Prices

June 13, 2019

HRC Futures: There Looks to be a Rally on the Horizon, Might Be Time to Get Opportunistic

Written by David Feldstein

The following article discussing the global ferrous derivatives markets was written by David Feldstein. As an independent steel market analyst, advisor and trader, we believe he provides insightful commentary and trading ideas to our readers. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

Without hesitation, the rolling 2nd month CME Midwest HRC future (HRC2) blew through any support left at $585 trading down to $550. The next support level looks to be $485. It might be time to get opportunistic.

Rolling 2nd Month CME Midwest HRC Future

From late 2017 until the peak in mid-2018, HRC2 rallied 60 percent. It has now fallen 42 percent from those highs.

Rolling 2nd Month CME Midwest HRC Future

All politics aside, the steel tariffs have been disastrous for the steel industry. In late 2017, service centers, especially those with a large percentage of their inventory comprised of galvanized and Galvalume products, took a beating. In the first half of 2018, it was the OEMs turn to see their profits crushed by this policy, especially the smaller sized OEMs. This also led to a great deal of losses for those selling A/R credit insurance. By mid-2018, additional domestic steel production was brought online, while additional projects for further capacity were announced. The service center community took a second round of significant losses starting in Q4 and continuing to the present. Domestic steel mills have also seen profits collapse along with their stock prices.

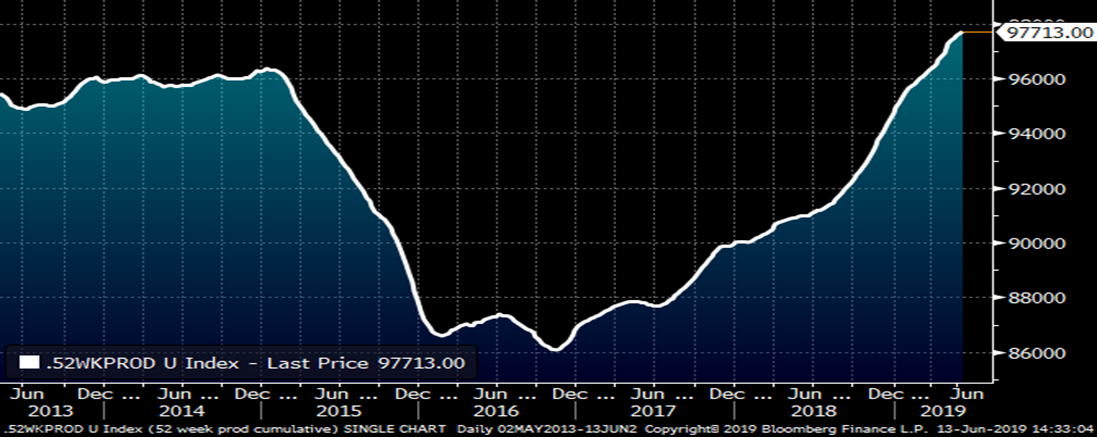

The 52-week sum of the weekly AISI U.S. crude steel production tonnage (chart below) continues to make new highs. Cutting domestic production has become an oversimplified and increasingly popular solution to ending the price slide in flat rolled, but which mill will take the hit? It seems that the two additional domestic mills sparked a turf war. An unplanned outage will spark a rally and is an ever-present upside price risk that must always be taken into account. As flat rolled prices and steel mill equity prices continue to plummet, an announced outage becomes increasingly probable as well. This would spark quite the short squeeze as being bearish on HRC has become a crowded trade.

