Analysis

November 7, 2021

Final Thoughts

Written by Michael Cowden

The House has finally passed a bipartisan infrastructure bill after months of wrangling not only among Republicans and Democrats but also among factions within the Democratic party.

“American steel built this country, and the industry is now ready to get to work on rebuilding this country. Repairing and modernizing our national transportation system is essential and we are glad Congress agrees,” American Iron and Steel Institute (AISI) President and CEO Kevin Dempsey said.

“This bill will also make sure that taxpayer funds are used to procure cleaner steel produced in the United States,” he added. “We are thrilled that, in the end, Congress was able to take this important step toward funding our nation’s infrastructure needs.”

That’s great news, no doubt. And it should be good news for steel demand. The question is when.

The Biden administration has made clear that it wants to invest in long-term, steel-intensive projects rather than the “shovel-ready” projects that the Obama administration rolled out in the aftermath of the 2008-09 financial crisis. Road and bridge work will be mostly a long products story. But a rising tide should lift flat products too, and plate in particular. Here are the key factors to monitor in SMU’s survey data in the months ahead as we look for any potential upward inflection in prices and demand.

FOB Mill Prices

We adjusted our hot-rolled coil price lower again last week. SMU’s hot rolled coil price now stands at $1,875 per ton ($93.75 per cwt), down $10 per ton from the week prior and down $80 per ton from what appears to be a cyclical peak of $1,955 per ton in early-September. That downward trend has been consistent. And it’s a big change from a year in which the only question had been not whether prices would go up but by how much. Could an infrastructure spending package reverse that trend? I don’t see a reason for that happening in the physical market short term. But maybe there will be some improvement in market psychology.

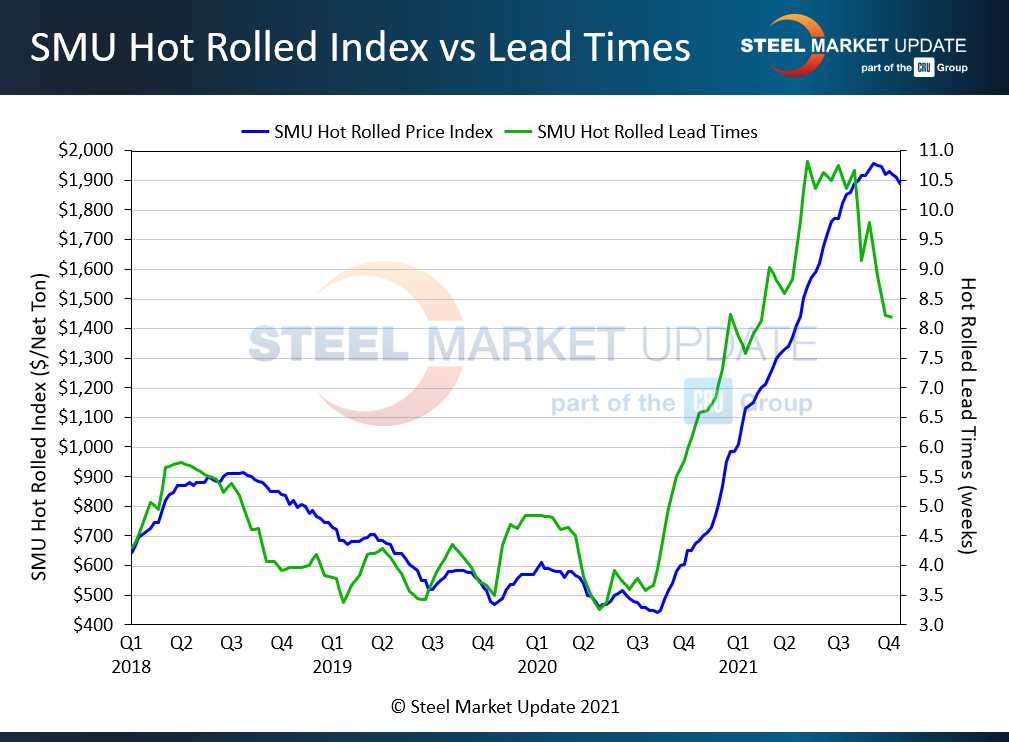

Lead Times

SMU pays very close attention to lead times – the time between when an order is placed at a mill and when it is processed. This chart above shows why we do, because lead times are often an advance indicator of price moves. When they’re getting longer, prices tend to move up. When they’re shortening, prices tend to fall or are vulnerable to falling. Hot-rolled coil lead times, the green line in this chart, peaked way back in mid-May at about 11 weeks. They bounced around 10-11 weeks into early August. And they have since fallen significantly and now stand at about 8 weeks on average. That would be a very strong lead time in any other market. And it’s roughly double the 3-4 weeks we recorded in the spring and summer of 2020. But it’s the first protracted downtrend we’ve seen since the early days of the pandemic.

