Analysis

December 5, 2021

Final Thoughts

Written by Michael Cowden

I’m concerned we’ve all gotten a little too complacent with the idea that the price correction underway will continue to be gradual and that the new floor for hot rolled coil, whatever it is, will be four digits instead of the sub-$400-500 per ton floors that have characterized past downcycles.

I’m not saying we’re headed below $400 again. Yes, this time is different – the industry is more consolidated, prime scrap will be harder to come by and more expensive, and an increased focus on fair trade, worker rights and carbon issues means that cheap imports won’t be able to flood in as they did in the past.

![]()

Also, mills are flush with cash and have strong balance sheets. Some of that money will be invested wisely, some spent foolishly. But almost no one is worrying about a note coming due. I don’t recall that being the case in the nearly 15 years I’ve been doing this.

That preamble aside, I think the idea that we might be headed back toward triple-digit HRC prices should not be dismissed. Because to suggest otherwise is to ignore some very basic indicators that have proven durable over the years – like the relationship between steel prices and lead times.

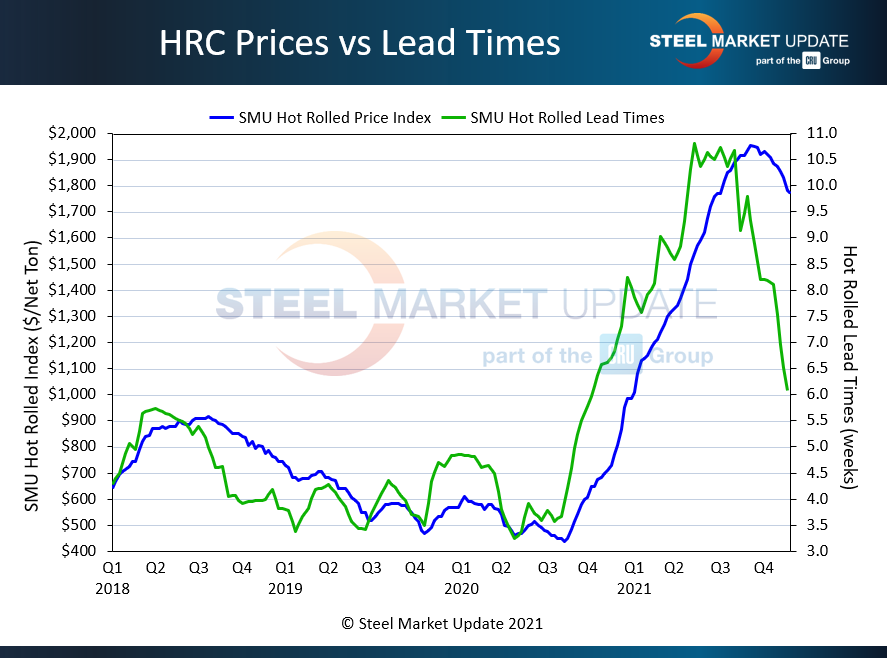

As our long-time members know, SMU keeps a close eye not just on prices but also on lead times. Lead times are the time between when an order is placed at the mill and when that order is processed. Lead times are a leading indicator – they lead prices higher on the way up. And they also lead them lower on the way down. And lead times are painting a more dire picture than the general industry consensus that prices will ease their way down to a higher floor.

Hot-rolled coil prices are in blue and lead times are green. Our average hot-rolled coil price is $1,770 per ton ($88.50 per hundredweight). That’s down about 6% from $1,885 last month and down nearly 10% from a 2020 peak of $1,955 per ton in early September. People keep talking about gradual declines. But in any other cycle a decline of $185 per ton in just a few months would have been catastrophic.

Declines in lead times have been much steeper. Hot rolled lead times have gone from 10-11 weeks on average over the summer to about six weeks more recently. And we’ve seen published hot rolled lead times from some mills as short as 3-4 weeks. Or about 67% lower than the peak.

In other words, some mills still have (or recently had) tons available before the end of the year. That’s not unheard of this time of year in a normal market, but it’s a huge change from earlier this year when buyers were on allocation and when lead times could be measured in months. What’s even more notable is that galvanized lead times at some mills are the same or maybe only a week or so longer than HRC lead times. That’s not normal.

There is not a 1-1 correlation between prices and lead times. Lead times vary widely by mill, and suggesting that price might follow lead times down is 50-67% back-of-the napkin at best and reckless at worst. But I think the scenario is at least worth thinking about. What if prices fell 67% from their September peak. That would be $655 per ton. That’s alarmist, I know. Again, I just raise it as food for thought. I’d also point out that $655 per ton is not a bad price if you compare it to past cycles when lead times fell to 3.5 weeks.

