Prices

March 12, 2020

CRU: Global Metallics Prices Hold, But Major Downside Risks Grow

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor

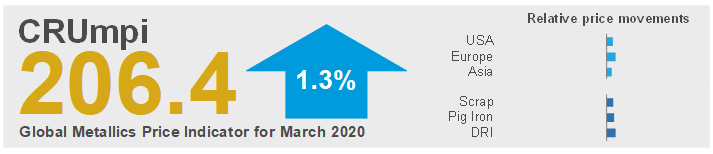

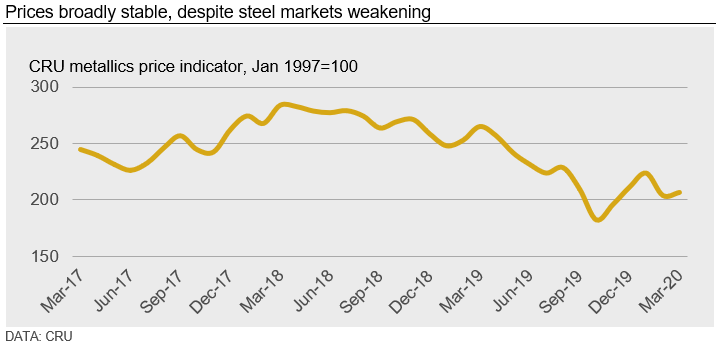

The CRU metallics price indicator (CRUmpi) rose slightly by 1.3 percent m/m to 206.4 (see chart). While this is broadly stable it bucked the trend compared to steel markets, which came under relatively more price pressure. Structurally, most markets were similar in condition to February, though the spread of Covid-19 and the oil price war are undermining confidence.

Metallics prices across most of the globe changed little m/m, with markets in major scrap exporting markets like the U.S. and Europe structurally similar in March compared to February. Still, price stability was a weaker-than-expected outcome for March, with many market participants anticipating price increases. For import markets, Turkish scrap buying was subdued following a buying spree in mid-February and prices in North East Asia were impacted by the Covid-19 outbreak.

For the U.S., both export and domestic demand were solid, but good supply availability amid mild winter weather balanced the market. Expectations were that prices would rise by $20-30 /l.ton, which is above the 10-year average increase for March of $17 /l.ton. While prime grades did rise by $10 /l.ton, obsolete grades, which are the largest in terms of volumes traded, were unchanged. Similarly, early trading in the EU was done at higher price levels m/m, but mounting downside risks sent prices sideways as trade wore on. For both markets, the absence of purchases from Turkey late in February also helped cap potential price increases domestically.

Further east, scrap prices in Russia fell seasonally as adverse weather conditions eased and domestic mills were able to access supply. Exporters there are becoming more competitive internationally with a recent devaluation of the ruble, but a scheduled rollout of a new scrap exchange trading system is causing uncertainty about the future of exports.

In China, scrap demand was much lower than is typical given the effects of the Covid-19 outbreak on steel demand. Still, prices were unchanged m/m because collectors were unwilling to risk collecting scrap and sectors like manufacturing and housing have been slow to restart operations, limiting supply. While some EAF operations have been restarted, demand has not meaningfully improved because they are operating at a loss and are tightly controlling output.

With Covid-19 now spreading into parts of southeast and northeast Asia, steel demand and prices have fallen and have taken scrap prices with them. Vietnamese billet export prices have fallen, while finished steel prices in southeast Asia are under pressure on concerns of low-priced imports competing with domestic mills. In Japan, price decreases were not as substantial as the prior month with domestic producers aiming to increase output and sales prior to the end of their fiscal year.

Pig iron prices were also stable m/m, although there was tightness in the Russian market. This was offset by strong availability from Brazil, even though there were heavy rains in the largest producing area of the country.

Outlook: Large Downside Price Risks are Mounting

International metallics prices are facing two major headwinds: the spread of Covid-19 and a Russia-Saudi Arabia oil price war. The former has further to spread in Europe, North America and likely South America, which is expected to impact steel demand there. As logistical issues resolve in China and industry returns to normal, there is a possibility that large volumes of steel are released to the global market and sink both steel and scrap prices.

The oil price war threatens to push commodity prices in general lower until it is resolved. In this regard, both steel and scrap prices face downside risks from this development. When oil drops, steel demand from the energy sector declines as does transportation costs for things like iron ore. In turn, this affects finished steel prices and ultimately pushes metallics prices lower.

As things stand, metallics prices face almost exclusively risks to the downside in the near term.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com