We’re seeing a similar trend in lead times for other products. The price movements for cold rolled and coated products haven’t been as consistently lower as what we’ve seen in hot rolled. But, in my opinion, it’s hard to see how prices don’t start to slip – especially with import offers for 2022 significantly lower than domestic prices. It’ll also be interesting to see whether the tariff-rate quota, or TRQ, with the EU has an impact. That one was officially announced the weekend before last. Just as SMU reported would happen. And it goes into effect on Jan. 1, 2022.

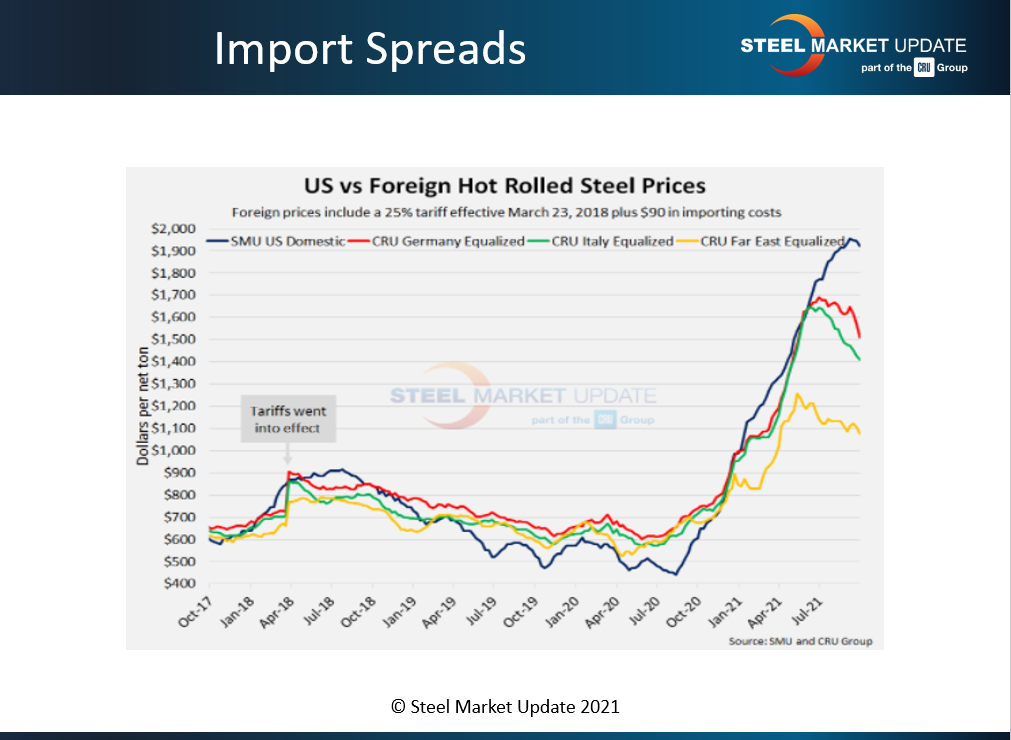

Import Spreads

The EU is not typically a source of low-priced steel. But U.S. prices have gotten so high relative to the rest of the world that, at least for now, the EU is comparatively cheap. And of course it’s not just the EU that wants a new deal on Section 232 – so do the UK, South Korea and Japan, to name just a few. U.S. HRC prices are theoretically $803 per ton more than Asian HRC prices. And that premium is approximately $480-570 per ton compared to EU prices. And while port congestion is a very real problem, the U.S. is not an island. And prices here cannot continue to rise if prices in the rest of the world fall. Is infrastructure alone enough to offset such larger global trends?

