Prices

March 24, 2016

TSI Index Another Option for Physical & Financial Contracts

Written by Brett Linton

In Sunday evening’s issue of Steel Market Update we published an article highlighting the Platts indices which are used by some mills and their customers to adjust flat rolled steel contract pricing. The other daily index out there is The Steel Index (TSI) which will be the index used for the NASDAQ Midwest Hot Rolled Coil contract (more about that later in this article).

There is quite a spread between the various indexes following hot rolled coil. On Sunday we asked Joe Innace of Platts to explain why his number was where it was at the time and today we asked Kurt Fowler of The Steel Index the same question – why the spread between various indices?

Mr. Fowler told us, “Regarding your initial question about the TSI numbers vs [other well known but unnamed index] numbers. While I am not familiar directly with the [index name deleted] methodology or contributors I have heard anecdotal information over the years.

One particularly useful one from the market went something like this. “[index name removed] is what happened yesterday, TSI is what is happening today and Platts is what is happening tomorrow.” I thought that this was a particularly astute observation once you understand the methodologies and timing of the various price reporting agencies. The [index name removed] reference is obvious. The TSI reference refers to the fact that our methodology primarily includes transaction data. The Platts reference refers to their inclusion of bids and offers as an indication of where the market is going. In all cases the data point is useful as long as you understand what it represents.”

The Steel Index published their hot rolled number today at $421 per ton which is at the lower end of the range reported by Platts (Platts owns The Steel Index) today of $420-$440 with a midpoint of $430 per ton.

As a reference point Steel Market Update reported our range earlier this week at $420-$460 per ton with a midpoint of $440 per ton ($22.00/cwt).

Mr. Fowler went on to tell us, “We publish a single reference index on a daily basis for US HRC to provide the market with clarity and confidence in our market index. In the near future, that number will be paired with a financial contract for HRC located on the NASDAQ OMX exchange. This pairing will allow market participants to engage risk management opportunities previously only available on CME. The significance of this cannot be understated as the current HRC market has resumed utilizing the CME contract and the price associated with that contract. An alternate choice will soon be available to do both physical and financial contracts. Until that time, market participants are subject to what is referred to as “basis risk” should they choose to utilize different indices for their physical and financial contracts. The “basis risk” is the difference in the numbers published by more than one index provider…

For this reason, we feel that TSI will become a positive choice for market participants to provide their customers with the opportunity to hedge their physical purchase with a financial instrument. Additionally, the US HRC contract on NASDAQ OMX will also have a US Shredded Scrap financial contract due to launch in late March or April 2016. This will extend the ferrous supply chain’s ability to engage in risk management activities for both raw materials and finished steel in the US market. This concept is sometimes referred to as the “virtual steel mill” by the exchanges.

In short, the methodology is proven, transparent and verifiable. It has survived audit and been certified. Exchanges around the globe have chosen TSI’s methodology as the settlement index for financial contracts covering scrap, coking coal, iron ore and finished steel.”

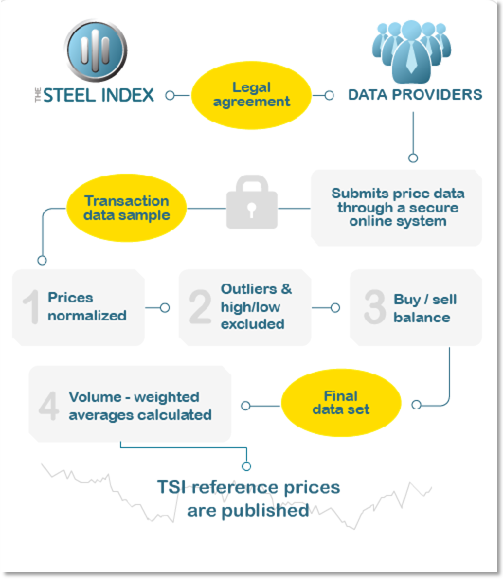

The following information was provided to Steel Market Update by The Steel Index regarding their methodology:

The TSI methodology is utilized for all of the ferrous supply chain commodities that TSI covers. The guiding principle is maximizing participation while minimizing subjectivity. The TSI methodology was in fact created to respond to a lack of transparency in the PRA industry at that time. (2006)

The methodology is available via the TSI website for all subscribers and non-subscribers alike to review in a PDF download (https://www.thesteelindex.com/en/procedures-methodology/) as well as several videos on our website that provide overviews of both our methodology (http://bcove.me/om3igytm) and our data provider process. (http://bcove.me/fv5kydzv)

One of the key elements of our methodology is the data provider process that we utilize to collect market transactions from the physical market participants. Interested parties sign a data provider agreement that ensures the following: confidentiality, conformity to the specifications of each index and audit capability to ensure accuracy. Again the primary source of information that is received for the TSI indices is actual transaction data.

– Data-driven methodology using transaction data to calculate volume-weighted price indices*

– Data-driven methodology using transaction data to calculate volume-weighted price indices*

– TSI “Data Providers” submit spot transaction data to TSI under confidentiality agreement

– Physical market participants only (over 600 registered today)

– Representatives from all relevant points of the supply chain, buy and sell sides

– Submission direct to TSI database through secure on-line channel

– Data normalized and “cleaned” before volume-weighted averages calculated for the day or week

* A note of differentiation is the volume-weighting process. TSI’s methodology requires volume weighting to be the last step in the process before publication of the index. Only after all other balancing and exclusionary steps are complete is the volume-weighting applied ensuring that any one transaction does not account for more than 40% of the volume for that reporting period. Other PRAs include volume-weighting at other points of their process.

An element of the current market that TSI (and Platts) fully comply with is auditability, and full compliance with IOSCO principles. The TSI indices have completed multiple regulatory and exchange reviews to ensure impartiality and accuracy in our pricing appropriate for the formal futures markets. With Dodd Frank and the associated rules from the CFTC, the regulatory environment is much more complex than in the past and TSI has survived the test. The CME Group already has a global agreement in place with Platts to provide them with access to our metals indices.

The US TSI HRC Index has been in existence since May 2006 and became a daily number in early 2012. As Joe mentioned in his document, both the Platts and the TSI numbers are included and referenced in physical market transactions. The TSI US HRC number will be included in the launch of an additional US HRC financial contract by NASDAQ OMX later this year.

The following link contains a comprehensive list of TSI based derivatives by commodity and market exchange. https://www.thesteelindex.com/en/derivatives/