Prices

April 28, 2016

Hot Rolled Futures: The Show Goes On!!!

Written by John Packard

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Dave Feldstein. As Flack Steel’s director of risk management, Dave Feldstein is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

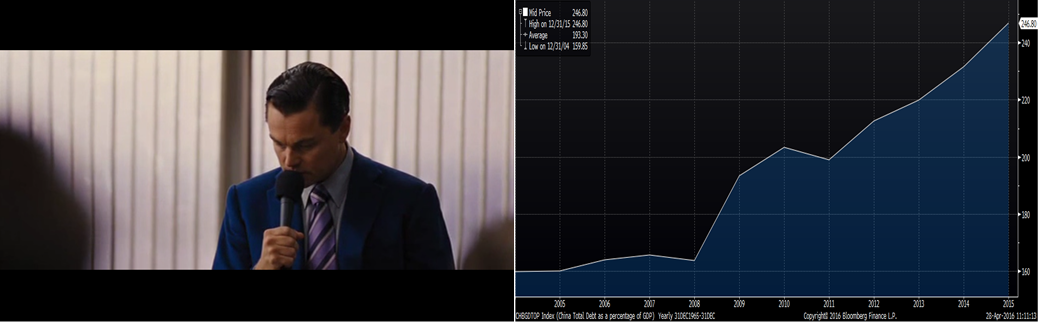

In the Oscar nominated film “The Wolf of Wall Street,” Jordan Belfort (played by Leonardo DiCaprio) is faced with the decision to resign as the head of his corrupt and fraudulent Wall Street stock brokerage in order to avoid indictment by the FBI. Jordan and the employees of his firm Stratton Oakmont produced incredible growth and profits for years while disregarding the rule of law, but as his father puts it in one scene, “Jordy, one of these days the chickens are gonna to come home to roost.” On the left side of the graphic above, Jordan is making his resignation speech to his staff. The right side of the graphic is a chart of China’s debt-to-GDP ratio at 247%.

Not more than five minutes into his speech, Jordan reverses course and announces “I’m not leaving” which sends his employees into a frenzied celebration! “THE SHOW GOES ON!!!!” he exclaims. Animal spirits erupt.

China has seen growth slow sharply as it transitions away from an export and fixed asset investment based economy toward an economy focused on a larger contribution from the service sector. For years, China has been disciplined in implementing reforms to accomplish this transition by limiting the use of their “old growth engine” to monetary policy via interest rate and reserve ratio cuts and measured infrastructure spending. Then the government did an about face and flooded the economy with excess capital of $260 billion in liquidity/stimulus in January and $90 billion in March.

“THE SHOW GOES ON!!!!”

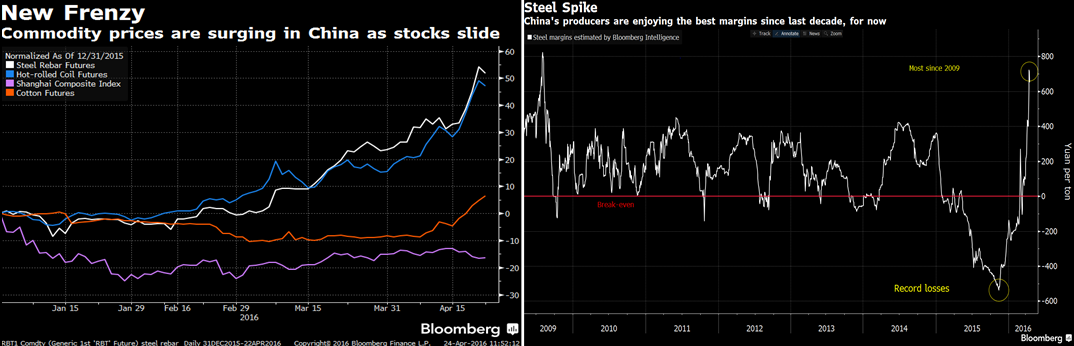

The catalyst for the global turnaround in commodities was this infusion of capital from China. For the USA steel industry, this catalyst collided with a lean supply chain management practice by the manufacturing industry, plummeting imports due to flat rolled trade cases and capacity reductions by domestic integrated steel mills. The result is a global phenomenon, a phenomenal rally across the ferrous space. More simply put a bubble where Midwest HRC prices have rallied 30% in eight weeks.

The tricky thing about bubbles or “irrational exuberance” as Alan Greenspan put it, is they tend to last longer than anyone expects. Or as Keynes put it, “markets can remain irrational longer than you can remain solvent.” Speaking of irrational, last Thursday, the Chinese rebar futures market traded 223 million tons. China produced 204.3 million tons of rebar in ALL OF 2015!!

