Product

January 30, 2020

Hot Rolled Futures: Shift into Further Backwardation as Commodity Complex Hit Hard

Written by David Feldstein

The following article discussing the global ferrous derivatives markets was written by David Feldstein. As an independent steel market analyst, advisor and trader, we believe he provides insightful commentary and trading ideas to our readers. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations or comments made by David Feldstein are his opinions and not those of SMU or the CRU Group. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

Don’t get me started on the benefits of implementing a hedging strategy into your steel or manufacturing business, but the degree to which you hedge your risk is a blend of factors including your forecast for steel and scrap price direction. No matter how you adjust the degree of your hedge, you always want to have some amount hedged, even for the most bullish of forecasts. Why? Uncertainty or in the parlance of our times, the black swan. Coronavirus is right up there with the best examples of a black swan*. There is a trading maxim that commodities take the stairs up and the elevator shaft down. Case in point, WTI crude oil (left chart) and CME copper (right chart) in the charts below where months of gains were evaporated in a few trading days. Shoot first, aim later.

*To be clear, this is a very serious situation. My intention is not to make light of what the World Health Organization today declared a global public health emergency and I hope the spread of the virus is quickly contained and the death toll remains as low as possible. I also sympathize with all those whose families are affected.

Commodities and equities were sold en masse as financial markets the world over dumped risky assets in a flight to quality, buying up Treasury bonds (left chart) hand over fist. The U.S. 10-year Treasury yield has collapsed from 1.9 percent to under 1.6 percent since the year began. Iron ore futures (right chart) also got hit hard losing almost 10 percent in the few trading sessions prior to the Lunar New Year holiday and the explosion in the numbers infected by the coronavirus. Asian financial markets reopen Monday, so while we are watching the Chiefs battle the 49ers, keep a close eye on if iron ore and Chinese hot rolled and rebar futures are being dumped.

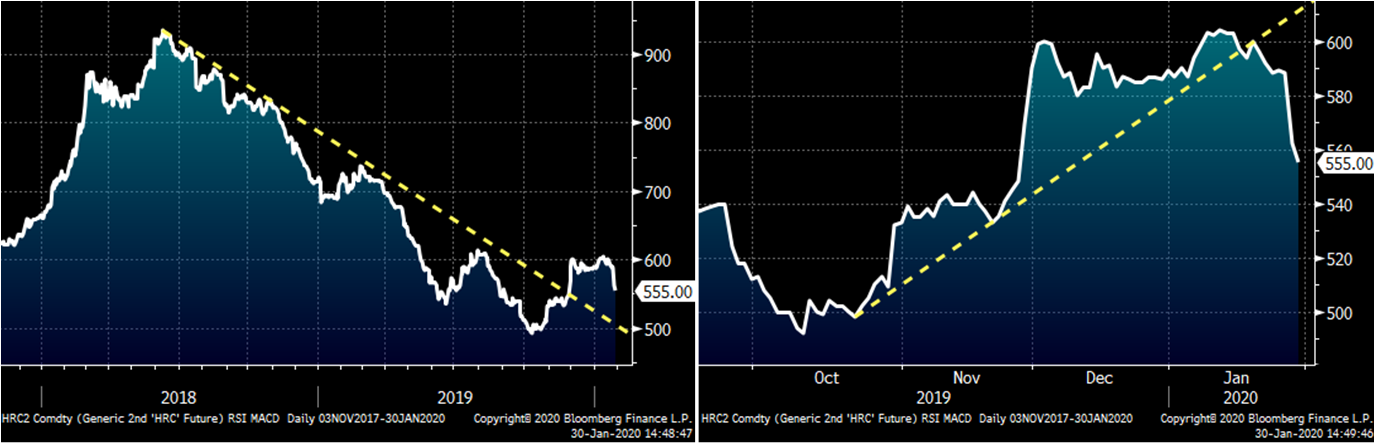

These two charts show the rolling 2nd month CME Midwest HRC future (long term on left). While the long-term down trend line was breached back in early December ending the long bear market, the uptrend of the nascent rally has been violated to the downside. If you look at the lower right-hand corner of the longer-term chart, a reverse head and shoulders pattern looks to be developing. I’ll follow up on this in future articles, but the $600 level is becoming an important one to watch.

