Market Data

February 25, 2014

January Chinese Trade Data

Written by Brett Linton

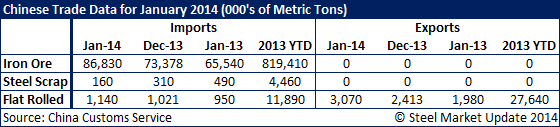

Chinese imports of iron ore in January were 86,830,000 metric tons (MT), an increase of 18.3 percent from the previous month and an increase of 32.5 percent from January 2012. Total iron ore imports for 2013 were adjusted to 819,410,000 MT.

January imports of steel scrap were 160,000 MT, down 48.4 percent from December and down 67.3 percent from the same month one year ago. 2013 total levels for steel scrap imports were adjusted to 4,460,000 MT.

Flat rolled imports in December were 1,140,000 MT, an 11.7 percent increase from the previous month and a 20 percent increase over January 2012 figures. Total 2013 imports were adjusted to 11,890,000 MT. Chinese exports of flat rolled steel were 3,070,000 MT for January, up 27.2 percent from December and up 1.5 percent from January 2012. Total flat rolled exports for 2013 are at an adjusted 27,640,000 MT. (Source: China Customs Service)

An interactive chart of this data can be found here on our website for logged in members. If you need help with your log-in or navigating our website please contact us: info@SteelMarketUpdate.com or (800) 432 3475.