Prices

November 16, 2021

Sheet Prices Defy Gravity of Shorter Lead Times

Written by Michael Cowden

Hot-rolled coil prices continue to slide. And galvanized base prices are holding more or less steady. What gives?

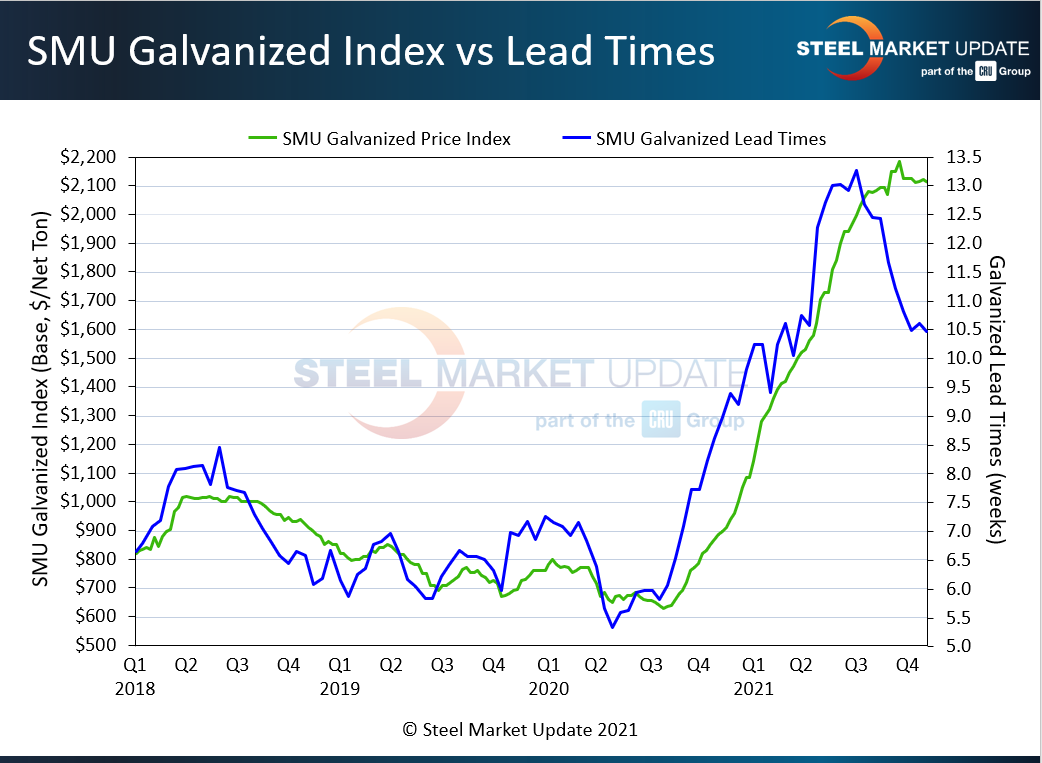

Check out the slide below. The green line is galvanized base prices. The blue line is lead times. Prices are on the left-hand side of the slide. Lead times are on the right.

Prices have been around $2,100-2,200 per ton in recent weeks. They peaked at $2,185 per ton in September and were at $2,085 per ton as of today. A $100-per-ton month-over-month decline would be a devastating correction in any normal market. But if you’re starting from almost $2,200 per ton – that’s only about a 4.5% dip.

Galvanized lead times, however, tell a different story. They’ve gone from more than 13 weeks over the summer to about 10 weeks more recently. That’s still a strong lead time by historical standards. But it’s a much more substantial correction than we’ve seen on the price side. The normal assumption would be that lead times are a leading indicator and that they will lead galvanized prices lower.