A.I.S.I. U.S. Crude Steel Production 52-Week Sum

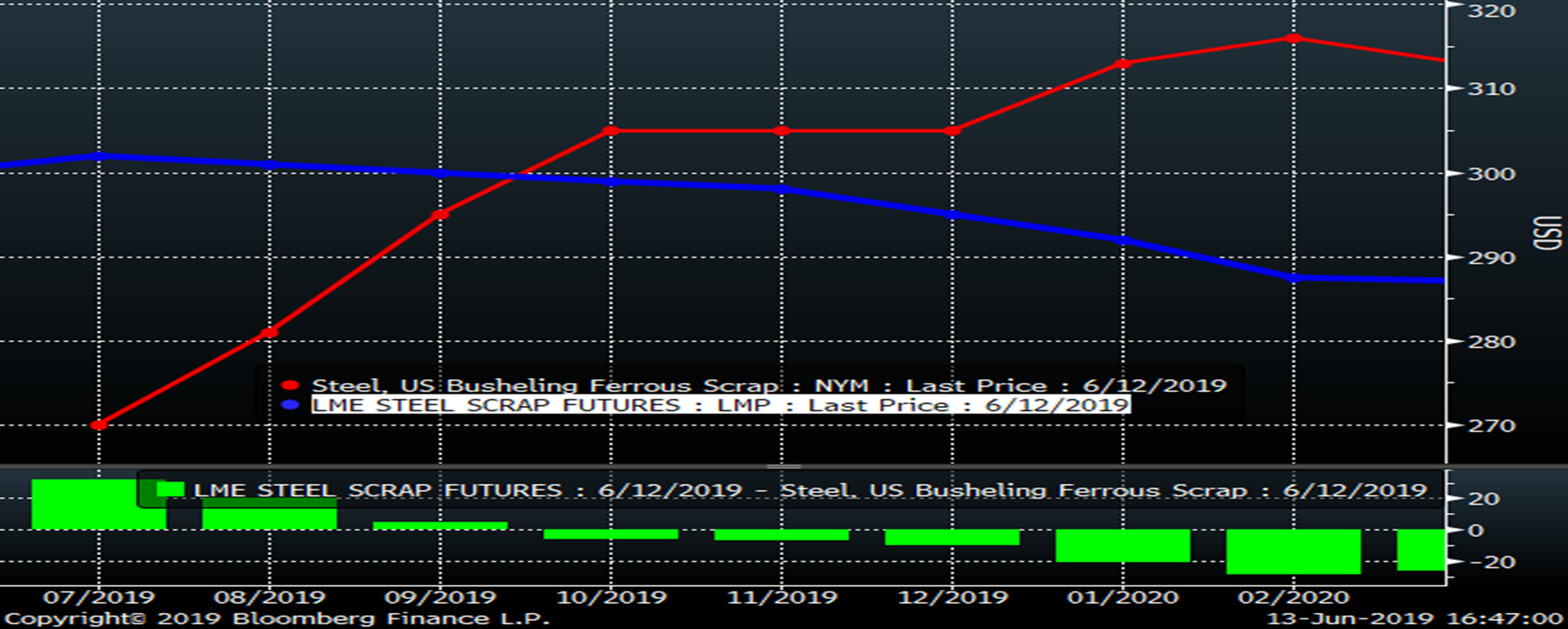

Below are the rolling 2nd month LME Turkish scrap and CME busheling scrap futures. Something peculiar has occurred; busheling is cheaper than shred. That is an anomaly in the historical data and is nonsense from a metallurgical perspective. It can’t last long.

2nd Month LME Turkish Scrap (green) & 2nd Month CME Busheling Futures (white)

The 2019 rally in crude oil failed after peaking around $67/bbl in late April and is now trading around $52/bbl. While this is a bad sign for rig counts and OCTG pricing, it may be an even worse sign for the global economy and GDP. Not only because oil has fallen back to the low $50s, but also because the chart pattern shows lower highs indicating oil will fall below the December 2018 low. Oil looks to be in a down trending bear market.