Yes, lead times and prices often rebound in Q1. But not always. (We’re looking at you Q1 2015.) And if you’re an investor, now might be a good time to make sure you’re clear on what percentage of a mill’s book is fixed-price annual contracts, what percentage is quarterly or monthly contracts linked to spot prices, and which part of their book is purely spot. Because I’ve heard from some buyers who have decided to walk away from contracts for next year. They found that the contract prices being asked for were too high, that the typical discounts to spot prices were too low, and that the risk of running out of steel was now negligible.

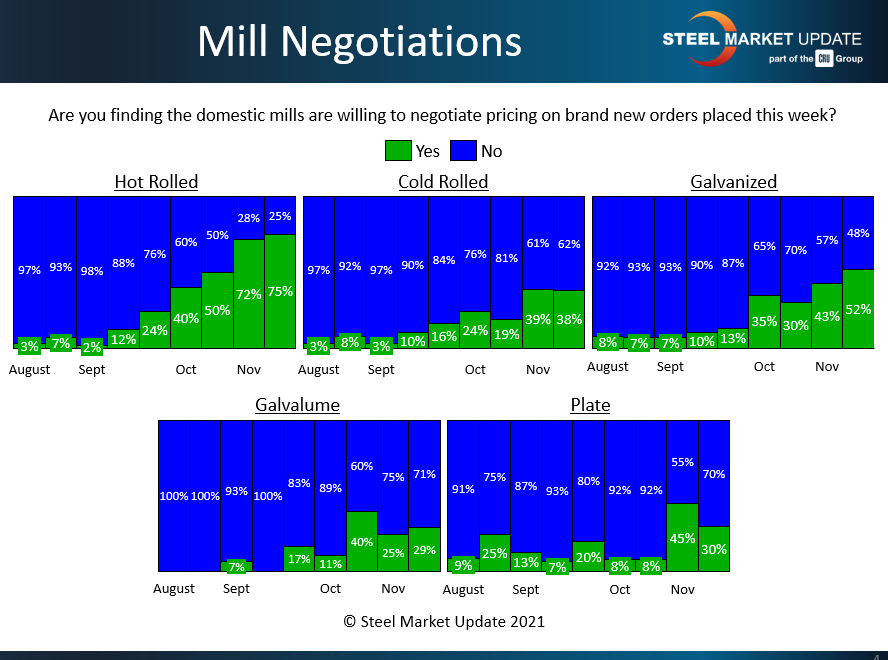

Short lead times mean that mills have more steel available. And if more steel is available, mills typically have less leverage in price negotiations. And that’s the case now when it comes to hot-rolled coil – and increasingly in galvanized too.

The blue bars indicate that mills aren’t willing to negotiate lower prices. The green bars suggest that producers are willing to accept lower prices. Approximately 75% of SMU survey respondents report that mills are willing to negotiate lower hot rolled prices. That’s up from 50% just a month ago. Also, more than half of respondents now say that mills are willing to negotiate lower galvanized prices as well.

I wrote in a prior Final Thoughts – when the market was soaring upward – that one week’s cold rolled price was often the next week’s hot rolled price. Now I’m keeping a close look at the outliers that we collect when we do our surveys and channel checks with market contacts. We’ve had some in the $1,400-1,600 per ton range that we haven’t been able to verify. And so they don’t factor into the ranges you see on our homepage.

But we keep tabs on them all the same. Because in a falling market, this week’s outlier can be next month’s price. Sure, maybe only a tuber buying thousands of tons and sending a lot of scrap back to a mill gets a ~$1,500 or so numbers now – and it might be a deal that’s not repeatable by anyone else. But word of those deals gets out, and eventually smaller buyers get that price too, albeit on a lag. Here’s the thing: When 75% of mills are willing to negotiate lower prices and lead times are short, that lag might not be very long.

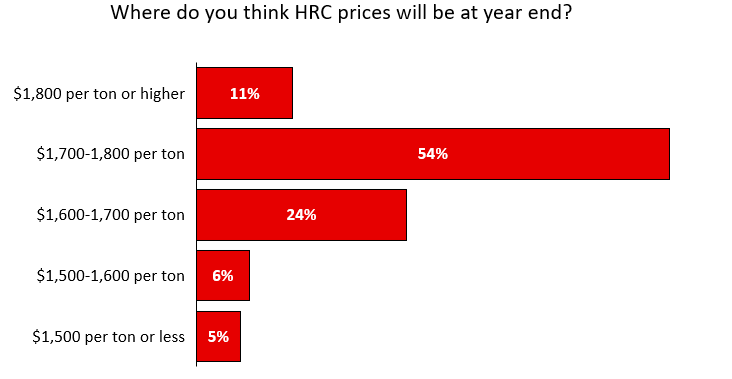

With prices falling, lead times coming in and mills more willing to negotiate, very few people responding to our surveys think prices will go up. Check out this one from our last survey:

Most think prices will end the year at $1,700-1,800 per ton, roughly where they are now. And about a third think there is still time for them to move lower, perhaps significantly so. That’s the extent of the forecasting we do – reflecting what our readers think will happen in the near term.