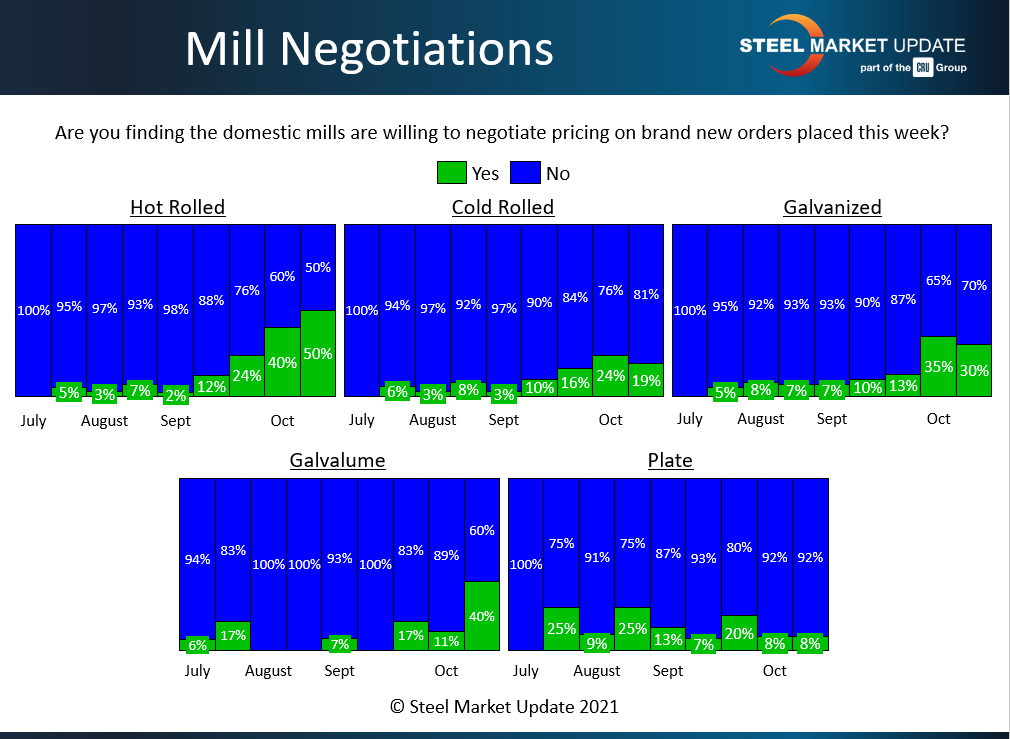

Mill Negotiations

And it’s not just prices and lead times that are falling while imports are rising. Respondents to our surveys report that mills have more tons available. There’s been a real change in that regard since about mid-September. And with more tons available, mills are more willing to negotiate on prices – especially when it comes to hot rolled coil and coated products. A little context here: these charts were boring earlier this year. It was just a blue curtain – meaning mills were unwilling to negotiate. So, yes, a lot of producers are still trying to hold the line on prices. But only about half when it comes to HRC. And that’s a huge change from what we’ve seen for most of the last 12 months. Could we see mills become less willing to negotiate on prices again should they sense that infrastructure might improve their lot?