July CME WTI Crude Oil Future

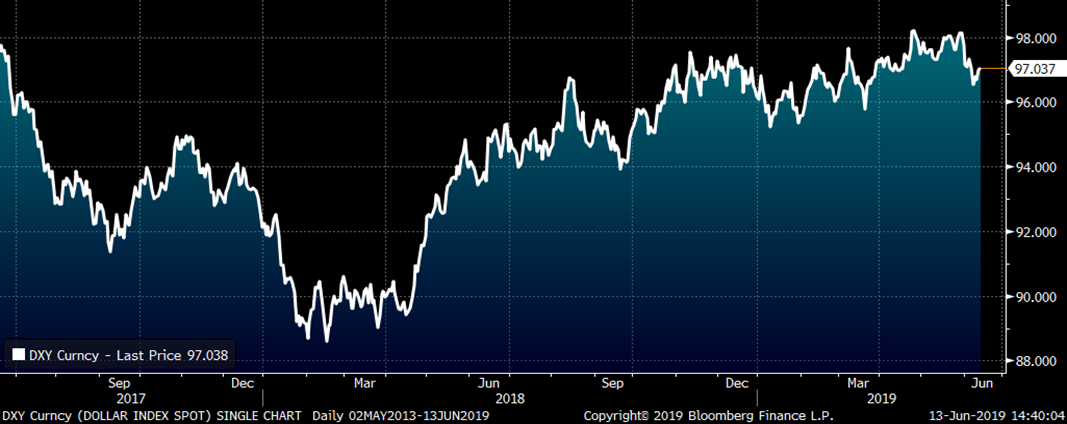

Another negative for steel prices is the resilient U.S. dollar, which has been range bound and remained above 96 for most of 2019.

U.S. Dollar Index

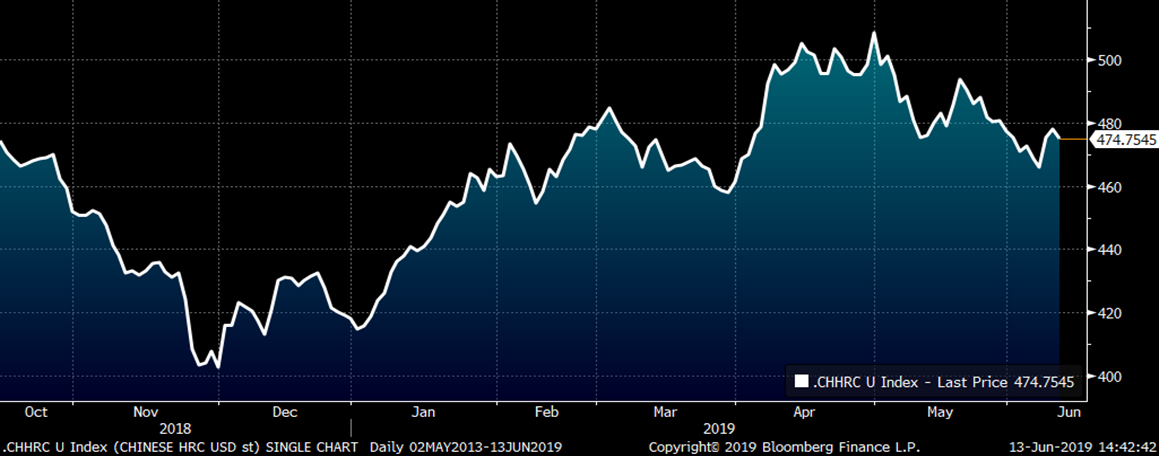

It’s not all bad, however, just plenty of conflicting and confusing data points. The active October Chinese HRC future settled today at $475/st while the July future settled at $503/st.