I can’t tell you when it will end or how high it will get, but I have a good idea of what will prick this bubble. Rather it is the spike in the chart to the above right. Chinese mills have reversed their fortunes from losing $90/t to making $100/t according to Bloomberg Intelligence. One would expect this profit potential will motivate Chinese mills to produce flat out for the next few months leaving the global steel industry with an epic oversupply of steel if, who am I kidding, when the show slows down again.

The chart above left shows the normalized percentage gain for the futures price of rebar (white) and iron ore (red) futures traded on the Shanghai Futures and Dalian Futures Exchange, respectively, starting on January 1st, 2016. The green line is the percentage gain of the CSI 300, which is China’s onshore stock market. However, the CSI 300 chart starts on January 1st, 2015 and shows last year’s amazing stock market rally so you can compare the three rallies on a percentage basis. The chart to the above right is the CSI 300 through July, 2015 and shows the crash that followed. The red arrow is where we were last year at this time in comparison to where the above left chart ends. In other words, before the Chinese stock market dropped 33%, it rallied another 17%.

Starting last week, Chinese regulators already stepped into the iron ore market by increasing margin requirements and limiting certain types of orders.

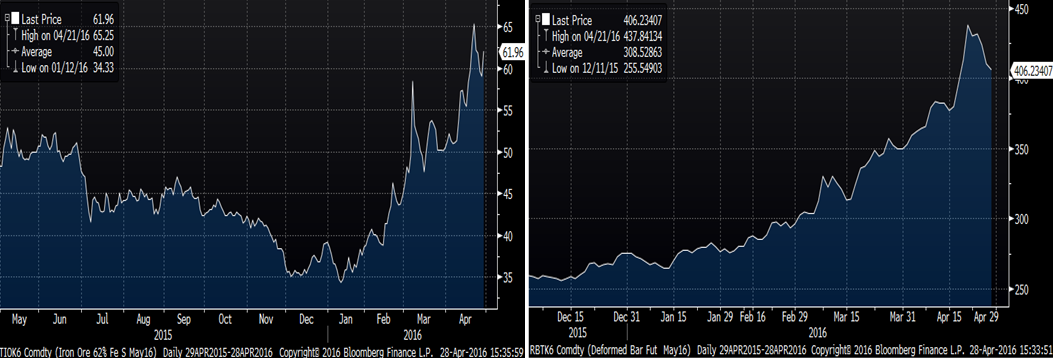

These moves combined with the announcement to enforce the steel production curtailment starting this week in Hebei for the Horticultural Expo initially pushed iron ore prices lower, before rebounding $3.65/t yesterday to $62.65/t for May. Similar to HRC, iron ore is in backwardation with Q3 2016 settling at $53/t and Q4 at $48.75/t.

So what is one of the ways to manage your business through all of this uncertainty/insanity? Futures!

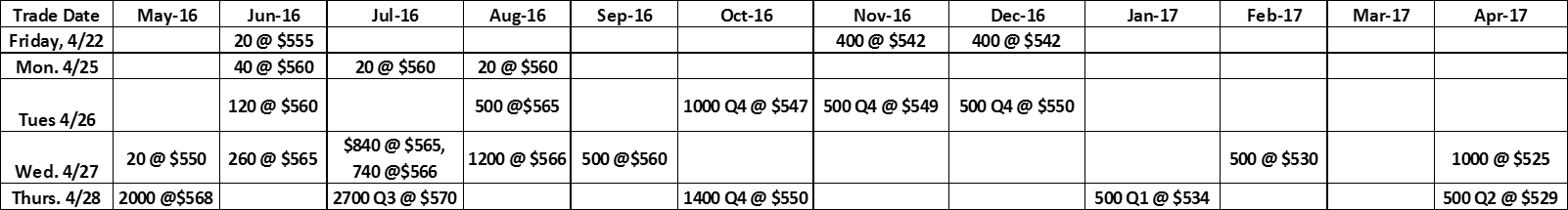

“THE SHOW GOES ON!!!!” May gained $25/st while June and July gained $17/st. Aug., Sept. and Oct were each up $10/st. Below are the trades during the course of the week for a total of 34,380 short tons traded.

*For the quarterly strips, ie Q4, 1000 means 1000 st/m or 3000 total.

Busheling scrap futures have awoken to trade 500 gt/m 2H 2016 (second half) at $260 yesterday. Today, busheling futures traded 200 gt/m of 2H at $280, 500 gt/m of Q3 at $285 and 200 gt/m of Q4 at $285. Perhaps some market participants are trading the “metal spread” by buying scrap and selling HRC futures and vice versa.