Prices

August 19, 2021

Hot Rolled Futures: Increasing Headwinds

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

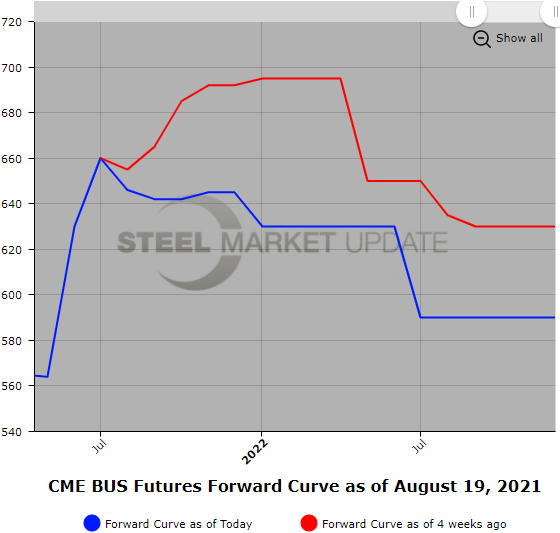

While the hot rolled index continues to grind higher, coming in at just under $1,900/ST, HR futures prices also moved higher but more sporadically as they have been well bid on some days and well offered on others.

Today HR futures gave back some of their recent gains over concern as global commodity markets have recently come under strong selling pressure as China signals some cooling off of growth. Large retracement in iron ore markets and recent softening in scrap prices, along with increasing HR imports, is causing some headwinds.

On the flipside, upcoming scheduled outages for mill maintenance leaves some room for supply uncertainty going into Q4’21. No clear signals on the lead time front, but macro trading elements are also starting to weigh into price forecast expectations. Business activity and forecasts remain positive, but the increased spread of COVID is adding uncertainty to HR price forecasting.

Based on settles from today back a month, the nearby Sep’21 and Oct’21 HR futures months have gained almost $135/ST as an average as compared to the Aug’21 through Jul’22 HR future (12 month strip) whose average price has gained almost $72/ST. We also can see another bump higher in May’22 and Jun’22 HR futures, which were up almost $120/ST on average over the last month. The prices in the back end of the futures curve have moved up relative to a month ago.

About 753,120 ST of HR trades were placed this past month with open interest hovering around 1,331,480 ST.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

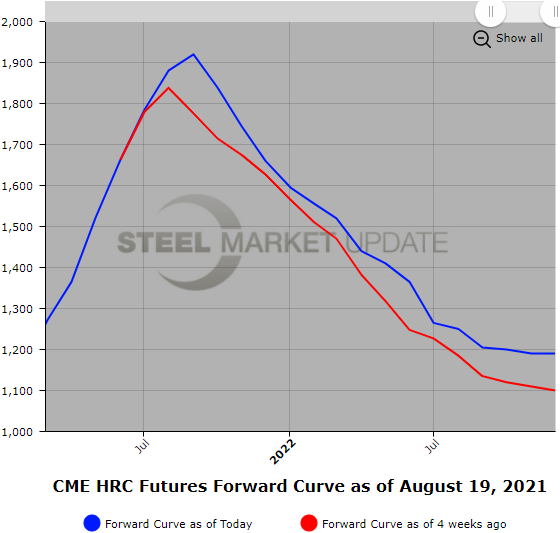

Scrap

In spite of the midsummer cycle, BUS futures were basically sideways for the Aug’21 settle, coming in just under $652/ST (up just over $3/GT versus Jul’21 settle). In spite of sitting at a high price peak, recent selling pressure along the BUS futures curve has left an average price drop for the 12 months of just under $50/GT. Increasing HR imports and lower pig iron prices are expected to add some selling pressure in BUS. The front of the BUS curve is trading in the mid $640/GT range with Q1’22 trading in the $625/GT area.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.