Active (October) Shanghai Futures Exchange Chinese HRC Future $/st

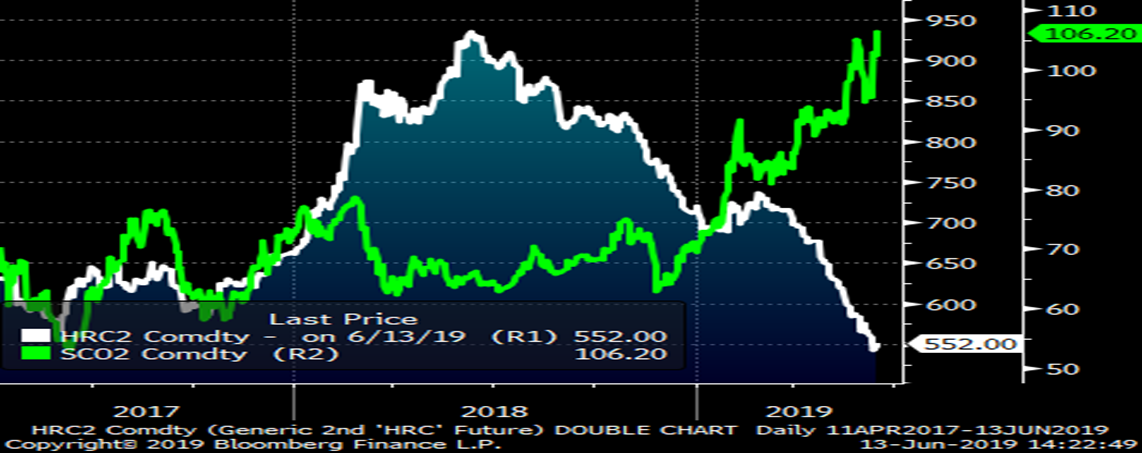

Meanwhile, the rolling 2nd month SGX iron ore future continues to rally to new highs settling today at $106.20! That’s the highest level since 2014.

Rolling 2nd Month SGX Iron Ore Future

This chart compares the rally in ore with the sell-off in Midwest HRC. Strange days indeed!

2nd Month CME HRC Future (white) & 2nd Month SGX Iron Ore Future $/t (green)

In addition to the falling price of oil being indicative of further weakness in the economy, interest rates have fallen precipitously with the U.S. 10-year Treasury rate closing today at 2.09 percent. However, the silver lining is that mortgage rates have dropped over 80 basis points, which will result in a boost to the struggling residential housing market.

Bankrate.com 30 Year Fixed Mortgage Rate National Average

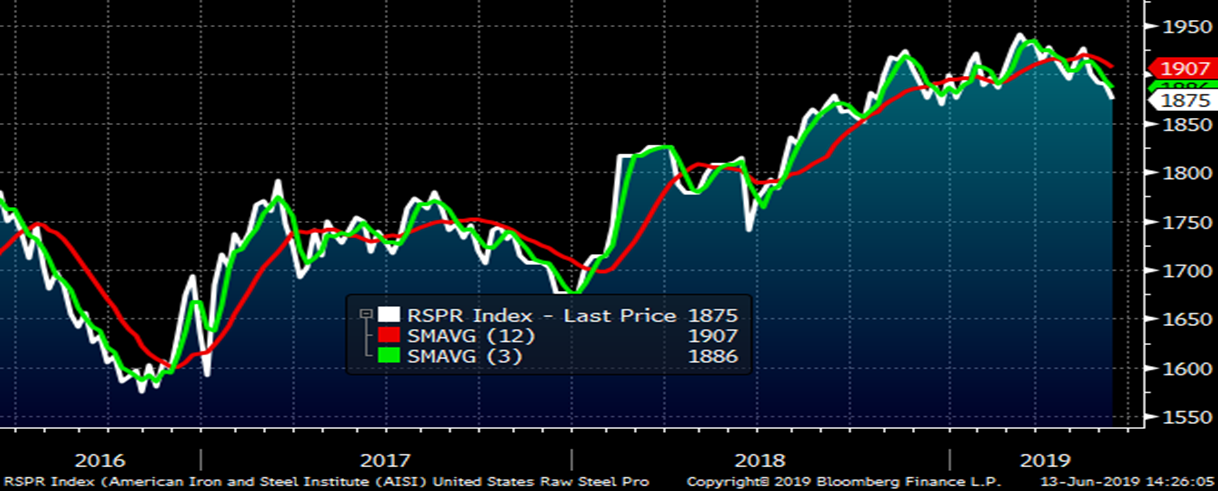

While the 52-week sum of AISI crude steel production continues to make new highs, weekly data has finally started to turn lower with the three-week moving average clearly moving below the 12-week, indicating a curtailment in production could finally be in play.

A.I.S.I. U.S. Crude Steel Production

The solution to falling prices is falling prices and prices have definitely fallen. At some price point, one would expect the sharp drop in service center inventory seen in Q1 could be reversed. That is, a large amount of capital from the service center community could be pushed back into the industry via restocking, providing mills with some increased lead times and the beginning of a new rally. While that price point could be $500 it could also be $400, but it is coming. When it does, there could be a breakneck short squeeze! I would be real nervous holding speculative shorts at this point.

