Prices

November 2, 2019

CRU: How Will U.S. Iron Ore Grow? Scenarios for the Future

Written by Ryan McKinley

By CRU Senior Analysts Ryan McKinley (USA), Ryan Smith (Australia) and Erik Hedborg (UK)

Part three of our three-part series: What’s next for U.S. iron ore production?

In parts one and two of our series, we examined the U.S. iron ore industry and reviewed recent market developments. We also explored the dependency of U.S. iron ore producers on the domestic steel industry and how the two markets interact with one another. Given the large impact that the domestic steel industry has on domestic iron ore producers, it follows that to predict the future of U.S. iron ore, it is best to look at the future of the U.S. steel market. In the final part of this series, we set out our base case view and explore two possible scenarios.

Base Case: EAFs Increase Share, BF Output Remains Steady

CRU expects 7 Mt of flat rolled EAF capacity to come online by 2024 as part of a total 17 Mt crude capacity increase. Although the U.S. is a net steel importer, low domestic prices for much of 2019, alongside trade actions over the last few years, have helped drive import volumes lower. We expect these two trends to continue in our medium-term forecast and thus expect this new domestic capacity to take some market share from imports. From the domestic supply side, additional EAF capacity will take an increasing share of commodity grade steel production from integrated mills as well as gain market share for some higher value-added products. However, we do not believe that BF production will fall meaningfully in the medium term following the idling of a couple of BFs in 2019. Our Steel Sheet Market Outlook predicts rising U.S. sheet demand, which we expect to be met by higher domestic EAF production.

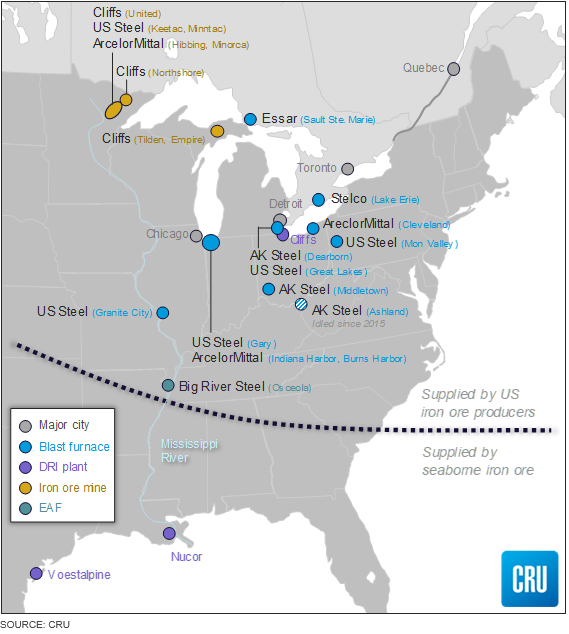

EAFs primarily utilize scrap metal with a smaller proportion of virgin iron units, such as DRI, HBI and pig iron, for many grades of steel. Over the last decade, U.S. imports of DRI/HBI have averaged about 2 Mt annually, while pig iron imports totaled between 4-6 Mt. Imports currently make up 100 percent of the country’s pig iron consumption in EAFs.

By 2024, we forecast that an additional 1.5 Mt of DRI/HBI demand will exist based on increased EAF production. Cleveland-Cliffs has been the first iron ore producer to capitalize on rising demand by constructing a DRI/HBI plant in Toledo, Ohio. Scheduled for completion in 2020, the 1.9 Mt/y of HBI produced at this plant will likely displace some import volumes as well as support additional demand for metallics. Still, there may be room for others in the market or for an additional plant to be built by Cliffs. While DR pellets must be low in alumina and silica, which requires high levels of relatively expensive processing given underlying U.S. geology, increased EAF production and metallics demand may drive prices high enough to entice new entrants to the market.

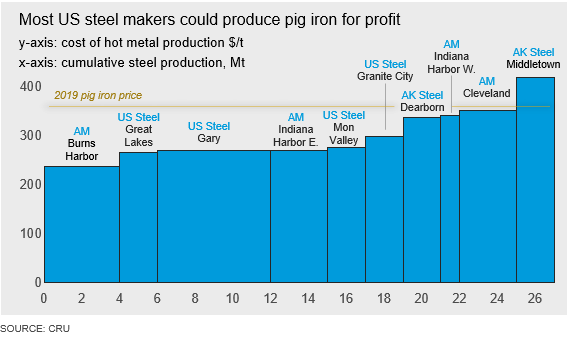

In contrast, pig iron import prices are competitive enough, and margins low enough, that most companies struggle to justify the capex required to restart BFs and put domestically produced pig iron on the market. At least one U.S.-based company has flirted with restarting a BF to become the only domestic pig iron producer. For now, the project has been put on hold, if not abandoned, because of issues surrounding access to iron ore. Hence, in our base case, we anticipate increased pig iron demand to be met by increased imports as opposed to recommissioned BFs.

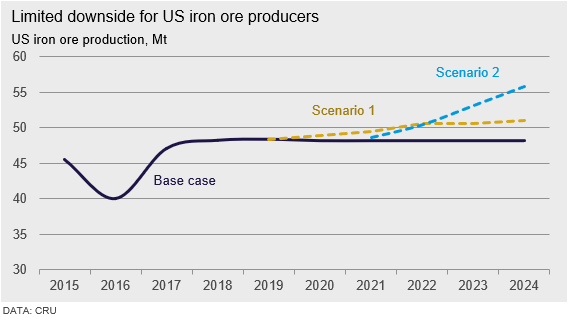

In short, even with additional steelmaking capacity set to come online between now and 2024, our base case forecast calls for U.S. domestic iron ore production to remain stable. While iron ore demand will rise alongside production of HBI at Cliffs’ plant in Toledo, it will be offset by lost demand from U.S. Steel’s BF idlings in 2019. Meanwhile, we expect the increase in pig iron demand to be met by higher import volumes.