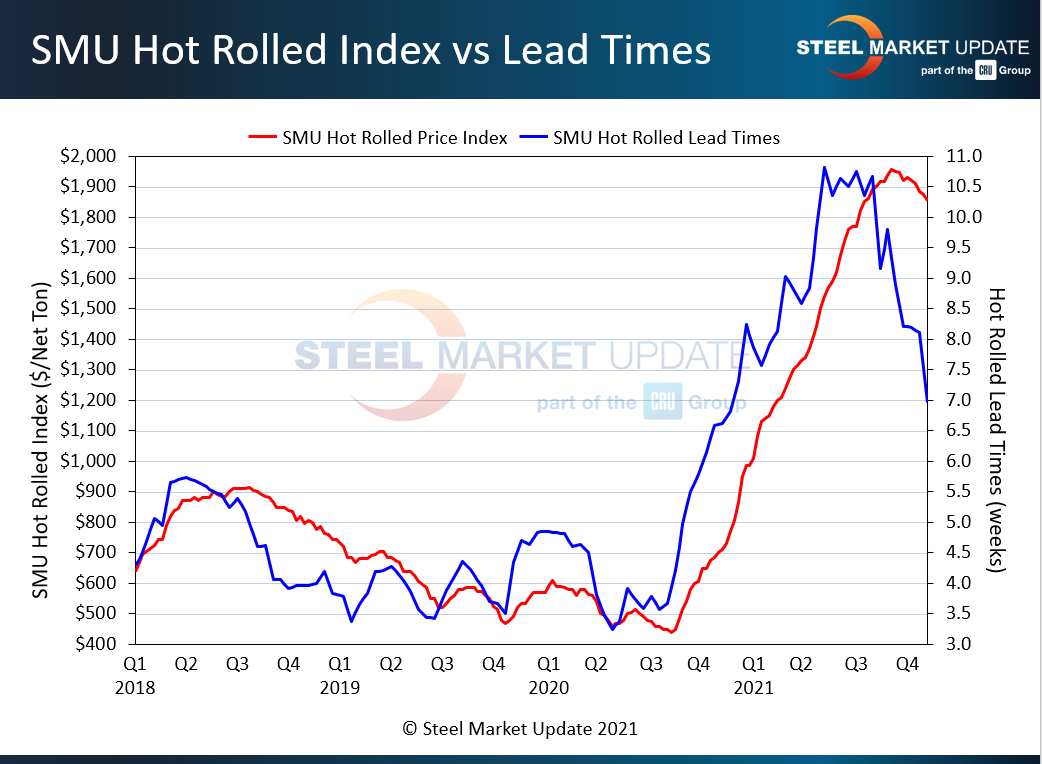

That is what’s happened in hot rolled coil. Lead times, the blue line, fell from a peak of 10-11 weeks over the summer to an average of about 6-7 weeks more recently. Prices, the red line, have fallen from $1,955 per ton in early September to $1,830 per ton as today – so a decline of $125 per ton, or about 6.5%. HRC typically reacts more quickly than CR/coated when it comes to price moves. And so I would expect galvanized prices to continue to come down. But, again, while HRC has definitely come down from its peak, the collapse some have been warning about for a while now simply hasn’t occurred. Although you can see why people are making such predictions.

As our Premium members know, inventories have been creeping up since April. We’re way higher in October 2021 than we were in October of last year. I wouldn’t worry about that too much. Remember, October 2020 was when demand snapped back and caught everyone by surprise. Inventories as a result fell way, way below normal levels. What does catch my eye is that we’re a little higher now than we were in October 2019. And 2019 was a comparatively normal year. With inventories higher, I’ve also been hearing that resale prices are moving lower a lot faster than fob mill prices. That’s normally a bad sign for prices in general.

