Market Data

April 23, 2014

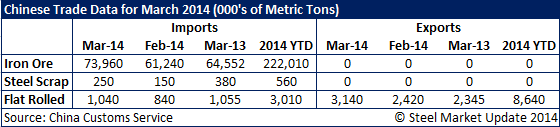

Chinese Flat Rolled Exports at 3.1 Million Tons During March

Written by Brett Linton

Details on steel trade data out of China were released earlier this week regarding iron ore imports, steel scrap imports, and flat rolled imports and exports. Chinese imports of iron ore during March were 73,960,000 metric tons (MT), an increase of 20.8 percent from the previous month and an increase of 14.6 percent from March 2013. Total iron ore imports for 2014 were adjusted to 222,010,000 MT.

March imports of steel scrap were 250,000 MT, up 66.7 percent from February but down 34.2 percent from the same month one year ago. 2014 total levels for steel scrap imports were adjusted to 560,000 MT.

Flat rolled imports in February were 1,040,000 MT, a 23.8 percent increase from the previous month but a 1.4 percent increase over March 2013 figures. Total 2014 imports were adjusted to 3,010,000 MT. Chinese exports of flat rolled steel were 3,140,000 MT for March, up 29.8 percent from February and up 33.9 percent from March 2013. Total flat rolled exports for 2014 are at an adjusted 8,640,000 MT. (Source: China Customs Service)

SMU Note: You can view the interactive graphic below when you are logged into the website and reading the newsletter online. If you have not logged into the website in the past and need a new user name and password we can do that for you out of our office. Contact us at: info@SteelMarketUpdate.com or by calling 800-432-3475. If you need help navigating the website we would also be very happy to assist you.

{amchart id=”127″ Chinese Trade Data- China Iron Ore, Scrap, Flat Rolled Imports and Exports}