CRU

January 15, 2021

CRU: Global Steel Prices at Record High

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores, from CRU’s Steel Monitor

Global steel prices, as measured by the CRUspi index, have increased for the 10th consecutive month, gaining 9.4% m/m and 116% y/y. This index now stands at 301.1, a new record high. This index continues to be supported by higher finished steel prices across all regions. The only exception to this was a few long product markets which were flat m/m.

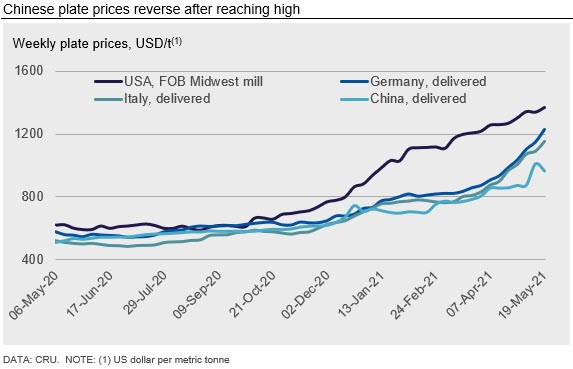

Most markets continue to reflect high levels of demand while supply is limited at best. While the CRUspi index reflects higher prices, we have now started to see price volatility emerge. This has primarily come from the Chinese markets, where after the May holiday finished steel prices surged by 10-11% in a single day before giving back nearly all these gains just five business days later.

This surge has come from two significant changes in China: elimination of the export tax rebate and capacity cuts. Price volatility has not been isolated to China, at least in terms of the futures market. In the USA, the CME Group’s HR coil futures contract (settled on CRU) has fallen this past week. Futures prices for 2021 H2 fell from an average of $1,554 /s.ton on May 10 to $1,321 /s.ton this past Monday, May 17. Futures markets are notoriously volatile, yet this multi-day selloff may signal that the end for further substantial price gains in HR coil is near.

Sheet Prices Continue to Rise at a Faster Pace Than Longs

Global sheet consumption continues to rise, reaching levels where current global production cannot keep pace. Demand continues to come from not only the post-pandemic demand rebound, but also from the rebuild of inventories throughout the supply chain.

Reflecting the continued, yet substantial m/m price rises, CRU’s Global Flat Products Steel Price Indicator (CRUspi flats) has again reached a new record high. Our current reading of 328.5 is up 11% m/m, up 146% y/y and, perhaps most notably, up 19.7% from the 2008 high.

Global long product prices have increased to the highest level since 2008 while supply has tightened due to production cuts and changes to export tax rebates in China. Demand is strong in many regions yet continued COVID-19 outbreaks and the return of seasonal patterns have led to some demand weakness. High prices have become a more visible threat to future demand as finance is limited, pushing buyers some to lobby for price controls.

The Global Long Products Price Indicator (CRUspi Longs) increased by 5.2% m/m to 245.9 in May 2021. This is the highest level for CRUspi Longs since October 2008. Higher prices in Asia and the USA were the driver for the rise.

Indian Mills Fight COVID-19 Locally While Continuing to Redirect Production to Exports

In India, a very serious upsurge in COVID-19 cases has led to localized lockdowns and a disruption to demand for sheet products. Due to this, mills have been able to increase export allocations, while moderating steel output to keep inventories somewhat balanced. Though even with these options, production cuts have taken place. These cuts, though, are not in response to a potential weakness in demand but are attributed to steelmakers diverting liquid oxygen supplies for medical needs. In normal times, these suppliers tend to offer 60% of their oxygen for industrial purposes and 40% for medical purposes. CRU understands that the shortage of oxygen for secondary steelmakers has led to a fall in finished longs output of ~15-20%. This led to a fall in mill inventories and has allowed prices to remain high.

Section 232 Tariffs in the USA Potentially Easing

Recent discussions between the USA and EU have begun with the aim of de-escalating the trade war. A few U.S. products were scheduled for tariff costs doubling to 50% in the EU beginning on June 1. The EU announced that this increase has been suspended, at least temporarily, while the U.S. continues to engage on trade talks. President Biden is planning on visiting Brussels in June for an economic summit surrounding the trade situation, and there is speculation that this could signify a change in the Section 232 tariffs on Europe. Changes to Section 232 could bring a substantial number of potential imports into a workable range for U.S. buyers, which would help to alleviate the current supply shortage on some of the most expensive products, such as wire rod. Granted, this change may not immediately provide relief to buyers as supply of many products remains limited around the world. However, this change may actually lead to more such agreements with other countries, such as Japan.

Outlook: Chinese Policy and Iron Ore Prices Will Lead Any Further Steel Price Change

Based on our current base case forecasts, global prices and the CRUspi index will rise further in June before turning lower. However, the Chinese government has taken a more active role in keeping its economy from overheating and its actions as well as potential results warrant our attention. One recent example is the y/y growth of the net increase of Aggregate Financing to the Real Economy (AFRE), the PBOC’s measure of broad credit, has slowed significantly since last October, from 60% in October to -40% in April. Market participants have read this as a sign of tightening credit and a deceleration of the economy.

One other factor that has supported finished steel prices is the recent trend of iron ore prices. The cost of this raw material has recently surged, and these gains have supported other raw material costs such as pig iron and scrap. Iron ore prices have weakened somewhat since the post-holiday surge, yet we anticipate that prices over the next several weeks will be a leading indicator to global steel prices. While finished steel prices are well above iron ore-based costs, any sustained move in iron ore is expected to be reflected in finished steel prices.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com