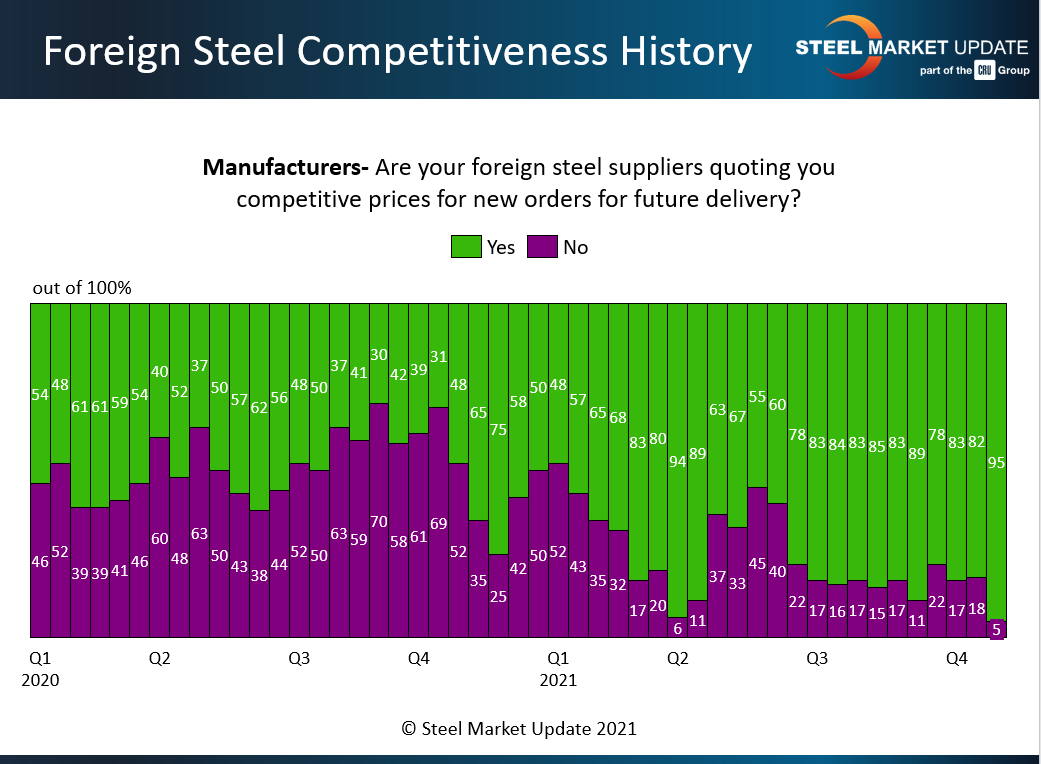

And it’s not just service center inventories that have been creeping up since May, so too have import volumes and the competitiveness of foreign offers. And that trend has become more and more pronounced as U.S. prices have remained high even as prices in the rest of the world have fallen or moderated. While U.S. mills seem to be holding the line on prices for now, it will be interesting to see what they do as lead times get deeper into 2022 and as imports become more of a factor for them to contend with in 2022. Again, one more signal that prices should move lower.