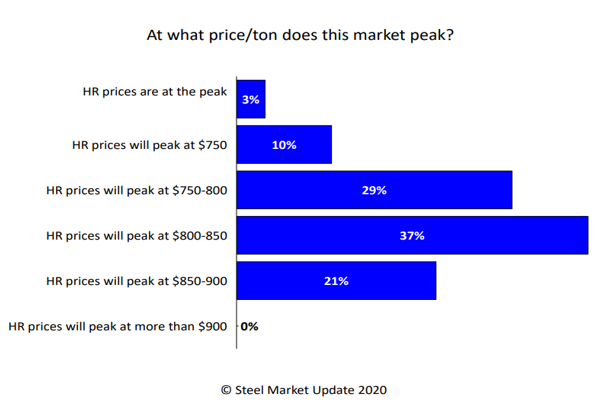

But steel is infamous for its recency bias. When times are good, people think they will roll on forever. And when times are bad, they tend to think they will never get better. Here is an example of just that – it’s from a survey that we did a year ago.

Hot-rolled coil prices were around $800 per ton – or less than half what they are now. But we were on the verge of the biggest upswing steel has seen in decades. And guess what people were thinking this time last year? The consensus was that prices would peak around $800-900 per ton – about where they were, or maybe a little bit higher. No one predicted that prices would be over $1,000 per ton at the beginning of 2021, just a month later. And no one dreamed that they would hit almost $2,000 per ton within 9-10 months. So I’d take our survey results – and people predicting that prices will remain about where they are, or maybe a little bit lower – with a big grain of salt.

Yes, this time is different in a lot of ways. But steel is still a cyclical market.

The saving grace is this:

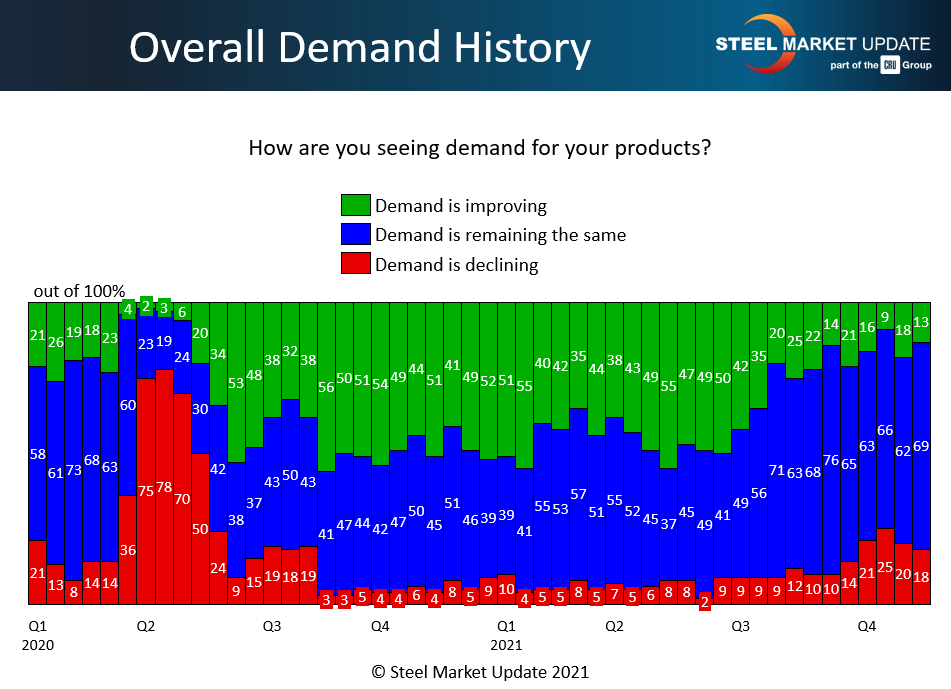

Most survey respondents continue to report demand as stable or improving. So this is not 2008. The music has not stopped. It’s just not blaring so loudly that it’s waking up the whole neighborhood. And I think a sauce of stable demand could keep the party going and make any big downward price moves a lot easier to digest.

PS – Speaking of parties, don’t forget to register for our Tampa Steel Conference. It will be live and in person. You can register here.

PPS – I’ve said it before, I’ll say it again. Don’t just read our survey data and complain about it. Join the conversation and make sure your views and your company’s experience are reflected in the numbers. You can do that by contacting SMU production manager Brett Linton at Brett@SteelMarketUpdate.com

By Michael Cowden, Michael@SteelMarketUpdate.com