Scenario 1: Integrated Mills Switch to Pig Iron Production

EAFs tend to sit in the middle of the cost curve, which can make them more competitive than some integrated mills for finished steel. It stands to reason that the 7 Mt of HR Coil production that is scheduled to come online in the next five years could potentially displace some of the more marginal integrated mills. If this is the case, then we could expect BFs on the higher end of the cost curve to refocus, concentrating solely on pig iron production in order to forgo permanent idling.

This scenario benefits iron ore producers greater than our base case. If the additional virgin iron demand created by new EAF capacity came from domestic BF pig iron and DRI/HBI, we estimate there would be a 2.5 Mt increase in iron ore demand.

This figure might be higher still if domestic BFs produce pig iron at prices competitive enough to displace imports. Currently, 90 percent of the BFs in the U.S. could produce pig iron for profit based on the average 2019 import price of $360 /t CFR New Orleans. By switching to pig iron production, they would take market share away from foreign exporters, even if only to use in their own mills. For instance, U.S. Steel’s recent partial acquisition of Big River Steel may present an opportunity to put its own pig iron into an EAF via the Mississippi River system. By shipping iron ore from northern Minnesota to its Granite City Works facility to create pig iron and then shipping it further down to Big River Steel, the company may be able to reduce or eliminate its exposure to foreign pig iron producers.

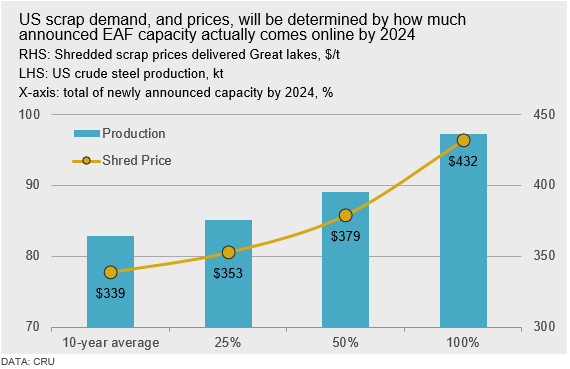

Scenario 2: Blast Furnace Revival – All BFs Near Full Capacity

Our second scenario assumes that production costs for EAF producers will rise as more capacity comes online and demand for scrap rises. Given the positive historical correlation between U.S. crude steel production and scrap prices, we can create a basic model that illustrates how scrap prices might react based on how much of the newly announced capacity actually comes online. With 1 Mt of increased production associated with a $6.50 /t rise in shredded scrap prices, and assuming U.S. capacity utilization stays at its 10-year average of 75 percent, we calculate that scrap prices could theoretically rise by almost $100 /t on average.

The increase in these production costs may make finished steel from EAFs less competitive and, by extension, make steel from integrated mills more attractive. According to the CRU Steel Cost Model, many integrated mills already occupy lower positions on the U.S. HR Coil cost curve than EAFs. However, if EAF costs increase, they will step up the cost curve, allowing even more integrated mills to occupy lower positions This creates an opportunity for BFs to take up a larger share of the market, which may lead to increased BF production.

BFs are major consumers of iron ore, requiring approximately 1.4 tonnes of iron ore for every tonne of liquid steel production. As mentioned in part one, increasing production at these BFs increases demand for U.S. iron ore. U.S. steel producer capacity utilization rates have held around 80 percent for most of 2019. In this scenario, should unexpectedly strong demand conditions occur as rising scrap prices push EAFs further up the cost curve, integrated mills could run close to 90 percent on average. This scenario is, of course, most beneficial to U.S. iron ore producers. If BFs begin running at 90 percent capacity, we estimate that iron ore demand, and possibly production, could rise by 7 Mt over our base case.

Possibilities for Growth in the Iron Ore Industry

The location of U.S. iron ore deposits makes the U.S. iron ore industry dependent on the domestic steel industry—particularly on the country’s BF-BOF sector. As we have seen across this series, exporting is costly, and so developments in the local iron ore market are generally triggered by developments in the domestic steel industry. As this industry continues to grow and change, iron ore producers are also afforded opportunities to grow. Recent production has been volatile, owing to the shifting landscape of the U.S. steel industry. However, provided that the U.S. steel industry can stay competitive, the future should bring stability to iron ore producers. The scenarios presented here show that there may be opportunities for expansion in the industry, even if most of the demand growth is coming from the country’s EAF sector.

At the very least, there is opportunity to develop new ventures such as Cliffs DR pellet and HBI project. There are some hopes of a better future for producers who have experienced recent market downturns. The industry may see either stability, higher DR pellet demand, or higher BF pellet demand, and it is difficult to predict which direction the market will turn. One thing is certain, iron ore producers will need to be decisive in their reaction in order to reap the benefits.

What’s Next?

In this insight series, we provided an overview of U.S. iron ore production, explained why the industry is uncompetitive on the seaborne market and how it will continue to rely on the development of the domestic steel market.

If you have any questions on this insight series, would like to suggest a scenario for us to look at or are curious about further analysis on this topic, please reach out to us on the contact details below.

Erik Hedborg, Senior Iron Ore Analyst (UK), erik.hedborg@crugroup.com

Ryan Smith, Senior Steel Cost Analyst (Australia), ryan.smith@crugroup.com

Ryan McKinley, Senior Steel Analyst (U.S.A), ryan.mckinley@crugroup.com