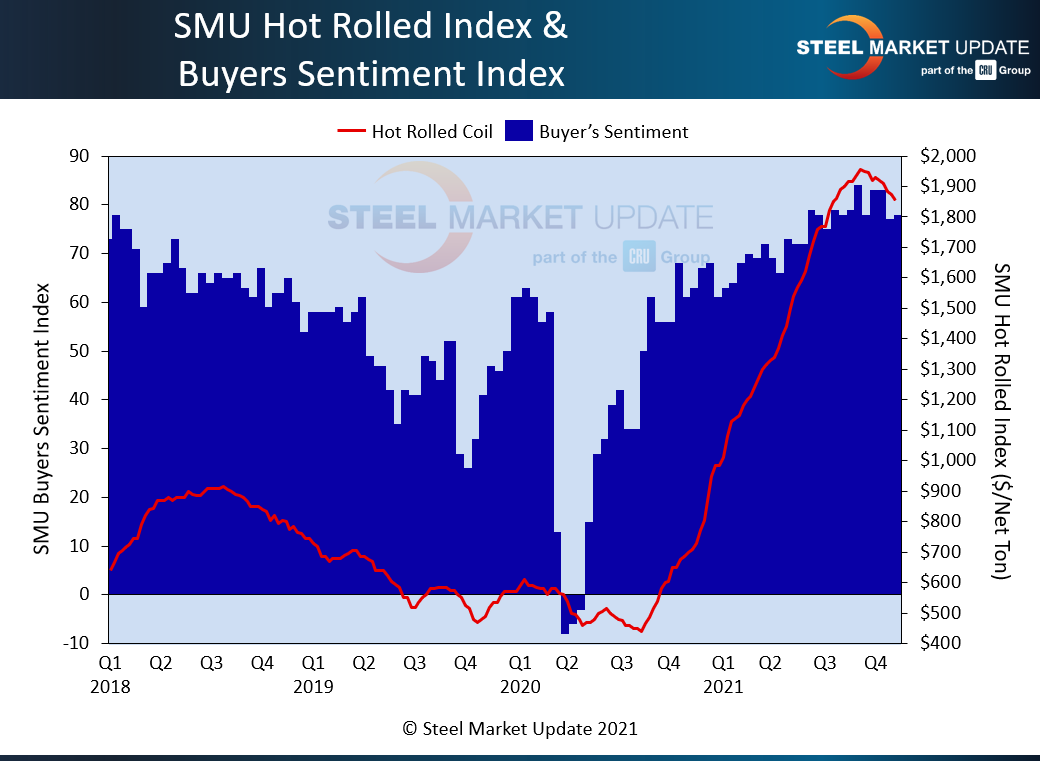

This slide is sentiment and prices. The red line is hot rolled coil prices. The blue bars are market sentiment. I tend to think of lead times as a leading indicator and sentiment as a lagging indicator when prices are starting to inflect downward. It’s understandable. Mills have been raising prices, and everyone along the supply chain has been passing those higher prices along without too much difficulty. Who wants to acknowledge that those good times might be ending? So, to recap: lead times are down a lot, prices are down a little, inventories are higher, imports are very competitive, and even sentiment is a little lower. Normally I would say without reservation that prices are in for a big correction – it’s just a question of when.

Here’s why I’m leery of making that prediction now.

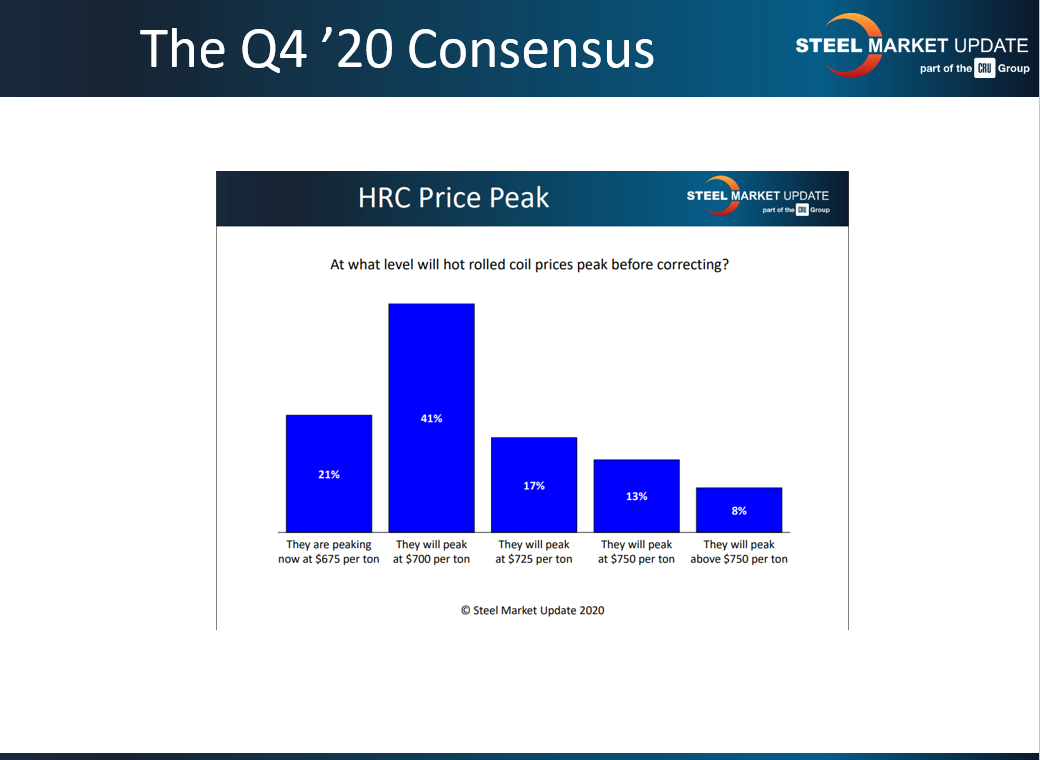

This is what survey respondents were predicting about HRC prices around a year ago. Recall that a year ago HR was around $700 per ton, which seems impossibly low now. And the consensus was that prices would peak around $700-750 per ton. Only 8% of survey respondents thought prices would go higher than that. Mills were pushing people to CRU minus a percentage in contracts because they thought CRU minus, say, $40-60 per ton was too generous if prices fell back to the normal levels of $500-600 per ton. Almost no one predicted that prices would be over $1,000 per ton two months later. And no one predicted that they would hit almost $2,000 per ton about a year later.

