Market Data

July 21, 2014

June Chinese Trade Data: Mixed Bag

Written by Brett Linton

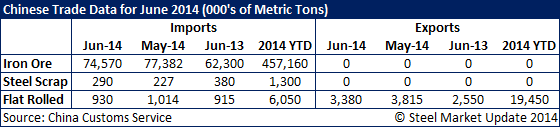

Chinese steel trade data for June 2014 was released earlier this week, providing updated data on iron ore imports, steel scrap imports, and flat rolled imports and exports. Chinese imports of iron ore in June were 74,570,000 metric tons, a decrease of 3.6 percent from the previous month but an increase of 19.7 percent from June 2013. Total iron ore imports for 2014 were adjusted to 457,160,000 tons.

June imports of steel scrap were 290,000 tons, up 27.8 percent from May but down 23.7 percent from the same month one year ago. 2014 total levels for steel scrap imports were adjusted to 1,300,000 tons.

Flat rolled imports in May were 930,000 tons, an 8.3 percent decrease from the previous month but a 1.6 percent increase over June 2013 figures. Total 2014 imports were adjusted to 6,050,000 tons. Chinese exports of flat rolled steel were 3,380,000 tons for June, down 11.4 percent from May but up 32.5 percent from June 2013. Total flat rolled exports for 2014 are at an adjusted 19,450,000 tons. (Source: China Customs Service)

SMU Note: You can view the interactive graphic below when you are logged into the website and reading the newsletter online. If you have not logged into the website in the past and need a new user name and password we can do that for you out of our office. Contact us at: info@SteelMarketUpdate.com or by calling 800-432-3475. If you need help navigating the website we would also be very happy to assist you.

{amchart id=”127″ Chinese Trade Data- China Iron Ore, Scrap, Flat Rolled Imports and Exports}