Government/Policy

September 10, 2019

Trade War Impacts China Exports in August

Written by Sandy Williams

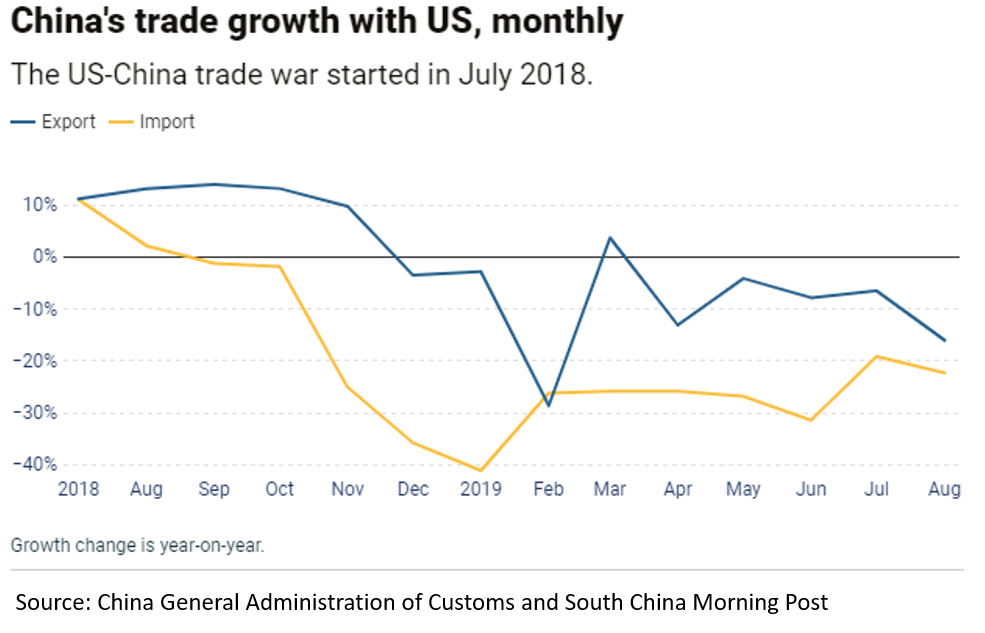

So far, China has held its own in the prolonged trade war with the U.S., but August saw an unexpected decline in exports. China’s exports fell 1.0 percent in August after gaining 3.3 percent in July. Imports declined 5.6 percent, resulting in an overall trade surplus of $34.84 billion, said China’s General Administration of Customs.

Exports to the U.S. plunged 16 percent to $36.33 billion after declining 6.5 percent in July. Imports from the U.S. to China fell 22.3 percent, leaving China with a trade surplus of $25.95 billion with the U.S.

China’s overall surplus was at a record high in the first half of 2019, according to a report released last week by the Institute of International Finance. July’s export gain, however, may have been temporary due to U.S. importers filling inventory ahead of anticipated new tariffs on Sept. 1.

“Meanwhile, our proxy for China’s underlying trade surplus, which controls for commodity prices by excluding oil and iron ore, was the highest ever in the first half of 2019,” said IIF. “Perhaps more surprising, given repeated rounds of tariffs, is that China’s exports remain robust. Part of the resilience in China’s exports reflects a shift in composition away from the U.S. and towards the euro zone and other economies in Asia, including Vietnam.”

The China Caixin PMI showed the manufacturing sector improving in August, pulling out of a contraction in July to a PMI reading in August of 50.4. Business sentiment, however, was among the lowest levels recorded in the PMI’s history as survey respondents reported worries over the trade war and weakening global conditions.

Some analysts agree with the deteriorating sentiment and expect China to see continued decline in export orders. “Trade data won’t go anywhere but south as the second half of the year plays out and China feels the impact of the latest rounds of tariffs,” said Neil Wilson, the chief market analyst for Markets.com, in a note on Monday.

Another round of U.S./China trade negotiations is planned for October, but White House advisor Peter Navarro stressed on Tuesday that “we need to be patient with the China negotiations.” In an interview on Yahoo Finance, Navarro said negotiations will be based on the 150-page tentative agreement that was made in May. “But the Chinese walked away from that. And in many ways, this deal will be determined by what the Chinese want to do,” he said.

The White House continues to insist that the trade war has not impacted American consumers and that China is paying “the full burden” of the tariffs.

China Steel Exports

Steel exports from China fell 10.0 percent in August and 14.8 percent from a year ago. Exports were at a six-month low of 5.01 million metric tons in August. In the first eight months of 2019, exports declined 4.4. percent to 44.97 million tons.

Part of the decrease was attributed to lower-priced steel from India entering the market in the ASEAN region as well as stronger domestic demand.

“We have not exported any steel to Vietnam for several months,” a Shanghai-based trader told Argus Media, citing severe competition from low-priced Indian hot-rolled coil (HRC) offers.

India is expected to increase shipments of hot rolled coil in the fourth quarter due to an economic slowdown at home.

China exports may pick up in September due to sluggish domestic demand in July, allowing Chinese producers to offer more steel abroad at lower pricing.