’ve got millions of pounds of inventory. I can’t just snap my fingers and make it go away,” he said.

Good luck out there, folks. Be careful. And remember that all of us at SMU appreciate your time and business.

By Michael Cowden, Michael@SteelMarketUpdate.com