Prices

March 21, 2019

HRC Futures: Ferrous Futures Continued Range Bound Market

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures market was written by David Feldstein. As the Flack Global Metals Chief Market Risk Officer, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website, www.FlackGlobalMetals.com. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

Midwest HRC futures have been range bound since bottoming in early January with April settling at $716 yesterday. The chart of the rolling 2nd month HRC future broke below its multi-year downtrend in the final week of 2018 (red line). Midwest HRC bottomed in response to domestic mills’ price increase announcements in mid-January and then peaked at $736, but has remained below the downtrend that started last summer (yellow line).

Interest in fixed pricing and hedging grew signfiicantly in 2018 following the volatility and pain sustained first by OEMs and then by service centers. Last week, the London Metals Exchange launched a Midwest HRC future tied to the Platts TSI Daily Midwest Index. The LME also launched a North European and Chinese HRC future. Many are hopeful that these additional products and the liquidity brought by the LME’s members and their network of liquidity providers could boost liquidity across the ferrous derivatives space at a time with interest in hedging solutions at all-time highs.

Rolling 2nd Month CME Midwest HRC Future

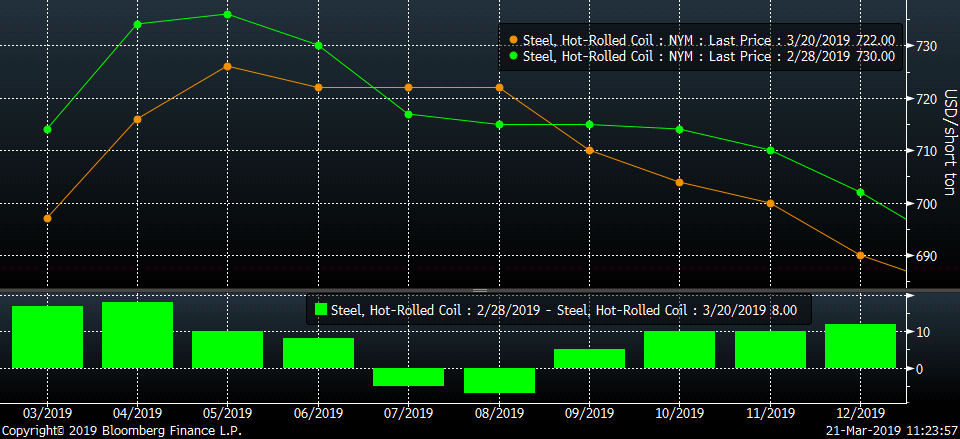

Futures are nothing more than derivatives of physical pricing, which has remained extremely stable around $700 for some time. This chart shows the CME Midwest HRC futures curve from three weeks ago with prices mostly lower, but with the curve seeing little change.

CME Midwest HRC Futures Curve

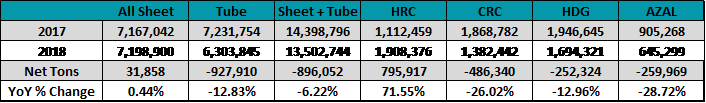

The consequence of the steel tariffs has been an increased fragmentation of the domestic steel market by region and product. This table compares annual net imports of flat rolled and tubular products in 2017 and 2018. Net imports of sheet products actually increased YoY as the decrease in exports exceeded the decrease in imports. If you look at it on a product-by-product basis, hot rolled net imports actually rose by almost 800k tons, while CRC, HDG and Galvalume saw sizeable decreases. This may lend some explanation as to the recent strength in HDG pricing relative to HR. The differential between the Midwest and Houston HRC prices has compressed to less than $20 due to this sharp drop in imports. However, the increase in net imports of HRC is likely due to tons stuck in the Midwest that would have otherwise been exported, which likely explains this pricing anomaly.

Annual U.S. All Sheet Net Imports (st)