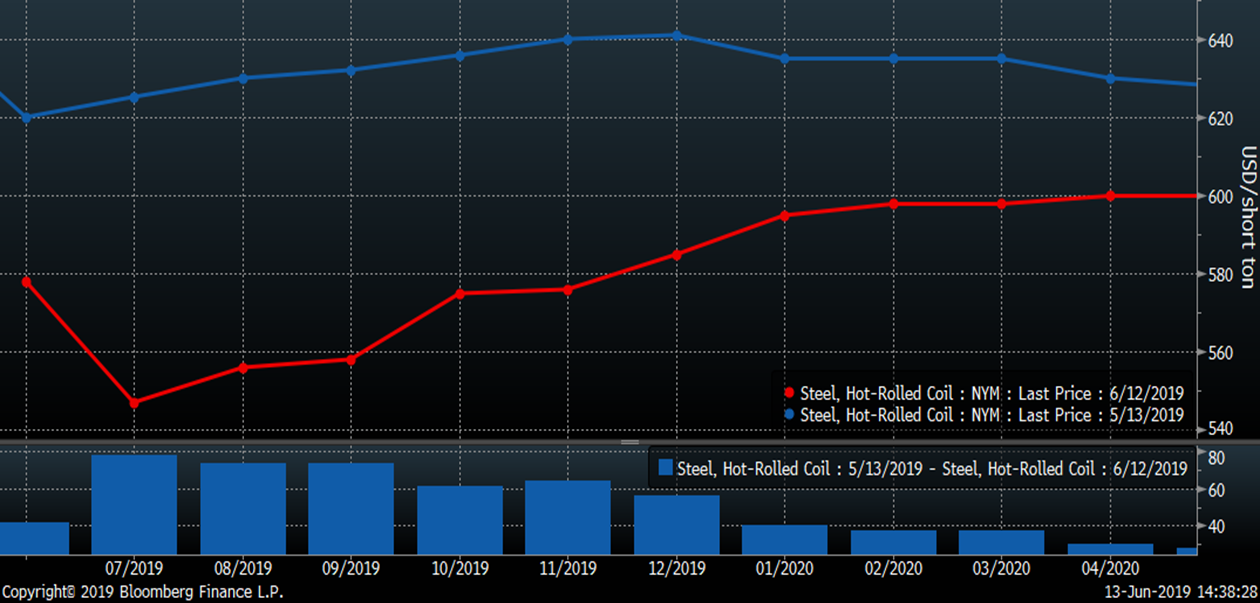

The most direct way to play a rally in HRC is to buy futures, but that’s not the only way. A calendar spread is another strategy. Buying the front months of the curve and selling the back months is a fantastic way to take advantage of an abrupt change in market direction. If Midwest HRC bottoms, prices will likely rally sharply and the curve will shift from contango (upward sloping) to backwardation (downward sloping). If you bought the September HRC future at $560 and sold the January HRC future at $600, you would collect a $40 convenience yield. That is, if the market bottoms and rallies, you stand to profit a minimum of $40 just from the curve shift. If the market continues to fall, the $40 convenience yield is significant enough that it will likely hold and you can trade out of it or roll it forward. For instance, if September falls to $450 and January falls to $490, you would lose $110 on the September future and gain $110 on the January future, which nets out to zero.

CME Midwest HRC Futures Curve

Another fantastic opportunity would be to buy busheling futures and sell LME Turkish scrap futures. For instance, September busheling at $295 is trading at $5 below Turkish scrap. Barring extremely rare circumstances, busheling scrap always sells at a premium to Turkish scrap for obvious reasons. The long-term relationship will revert in due time, but if Midwest HRC rallies, look for busheling to rebound as well and regain a nice premium to Turkish scrap over a matter of days or weeks.

Buying Q4 busheling at $5 over Q4 Turkish scrap is a no brainer in and of itself, but also a fantastic trade to mitigate upside price risk in Midwest HRC.

LME Turkish Scrap & CME Busheling Futures Curves