Product

August 20, 2013

July Chinese Iron Ore, Scrap, and Flat Rolled Trade Data

Written by Brett Linton

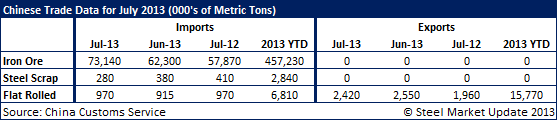

Chinese imports of iron ore in July were 73,140,000 metric tons, an increase of 17.4 percent from the previous month and an increase of 26.4 percent from July 2012. Year to date iron ore imports are at 457,230,000 MT through June.

July imports of steel scrap were 280,000 MT, down 26.3 percent from June and down 31.7 percent from the same month one year ago. Year to date levels were at 2,840,000 MT for the first seven months of the year.

Flat rolled imports in June were 970,000 MT, a 6 percent increase from the previous month and equal to imports during July of 2012. Year to date imports were at 6,810,000 MT. Exports of flat rolled steel were 2,420,000 MT for July, down 5.1 percent from June but up 23.5 percent from July 2012. Year to date flat rolled exports are at 15,770,000 MT. (Source: China Customs Service)