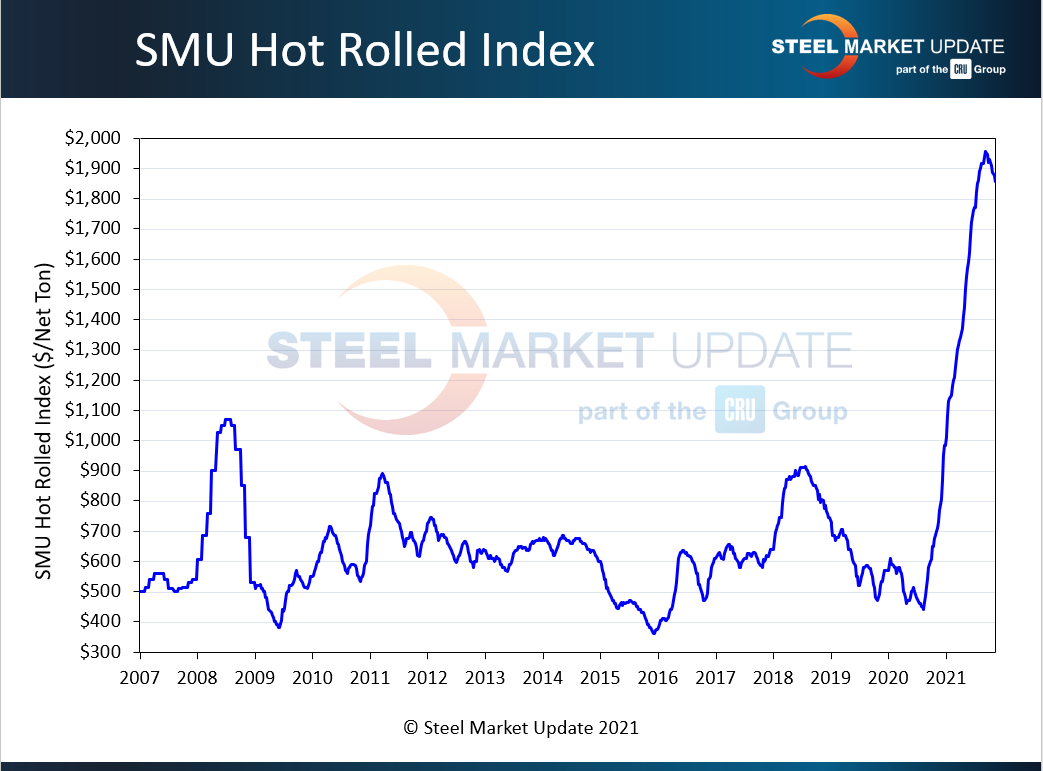

So what the heck happened? At risk of stating the obvious, a global pandemic. There are any number of ways to measure the impact of it. But here is one that I’m familiar with – steel prices.

This shows HRC prices going back to 2007. The one spike around 2008 is the housing bubble and subsequent financial crash. The other spike is 2018 – that’s when Section 232 tariffs were rolled out and the 25% tariffs caught everyone by surprise. Those were big, big stories that generated tons of headlines. And they are absolutely dwarfed by the events of the last two years.

So let’s be humble. None of us has experience with a market like this. There are factors to consider now that we simply haven’t had to think much about before – worker shortages, parts shortages, congested ports, inflation. I have talked to people who have bought imports at good prices but can’t get the material from the docks to their doors. I have also talked to people who bought imports that were supposed to arrive in the spring that weren’t delivered until just last month. I have also talked to people supplying the automotive industry who say that the chip shortage might be only the tip of the iceberg. What’s next? A shortage of magnesium, a shortage of some widget we haven’t even thought about yet – including the automakers themselves. How do you model these things?

Meanwhile, fear of a correction has kept some buyers buying only as needed from domestic mills – something that typically serves to extend pricing cycles. There seems to be a growing consensus that prices will correct – it’s just a question of when and to what extent. Presumably it will be somewhere between where U.S. prices are today and where, for example, European prices are for Q1-Q2 ’22 delivery.

I think there is also a case to be made that models developed before the pandemic have been slow to adapt to a post-pandemic reality – if they’ve even been adjusted at all. And so I think there is also a case to be made that wherever prices correct to might be a lot higher than in the past.

By Michael Cowden, Michael@SteelMarketUpdate.com