Market Data

October 15, 2020

CRU: Global Scrap Prices Lose Momentum Due to Supply Influx

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor

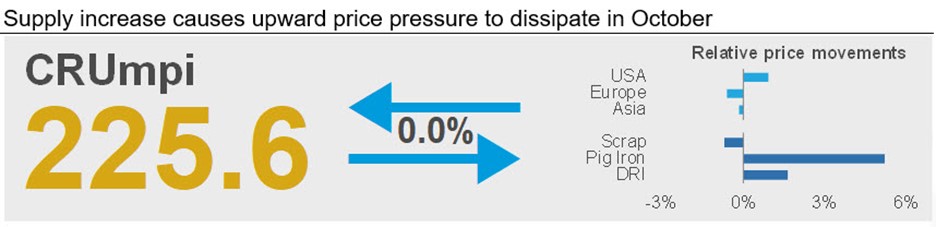

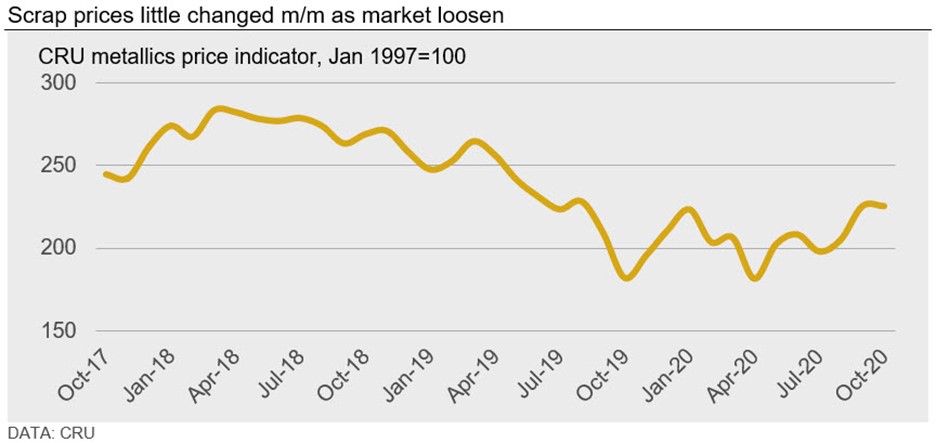

The CRU metallics price indicator (CRUmpi) was unchanged m/m in October at 225.6 following large price increases the prior month. Supply in many markets became more available as prices rose, and this helped prevent additional upside pressure. For November, market sentiment is that prices will again be little changed, and we do not see much in the way of substantial upside or downside pressure.

A rise in global scrap prices during September lost most of its upward momentum in October even as finished steel prices rose in many markets. A return of supply to the European and U.S. markets prevented another round of expected price increases, which was compounded by waning demand from Turkish scrap importers. Chinese demand was subdued ahead of its Golden Holiday week, causing prices to fall m/m. Prices were stable or somewhat lower in other parts of Asia as well. The two exceptions to this loss in price momentum were Russia and Brazil, with mills in the former stocking up ahead of winter while continuously rising demand caused prices in the latter to reach yet another record level. Pig iron prices also rose m/m despite the absence of Chinese buyers.

U.S. scrap prices were weaker-than-expected for October, trading at mostly unchanged levels m/m. September’s substantial price increase drew more scrap supply into the market and offset rising demand driven by higher steel output and prices. There were little variations in regional price directions, although there was some downside pressure on shredded scrap for mills closer to the export market. With higher supply availability locally, mills also reduced the number of remote purchases they made.

A similar situation occurred in Europe, where obsolete grades were minimally changed m/m and prime grades in Northern markets underwent downwards price pressure. Demand for steel long products has limited upside potential for the remainder of the year, and this helped prevent any upswing in obsolete prices. For Germany, this factor, alongside an oversupplied market as the result of higher September prices, contributed to a small m/m price decline.

A lull in import scrap buying activity in Turkey did little to help oversupplied European markets. Demand for Turkish rebar both domestically and internationally has pulled back, and there is some ongoing concern among market participants that Turkey’s involvement in recent conflicts abroad may yet put further pressure on the country’s economy. As a result, Turkish scrap import prices and trading activity have been suppressed.

In China, prices fell ahead of the Chinese National Holiday amid weakness in the finished steel market and increasingly bearish sentiment. The slowing pace of steel demand improvement briefly soured scrap market sentiment given expectations of production cuts in the near future. This resulted in a decrease in scrap prices. Still, this downward move was reversed the following week after scrap arrivals into mill yards’ plummeted and they were forced to renege on part of this decrease to keep material flowing. In other parts of Asia, prices were either stable or somewhat lower m/m as participants look for clearer market direction.

Two notable exceptions to the global scrap price stall were Brazil and Russia. In Brazil, higher y/y production of long products has increased demand for scrap domestically and caused prices to surge to yet another record for a second straight month. For Russian steel producers, competition for scrap remained heated again in October as they look to secure enough material ahead of winter. Competition between domestic mills is fierce enough that the typical premium paid for scrap bound for the export market has now evaporated.

Both Russian and Brazilian producers also helped support global pig iron prices as they seek to offset rising scrap costs. With more pig iron staying within these domestic markets, export availability has been constrained enough that prices rose m/m even though Chinese, European and American buying activity was limited.

Outlook: Price Stability Likely to Continue into November

U.S. and European scrap markets are unlikely to face substantial downwards or upwards pressure in November. While September’s price increase resulted in greater supply availability, it appears demand generally has been strong enough to create a balanced market. Moreover, with U.S. finished steel prices moving higher, mills there may not be keen on losing negotiating leverage by forcing scrap prices lower. For these markets, movements in Turkish import prices are likely to be a leading indicator of next month’s price direction.

A potential ban on Australian coal imports in China may cause upside demand pressure for scrap in China, while Vietnamese scrap prices are likely to find support from seasonal factors and support prices in other Asian markets. We also expect Chinese buyers to return to the pig iron market given how high scrap prices are there relative to international markets. This will keep the pig iron market tight, but we think prices are nearing a peak for the year as iron ore costs ease.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com