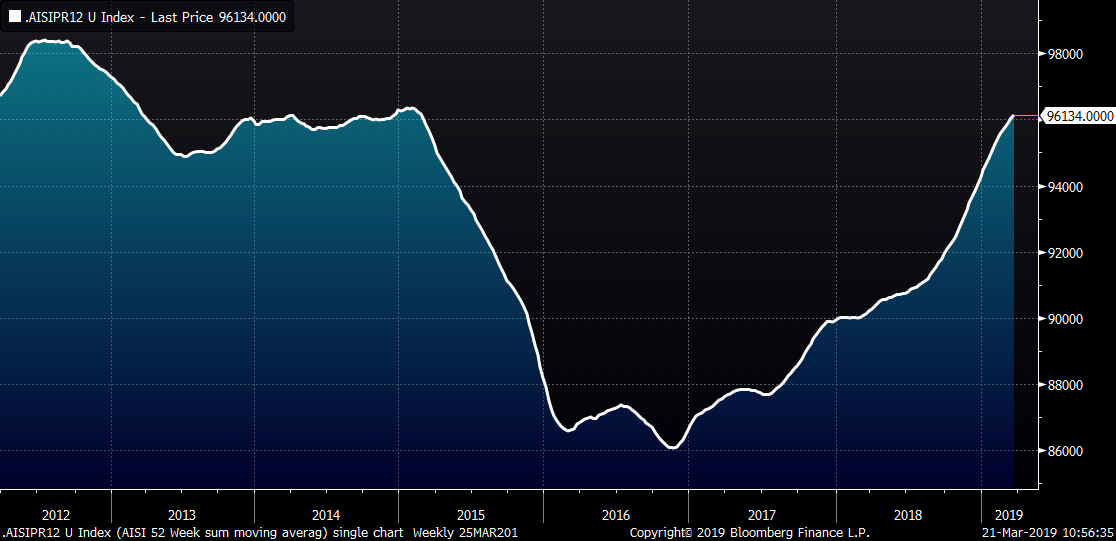

Ultra-low imports and a sharp decrease in service center inventories combined with unattractive import differentials indicating future supply tightness is a perfect recipe for a rally. However, the “rally” is looking more like a dead-cat bounce and a consolidation move in a longer-term downtrend. Perhaps a rally is coming, but you have to wonder why prices have struggled so much. Why isn’t the market responding more bullishly to these developments? Perhaps the metrics are in flux as indicated by the net import data above and this chart below that shows a 52-week moving sum of the weekly AISI crude steel production data. This chart shows that the current 52-week sum is near production levels not seen since 2014, just prior to the massive global flat rolled sell-off and domestic steel mill consolidation.

Moving 52-Week Sum AISI Crude Steel Production

Domestic mills are rolling steel at levels not seen in years. Granite City and JSW are fighting for market share. Add a broad-based manufacturing slowdown with negative YoY growth in the steel demand heavyweight industries of automotive, construction and energy and the failed rally starts to make more sense.

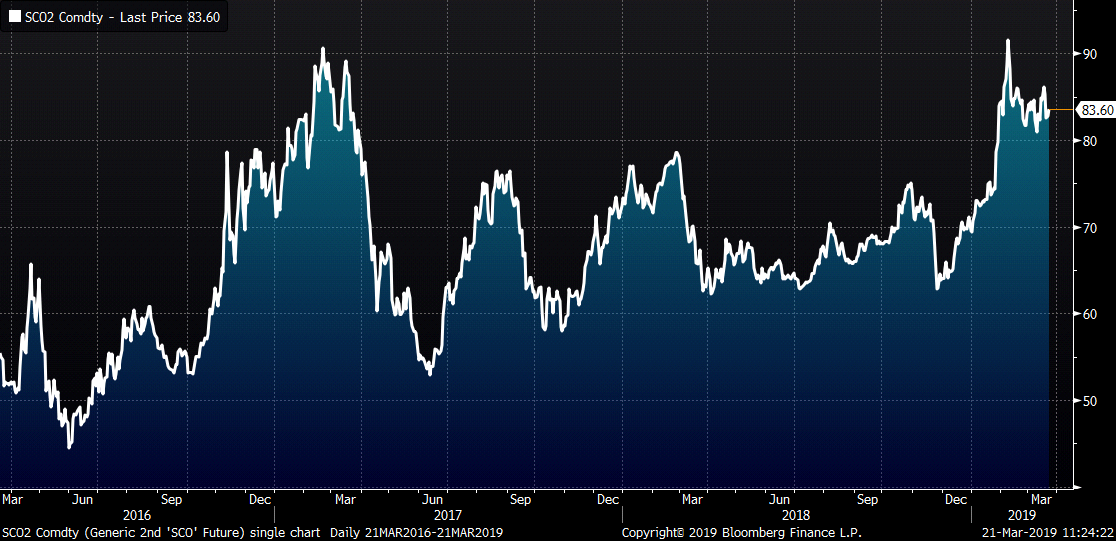

On the raw material front, we see similar tightness. Following Vale’s Brazilian dam disaster, the iron ore rally has settled down into a range with the 2nd month SGX future settling today at $83.60.

2nd Month SGX Iron Ore Future

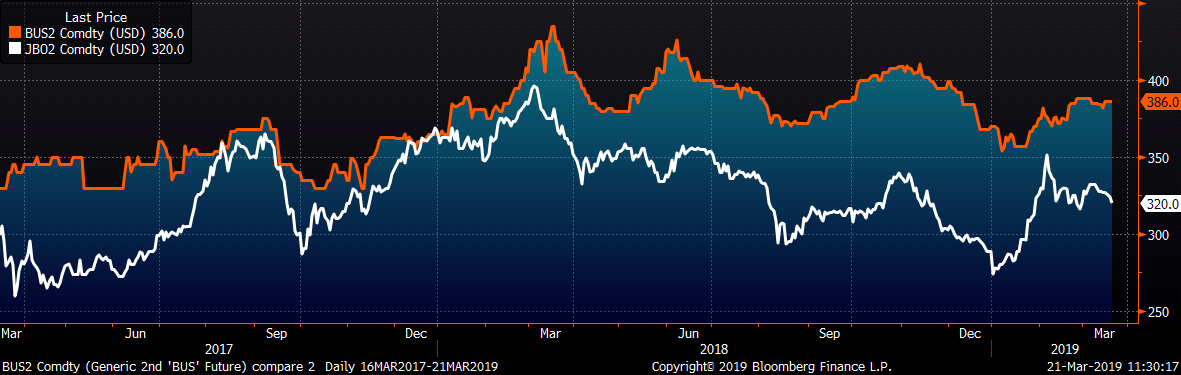

The 2nd month busheling future has remained range bound between $380-$390 since mid-February. The 2nd Month LME Turkish scrap future has been range bound in the $315-$335 area since it peaked at $351 on Feb. 6.

2nd Mo. LME Turkish Scrap & 2nd Mo. CME Busheling Futures