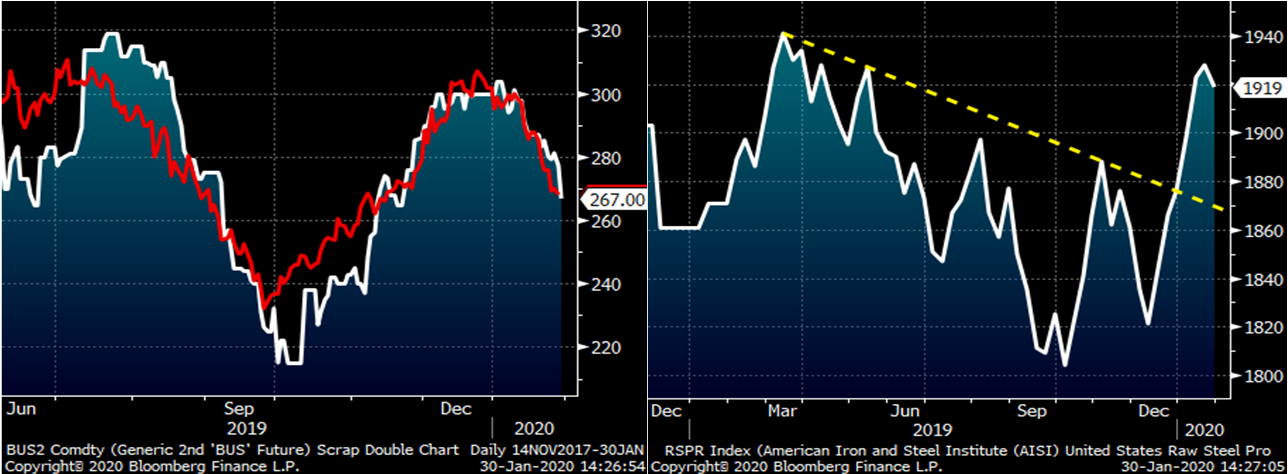

The chart on the left shows the rolling 2nd month CME busheling (white) and LME Turkish scrap futures (red) under pressure along with the rest of the commodities suite. Weak Turkish export demand has been rumored to be the main driver pushing scrap lower. The CME February busheling future traded 2k tons at -$21 or $275 today. Skepticism that busheling will fall by this much in February is warranted considering domestic mills’ production levels moving back up near 2019 highs (right chart) and word on the street that scrap is in high demand from Midwest mills, who might be willing to pay up rather than provide an excuse for hot rolled buyers to expect lower prices.

In my last SMU article, I wrote:

Sentiment is in the dumps. The industry is shuffling their feet into 2020 still in the fog of 2019. I say pick your heads up and start dialing because the cavalry is coming, they’re wearing a hard hat and riding a bull!

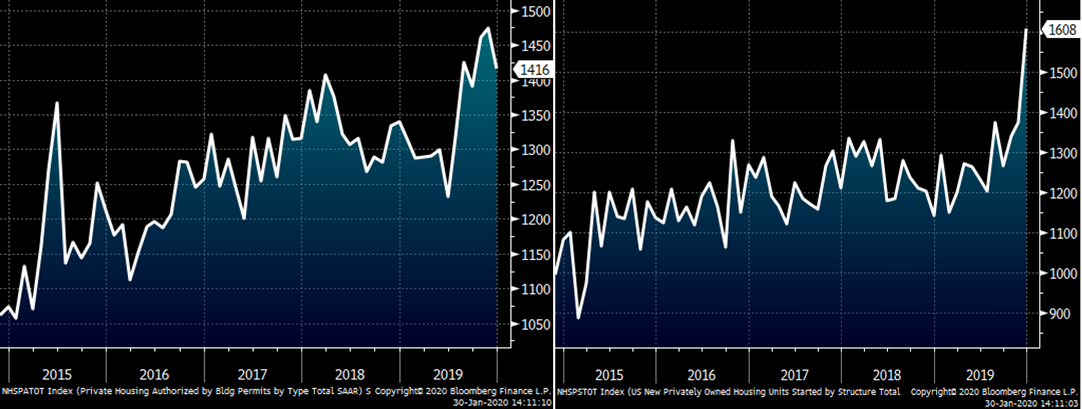

November building permits exploded higher (left chart) and December housing starts followed suit (right chart). The December new home sales were lower than economists expected, but the annualized rate was up 23 percent YoY. The U.S. residential home market is significantly undersupplied. This undersupply along with extremely low interest rates will fuel housing starts to the max in 2020.

Monday is no day for a super bowl hangover as the ISM Manufacturing Index, expected to gain 0.8 to 48, is going to surprise to the upside in a big way. So far this month, all five regional manufacturing and business indexes have gained better than expected with Philly and Richmond (left chart) exploding higher. This bodes well for the ISM PMI, and so goes the PMI goes the steel price.

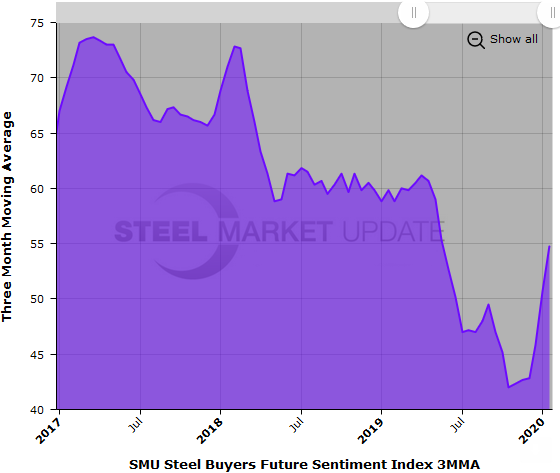

To take this a step further, Steel Market Update’s Steel Buyers Future Sentiment Index has seen a nice recovery. See last Thursday’s lead SMU article for more intel on the subject.

The most interesting data point from last week was the increase in Houston hot rolled prices to above $600. The Houston import price is well above all Midwest Indexes. That is a bullish data point indeed!

Despite the sharp drop in supply (service center/imports), spike in construction demand and improving sentiment, the hot rolled coil futures curve has been under serious pressure since 2020 began (red line Jan. 2 settle). Today’s curve (green line) offers those steel buyers with improving sentiment in the chart above an opportunity to lock in prices $50 below spot for Q2, Q3 and Q4. The 2019 bear market is behind us. Steel market dynamics are much improved. It’s time to dust off the 2017 playbook and buy the dips.

One last quick note before we go. Last week, Patrick Cullen passed suddenly and tragically at the age of 47. Patrick was in his sixth year as a futures broker at Crunch Risk brokering hot rolled, busheling and AUP futures. Patrick was an old and dear friend of mine. He was a 6’7” kind-hearted lovable and extremely generous giant. For those of you that got to know him over the years and want to attend the funeral or pay tribute, click on these links for more information.