Prices

October 19, 2017

Futures: HR Rebounds on Mill Price Increases and Expected Longer Lead Times

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

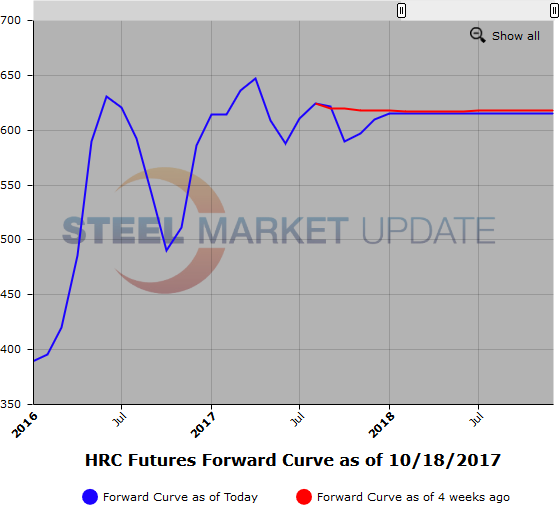

It has been a very active trading week in HR futures along all portions of the curve as over 83,000 ST traded since last Thursday on the NYMEX. As the index the CME uses for HR dropped a second consecutive $17/ST to place the spot market at $581/ST[$29.05/cwt], the mills released a price increase that was pretty well supported across the board and helped change the market sentiment in short order. While the market was being aggressively sold in the nearby months in the last week or so, the market turned on a dime on Wednesday immediately following the HR price increase announcement.

Late last week and early this week, Nov’17 future was trading $585[$29.25/cwt] to $590/ST[$29.5/cwt] and traded today at $600/ST[$30/cwt], a nice $15 rebound. Dec’17, which was trading at $597/ST[$29.85/cwt] average, had moved up to $622/ST[$31.10/cwt], a solid 4 percent move higher.

And Q1’18 and Cal’18 have also shifted higher by $10/ST at the tail end of this week. Also of note, the upward sloping HR curve has shifted the point of inflection, the point where the curve flattens out, from Jan’17 forward to Dec’17 forward.

Open interest this week rose by about 30,000 ST as new positions were placed. Open Interest now stands at over 15,200 contracts or 304,000 ST.

Last Friday, we traded Q1’18 HRO 620 calls in 2,000 ST/mo. The market offer last was $22/ST (HRO – U.S. Midwest Domestic Hot-Rolled Coil Steel (CRU) Index Average Price Options Settlements). If you are interested, you can visit the CME site here.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

Scrap

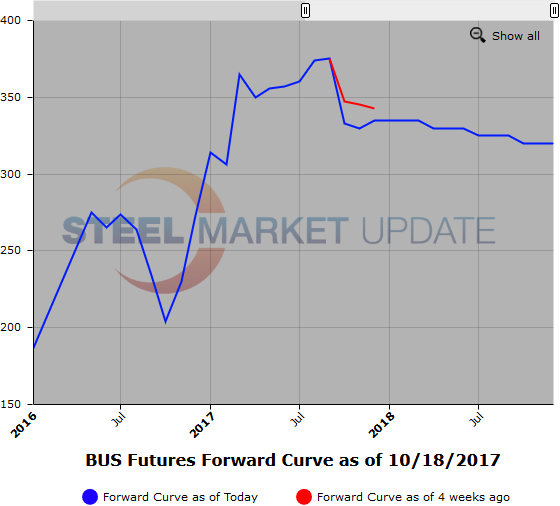

Interestingly, 80/20 scrap has softened in the middle dates the last few days after its recent nice rally following the cargoes that traded at $305/MT. Softer Chinese prices are pausing the rebar rally, which in turn has shifted near-term sentiment with respect to anticipated future scrap demand. Near dates are trading just above $300/MT and falling off $15 going into the Q1’18.

In U.S. domestic scrap markets, the chatter has BUS rebounding $20 to $30/GT for Nov’17 period. Have seen BUS bids rise with the move higher in HR. Offers remain well above the current spot market. With lower anticipated imports going into year-end, it seems we could get a nice pickup in demand for BUS.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.