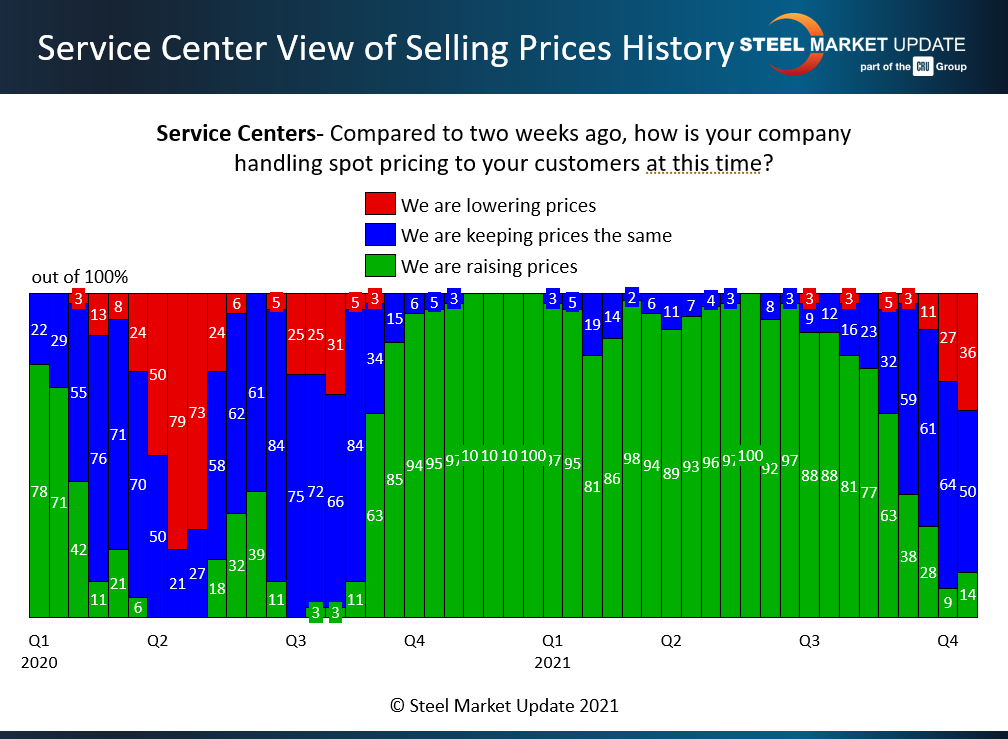

Resale Prices

Mills might be holding the line on fob prices – especially if you’ve got a December lead time. But January could be a different story. And we’re already seeing some interesting developments on the resale side. We don’t track resale prices themselves. But we do watch for trends. For most of the last year, both mills and service centers were aggressively raising prices. That cycle has fallen apart. And you can see that change has really taken place over just the couple of months. The green bars are service centers raising resale prices. The blue bars are service centers keeping prices the same. And the red bars are service centers lowering prices. It was almost all green – or service centers raising resale prices – until the middle of the third quarter. Then we had an increasing number of service centers holding prices steady. And finally the trend of lower resale prices, the red bars, has become much more pronounced over the last month. In fact, we regularly hear in channel checks of the market that resale prices are roughly the same as fob mill prices – which means people are selling at or below replacement costs. We’ve been seeing that trend for a while now on the coasts, where imports play a greater role. And so some of the lower resale prices in coastal markets resulted from companies blending domestic and import prices. But we’re also starting to see the trend now in the Midwest and in the Ohio River Valley, places where imports don’t typically play as large a role. So, not to spook you after Halloween, but we haven’t seen anything like this since the early days of the pandemic. If infrastructure does have an impact, maybe we’ll see it first in resale prices not falling as fast as they have been lately.

