Prices

December 7, 2021

SMU Price Ranges & Indices: Look Out Below!

Written by Brett Linton

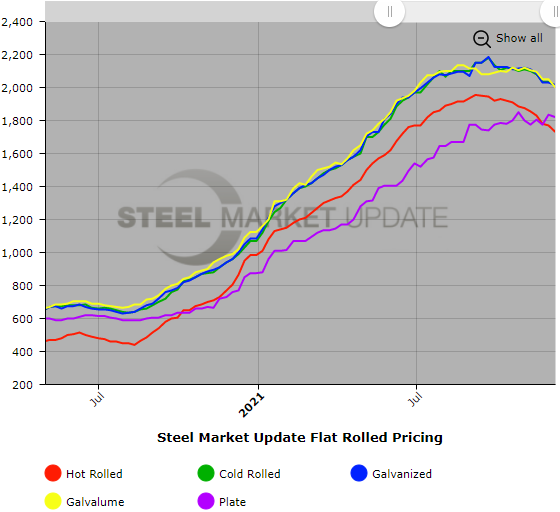

Sheet and plate prices fell across the board this week on shorter lead times, import competition and increased spot availability from domestic mills. Declines for hot-rolled coil were generally steeper than those for value-added products. And while certain mills are trying to hold the line around $1,800 per ton, EAF producers were reported to be in the low $1,700s per ton – with chatter about deals being quietly placed at even lower numbers. And sources reported significantly lower prices even on coated material as certain mills take aim at imports with “foreign fighter” deals available to some of their larger customers. SMU’s Price Momentum Indicators are pointing Lower for all sheet products – meaning we anticipate further price declines in the next 30 days. The plate momentum remains at Neutral as the impact of a round of price hikes announced in late November continues to be digested.

Hot Rolled Coil: SMU price range is $1,660-$1,800 per net ton ($83.00-$90.00/cwt) with an average of $1,730 per ton ($86.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range decreased $40 per ton compared to last week. Our overall average is down $40 per ton from one week ago. Our price momentum on hot rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 4-8 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold Rolled Coil: SMU price range is $1,900-$2,120 per net ton ($95.00-$106.00/cwt) with an average of $2,010 per ton ($100.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago, while the upper end decreased $40. Our overall average is down $25 per ton from last week. Our price momentum on cold rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 5-12 weeks*

Galvanized Coil: SMU price range is $1,900-$2,130 per net ton ($95.00-$106.50/cwt) with an average of $2,015 per ton ($100.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end decreased $30 per ton. Our overall average is down $15 per ton from one week ago. Our price momentum on galvanized steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,978-$2,208 per ton with an average of $2,093 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-14 weeks*

Galvalume Coil: SMU price range is $1,900-$2,100 per net ton ($95.00-$105.00/cwt) with an average of $2,000 per ton ($100.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range decreased $50 per ton compared to one week ago. Our overall average is down $50 per ton from last week. Our price momentum on Galvalume steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,191-$2,391 per ton with an average of $2,291 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-10 weeks*

Plate: SMU price range is $1,780-$1,860 per net ton ($89.00-$93.00/cwt) with an average of $1,820 per ton ($91.00/cwt) FOB mill. The lower end of our range decreased $35 per ton compared to last week, while the upper end increased $5. Our overall average is down $15 per ton from one week ago. Our price momentum on plate steel remains at Neutral until the market establishes a clear direction.

Plate Lead Times: 5-8 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.