Analysis

March 21, 2025

SMU Survey: Steel buyers maintain confident market outlook

Written by Brett Linton

SMU’s Buyers’ Sentiment Indices showed mixed movements this week but remain strong, reflecting continued confidence among steel buyers for their companies’ chances for success.

After climbing to a 10-month high in February, our Current Sentiment Index declined this week for the second-consecutive survey. Despite the dip, it remains one of the higher readings of the past year, continuing to indicate that buyers are optimistic for their companies’ chances of success.

Following one month of declines, our Future Buyers’ Sentiment Index rebounded this week. Future sentiment continues to show that buyers maintain a positive outlook for the first half of the year.

In our two previous surveys, Current Sentiment exceeded Future Sentiment, meaning buyers were more optimistic for present business conditions than future success. This week, the indices have returned to their typical trend, with buyers once again most optimistic about future prospects.

Every two weeks, we poll nearly 2,000 steel industry executives asking how they rate their companies’ current chances of success, as well as business expectations three to six months down the road. We use their responses to calculate our Current and Future Steel Buyers’ Sentiment Indices, metrics tracked since SMU’s inception.

Current Sentiment

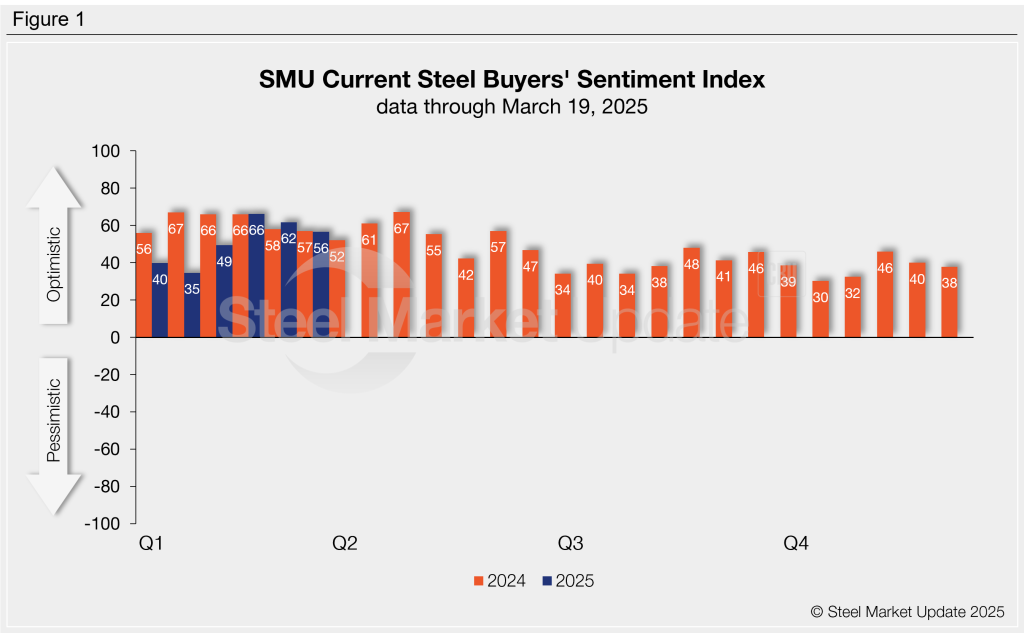

SMU’s Current Buyers’ Sentiment Index fell six points this week to +56 (Figure 1). While down, this is the third-highest reading seen in the past nine months. For comparison, Current Sentiment averaged +48 throughout 2024 and was slightly higher this time last year at +57.

Future Sentiment

Future Sentiment recovered four points this week to +64, almost erasing the five-point decline seen two weeks ago. Prior to this survey, Future Sentiment had trended lower since late 2024, but remains in highly optimistic territory (Figure 2). Future Sentiment averaged +65 across 2024 and stood at +70 one year ago.

What SMU survey respondents had to say:

“Trajectory of trade cases and high import costs will keep our domestic supply chains strong as spreads grow on elevated pricing.”

“Yes, we will be successful, margins will be excellent thanks to rising prices.”

“Uncertainty is a concern.”

“Tariffs are costing us too much money.”

“Imports are somewhat risky given the US Presidents changing tariffs and trade at a whim.”

“From the macro side, there are definite concerns, but our backlog is pretty solid.”

“We buy and sell wisely ensuring our stability and success.”

Sentiment trends

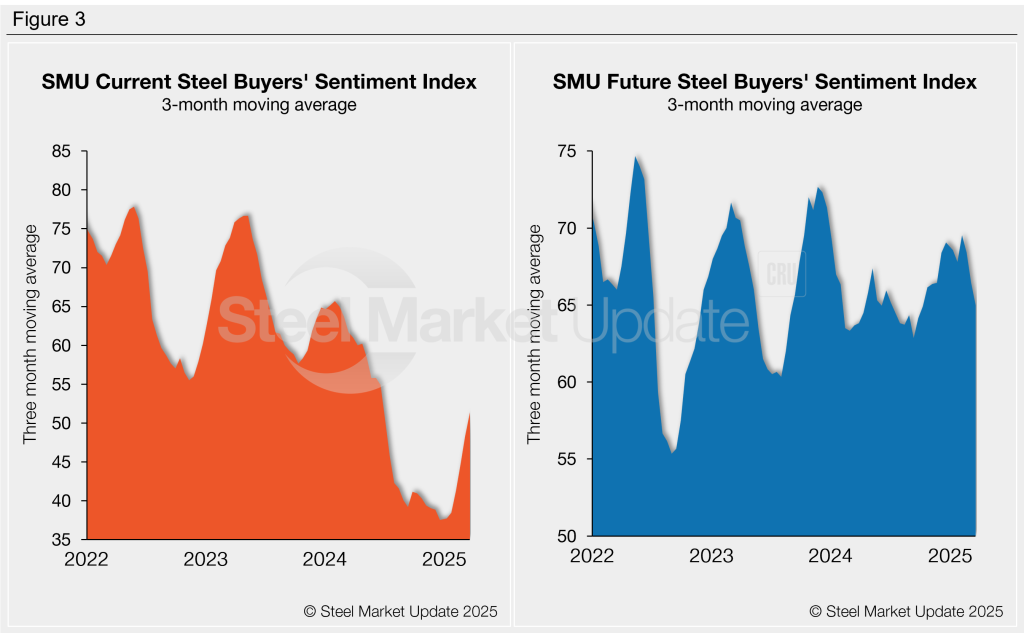

When analyzed as a three-month moving average, Sentiment Indices moved in differing directions this week (Figure 3).

The Current Sentiment 3MMA has been trending higher since the start of this year, increasing to a nine-month high this week to +51.37.

Following February’s 13-month high, the Future Sentiment 3MMA has declined across the past six weeks, now standing at a five-month low of +64.99.

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.