Market Data

July 1, 2014

June in Review

Written by John Packard

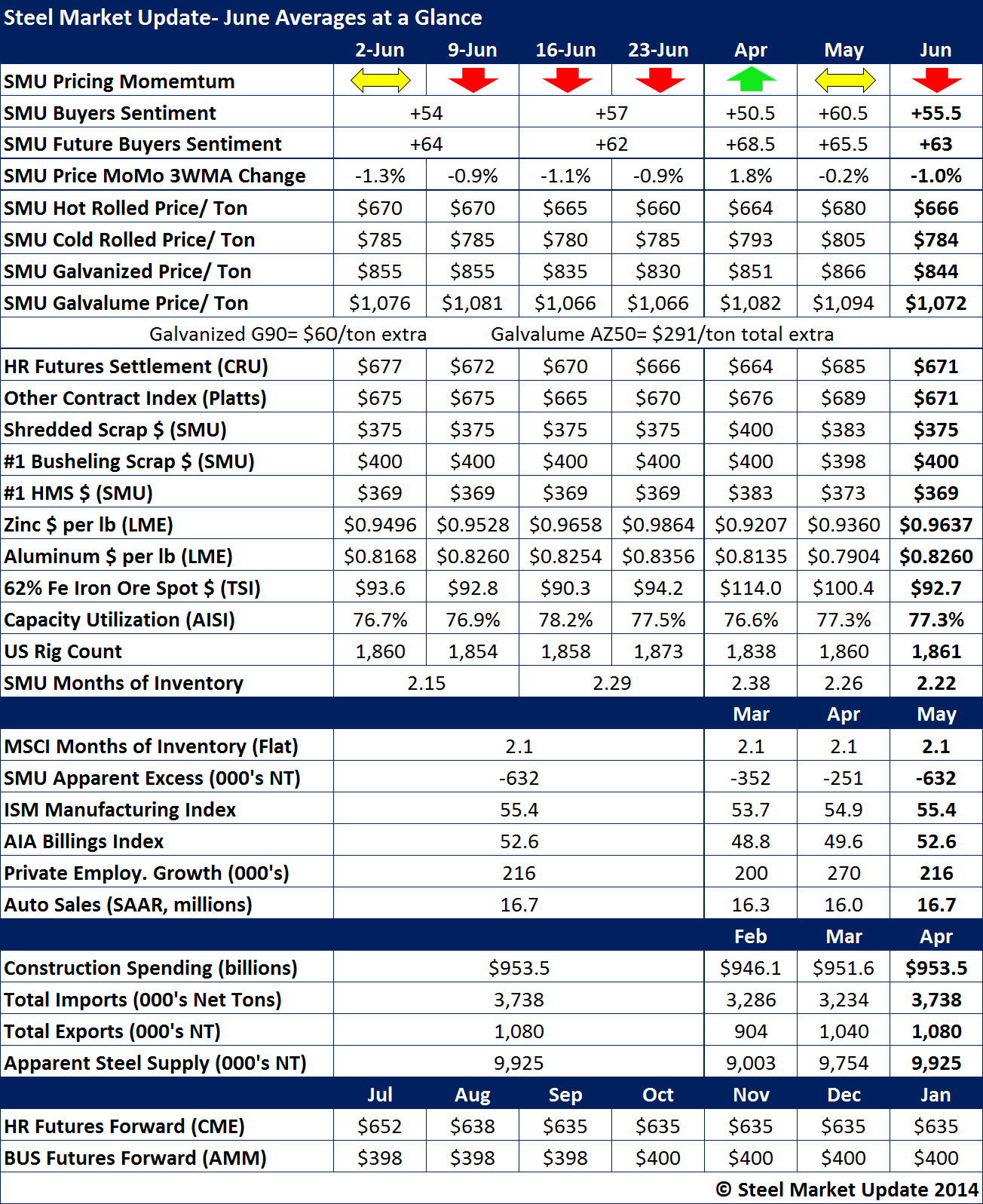

Hot rolled prices eroded during the month of June with the month ending at $660 per ton ($33.00/cwt) and our June monthly average $666 per ton. At the end of May our average was $680 per ton so we are down $14 per ton based on the monthly averages.

The CRU hot rolled coil futures settlement for the month of June was $671 per ton, down $14 per ton from the prior month average. The Platts HRC index dropped the most with $18 per ton of negative movement during the month. Both CRU and Platts ended up with the same average for the month at $671 per ton.

SMU Price Momentum was pointing toward lower prices until the last day of the month when we adjusted our Indicator to Neutral due to the US Steel price announcement.

SMU Steel Buyers Sentiment Index continues to be in the very optimistic range of the Index as the month averaged +55.5.

Iron ore prices continued to trade under $100 per dry metric ton (62% Fe) and averaged $92.7/dmt for the month.

Service center inventories (non-seasonally adjusted) remained at 2.1 months while our Apparent Deficit analysis showed distributors flat rolled inventories as being 632,000 tons in deficit. This is a good sign for the domestic steel mills as they push for higher prices.

Demand is also good with the ISM Manufacturing Index, AIA Billings Index, Auto Sales and construction spending all showing positive growth and trends.

The big negative for the month was foreign steel imports for April at 3.738 million net tons. Not shown on the report (since it is not the final number yet) is the May imports should exceed 4.0 million net tons.

SMU knows there is a lot of emotion expended whenever steel mills announce price increases. We encourage our readers to watch the HRC (hot rolled coil) futures forward curve for hints as to what direction the money is saying prices will head. The forward curve can be found on the home page of our website and an interactive graph/table is linked to the forward curve and available to our members (log in required).

The forward curve has HRC at $635 per ton beginning in September through January on the table below. On our website you can find an interactive graph/table which also has where the forward curve was one month ago. You may want to keep these numbers in front of you as you think about the direction of prices in the coming months.

We will have a number of people who are associated with the Futures markets at our Steel Summit Conference in September. Andre Marshall will be there and is speaking on the Chinese Futures markets. Tim Stevenson of Cargill is also a speaker (projected steel usage in the energy sector) but he is an expert on the HRC derivatives markets. If you want to learn more about the futures markets, plan on meeting Andre and Tim and spending some time learning more about the markets.