Market Data

June 27, 2017

SMU Market Survey: Section 232 Comments

Written by Brett Linton

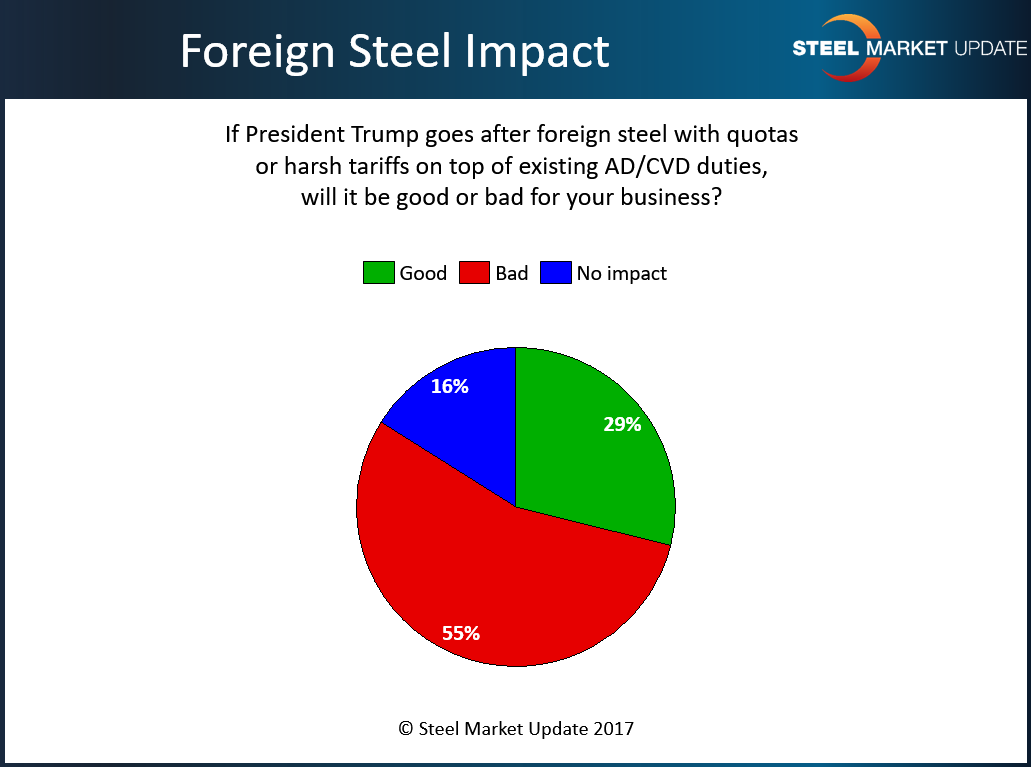

Last week, Steel Market Update (SMU) conducted an analysis of the flat rolled steel market trends. As part of that process, we asked the 100+ companies who responded to our inquiries if quotas or tariffs would be good or bad for their company. We found the majority of the mostly manufacturers and service centers responding believe quotas/tariffs would be bad for their business (55 percent), while only 29 percent believe they would be good.

Here is what the responses look like:

What Our Respondents Are Saying

We buy heavily domestic and it will help companies who use domestic material. There will also need to be legislation that helps manufacturing.

It would be good in the short term for the service centers as mills increase prices, but the long-term effects of the increases could be bad for U.S. manufacturing.

We have a melt and manufacture requirement on most of our domestic product. That means we will likely have to take the price increase and pass it onto our customers. If this extends to semi-finished / finished fabricated parts, it may shut down our ability to compete in the market.

Helps domestic and hurts our import program. On balance, domestic manufacturers should be able to buy at world market prices or close to world market prices. How else can they compete with the rest of the world?

Huge impact on light gauge galvanized will disrupt supply as domestics don’t produce much at all.

Rather than flat roll, the imports will change to fabricated products, which in the long term will cost more U.S. jobs and decimate manufacturing companies in this country.

It is painfully obvious that the domestic steel mills have no pricing discipline. if foreign competition is going to be regulated, then who will protect the consumer in the short term. Long term, the market tends to work itself out.

BOTH: Good for current inventory, but it will give mills the basis to gouge further price increases when they are not needed. Profits are being made all around, no need to screw up the market. We cannot produce enough domestic material and don’t need to.

We use a lot of .016 galvanized. The domestic cost for this is always high. The better deals can be found with imports (most often Mexico). We have competitors that manufacture in China. If we can’t control our cost by buying foreign steel, then we will lose business to our competition who buys steel and manufactures in China.

Business is tough already. Assuming mills will repeat history, they will raise prices and deter what ever business is left.

Good in the short term. When prices go up, we generate more revenue on the product we sell. The challenge is to be in the proper market position to sell at the higher prices.

Potential supply constraints allow those with inventory to participate more fairly than in times of oversupply when distributors often don’t manage their commercial decisions so prudently;. And price increases also tend to lead to short term margin expansion.

In the short term, we will make more money as prices will rise. In the long term, steel consumption in the USA will decline as more manufacturing will go offshore. A disaster for all.

We need affordable steel to buy to make our products. It’s a global market and we should protect from dumping practices, but not artificially inflate global steel prices.

As a distributor it could be both. My business plan calls for quick reaction to any market event, not trying to call the market events.

It is total uncertainty at this point if there will be an impact on our business. If the penalty is harsh, we may see allocations on some products. When that happens, no one can grow.

This has the potential to significantly disrupt the natural supply chain. That all by itself will bring harm to all involved, from mill production to the ultimate manufactured product. Competitiveness is built on efficiency, which is best designed naturally. The U.S. manufacturing sector will be hurt and therefore so will its supply chain and the workforce that supports it.

We have long-term commitments to our customers that we do not currently have inventory to cover.

Going after the foreign steel market will give downstream producers, including their supply chain, a huge advantage over the U.S. supply chain. The Section 232 may be a short term gain, but it will be a long term lost for the hole country.

It will ultimately drive manufacturing out of the USA.

It will provide domestic mills with a bigger stick to push prices upward placing a burden on profitability for the end users.

Generally good, but concerned about unintended consequences. If it ends up hurting manufacturing by increasing their costs excessively…it will be bad for entire economy.

Lack of competition does not help anyone including the American manufacturer. Have you ever seen a mill announce an increase and most mills not follow; even with different input costs (iron ore/scrap)? Funny how they continue to verbally contend they are losing money. Last I checked the lowest paid U.S. steel mill employees make more than 95 percent of my manufacturing employees and the CEO’s/Executives are making millions. Greed promotes the greedier to get more greedy