Market Data

May 1, 2016

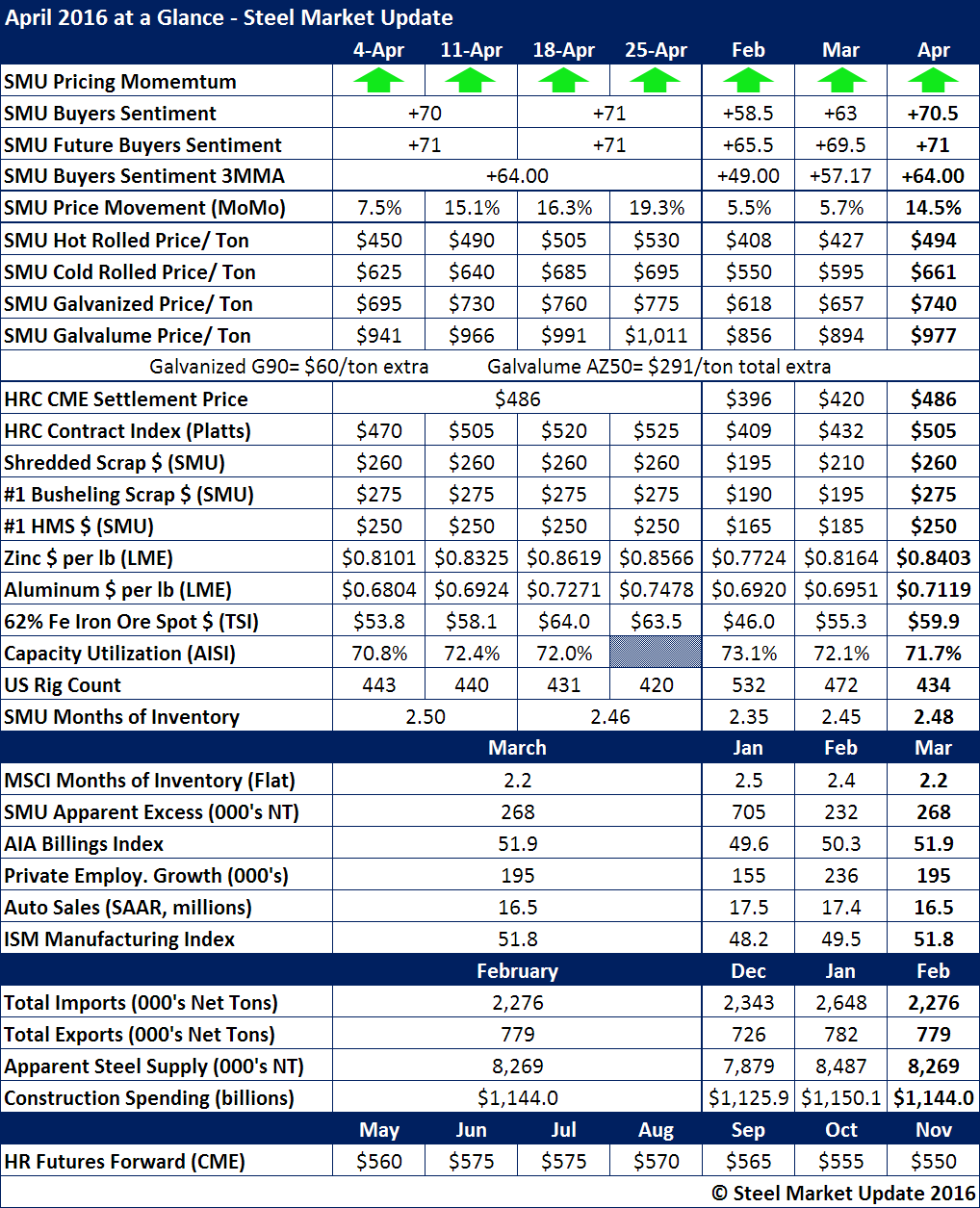

April 2016 at a Glance

Written by Brett Linton

If we could sum up the month of April in one word it would be, wow! We saw flat rolled steel prices jump by $90 per ton from the last week of March until the last week of April. Our HRC average for the month of April jumped by $87 per ton, while the CME HRC Settlement Price moved up by $86 per ton.

The SMU Steel Buyers Sentiment Index set records for being the most optimistic in the history of our index which goes back to November 2008.

SMU Price Momentum continues to reference higher prices over the next 30 to 60 days.

Ferrous scrap and commodity prices moved higher as the month progressed. Iron ore prices reached $70 per dry metric ton after beginning the month in the $50’s. By the end of the month ore was still higher in the low to mid $60’s for 62% Fe fines in China. Zinc prices ended the month at $0.8757 per pound.

MSCI inventories dropped to 2.2 months supply although cold rolled and galvanized are much lower than that. The SMU Service Center Inventories Apparent Excess/Deficit model has inventories close to being fully balanced and our Premium level members know we are forecasting inventories to move into a deficit over the coming months.

Even though we have weekly capacity utilization rates published, we know from the various mill conference calls that flat rolled utilization is over 80 percent with SDI reporting the highest level at 88 percent. The flat rolled market is tight and will remain that way as long as USS and AK Steel keep capacity off the market and imports come in at reduced rates.