Analysis

October 7, 2021

Final Thoughts

Written by Michael Cowden

Let’s put aside the question of whether the steel market has peaked. Let’s just assume that it has, for the sake of argument.

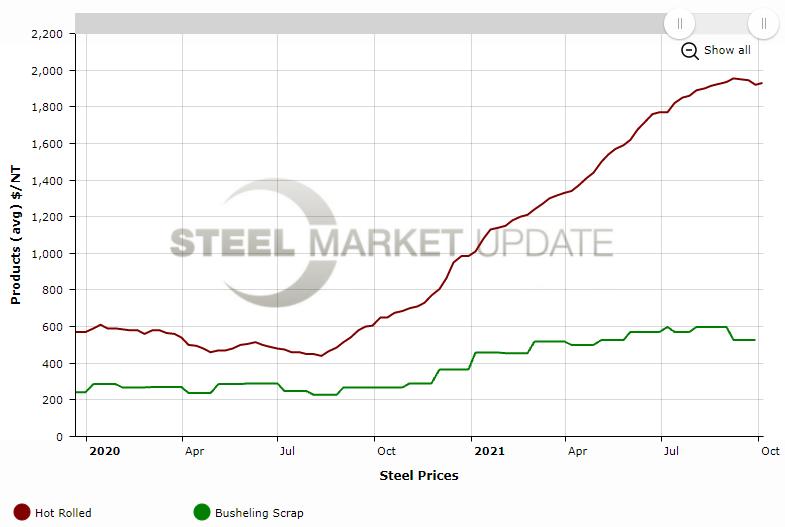

Will the correction be gradual, rapid, or gradual until it’s rapid? I tend to think it will be the latter. But let’s put the question of timing aside and just look at the potential downside risk in one chart from SMU’s interactive pricing tool.

Note that this chart, which you can recreate by clicking here, has been updated to allow you to display prices in the same unit of measure – and so I’ve converted everything to net tons so we can make an apples-to-apples comparison:

A lot of people out there think that the correlation between steel and scrap has broken forever. And that has been the case for the last year or so. But let’s just assume for a moment – for the sake of argument – that we go back to a cost-plus market.

As I noted in a prior Final Thoughts, steel took a mega-yacht to a private resort in French Polynesia. Scrap had a pleasant drive to the Indiana Dunes. And if the bill for those trips comes due, one might be slightly higher.

So what might the bill for steel’s trip to Tahiti look like?

Prices for busheling scrap are the green line in the chart above. Hot-rolled coil prices are the red line. An old rule of thumb used to be that it cost $150 per ton (give or take) to convert scrap to coil. When the market is slow, which it isn’t right now, that number can creep up.

Let’s say – again, for the sake of argument – that it’s $175 per ton. Then we’re looking at hot metal costs of around $700 per ton. And so mills, given current spot HRC prices of $1,930 per ton, are theoretically making well over $1,000 on each ton of steel sold. That helps explains all those announcements about record quarterly profits.

The thing is, it cuts both ways. Maybe mills can stay disciplined and close the HRC-scrap gap slowly. Or maybe they end up fighting against each other or imports for business and it closes quickly. Either way, there is still room for a decline of about $1,000 per ton if we go back to cost plus – and most producers would still be profitable.

I don’t want to predict when or how fast that correction might occur. But, as I noted in Final Thoughts on Tuesday, there are plenty of signs that it is already happening.

U.S. prices are way higher than prices in the rest of the world. Steel futures prices for Q1 2022 are hundreds of dollars below current spot prices. And while fob mill prices have been mixed, secondary and resale prices are falling.

What’s going on?

“The resale market has been drifting lower as sellers try to monetize inventory ahead of a market decline. They also still have a large backlog of orders (mostly late) yet to arrive. These late orders bump into shorter lead-times. And nobody wants the late steel and the on-time steel at the same time,” one source at a Midwest service center said.

What comes next?

“Indices are sticky during transition; especially down as buyers stall new purchases. The down direction tends to gap lower when the price finally hits a number that attracts a purchase,” he said.

And with imports arriving at “massive” discounts to domestic prices, some sellers can easily afford to drop tags to attract customers if they need to, the Midwest source added.

On top of all that, supply chains have been stretched to the point where it could hurt demand, some respondents to SMU’s latest survey said.

“We’ve shut down three lines for this month (about 20% of our overall output) due to electrical component shortages,” one respondent said. “If it isn’t that, it’s materials out of Europe that sit in the harbor for 10 days and then at the port for 21 days, or the trucks to get our finished goods to customers. … The supply chain is breaking in multiple places.”

But other survey respondents continue to predict a gradual decline despite the HRC-scrap gap, the import-domestic gap, the fob mill-resale gap, and concerns about fragile supply chains.

“Seems everyone has more inventory. However, it does not appear end-user demand, with the exception of automotive, is down much,” said another respondent. “Imports are increasing. But as with domestic production, the material is arriving late. Without a doubt the increased steel prices are a factor in the increased inflation the U.S. economy is experiencing – but the U.S. economy does not appear to be slowing as it has in the past during periods of inflation.”

And he, like many others, predicted any correction would be gradual.

“Domestic mills still have large order backlogs, and there are many unknowns such as what impact increased automotive demand will be once chips become more available,” he added.

Other respondents seconded that opinion – that the market might have peaked but that solid demand would blunt the possibility of a sharp correction.

“Demand is still good, and supplies are still tight,” a third respondent said. “Inventories are getting better, but not fully recovered across the board.”

By Michael Cowden, Michael@SteelMarketUpdate.com