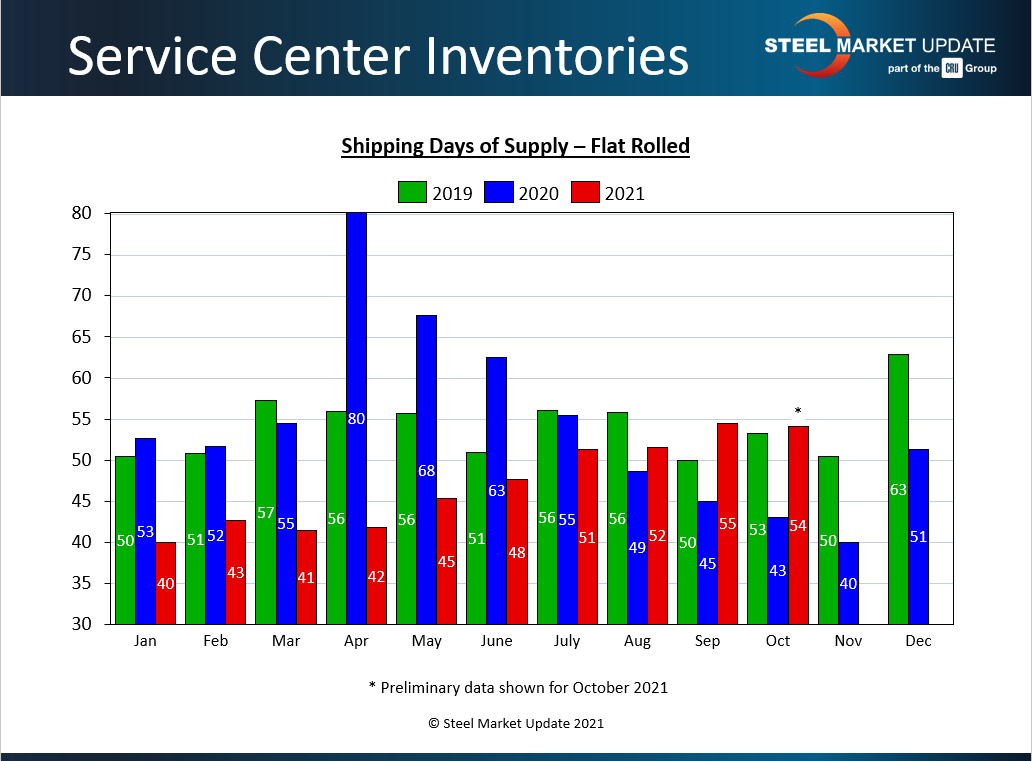

Service Center Inventories

SMU also keeps a close eye on sheet and plate inventories at domestic service centers. And stocks have been creeping up since about April – way before prices peaked. And there was probably a fair amount of double ordering that went on earlier in the year as people scrambled for steel. So I wouldn’t be shocked if inventories continue to edge higher. Keep in mind that for a while price was a secondary concern to availability. And we’ve shifted back to a more normal situation: price is again the primary concern. So, again, I’d expect inventory numbers to continue to move up and for prices to continue to slip. But, think back to earlier this year. Many people thought that prices above $1,000 per ton in Q1 where not sustainable and that a correction was imminent. Then we had winter storms hit the southern U.S. and northern Mexico, sparking power cuts, mill outages and supply shortages. Prices started going back up again and inventories slipped modestly or held steady. The point is, news matters, events don’t always go as expected and we now have a new variable in infrastructure that could be a very positive one on the demand side.

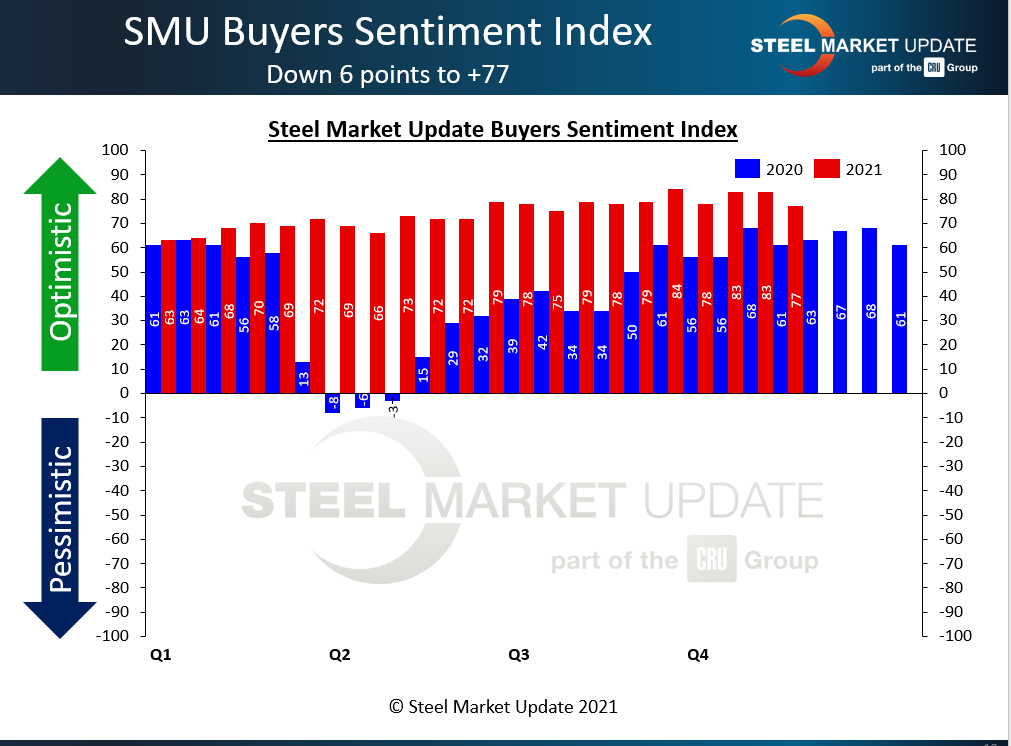

Sentiment

Some of the same people who are reporting lower prices, shorter lead times, and higher service center inventories are just about as bullish as they’ve ever been about their own business prospects. Although you can see that sentiment, like prices, has tailed off a little recently. Will that downward trend continue? Many analysts spent the last year saying that prices would correct. And they didn’t. And the split between analyst outlook and mill rhetoric is more divergent than ever. So keep a close eye on this one to avoid any potential bear traps. People are still optimistic, demand is not bad – and that was before infrastructure passed.

P.S. – Do you like what you see? Don’t just read the data, see your company’s experience reflected in it. Contact SMU production manager Brett Linton at Brett@SteelMarketUpdate.com to learn how to participate in SMU’s surveys.

Michael Cowden, Michael@SteelMarketUpdate.com