Sheet

March 17, 2025

February service center shipments and inventories report

Written by Estelle Tran

Flat rolled = 58.6 shipping days of supply

Plate = 49 shipping days of supply

Flat rolled

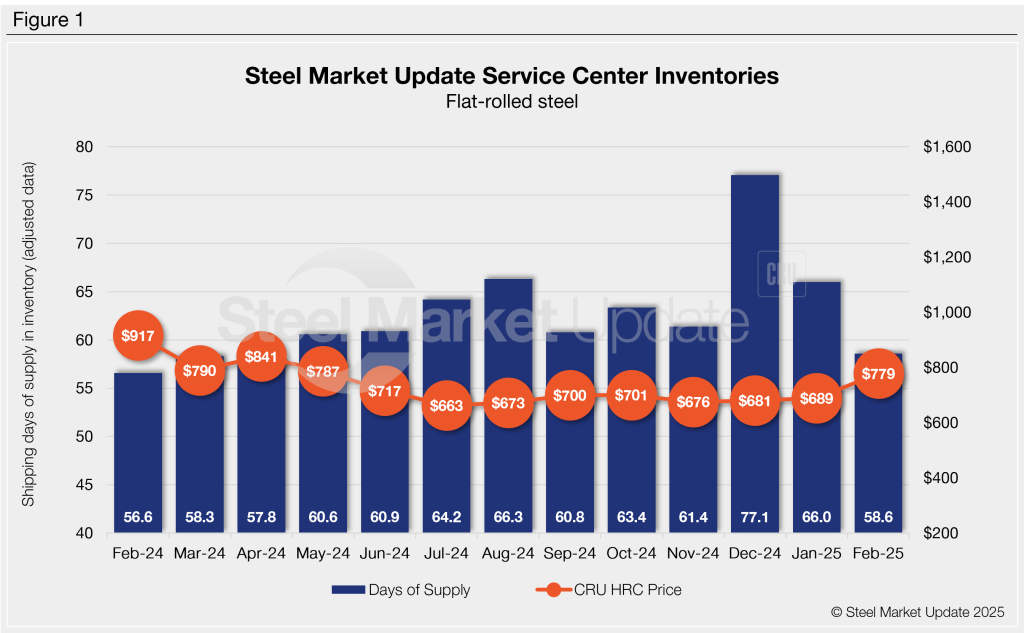

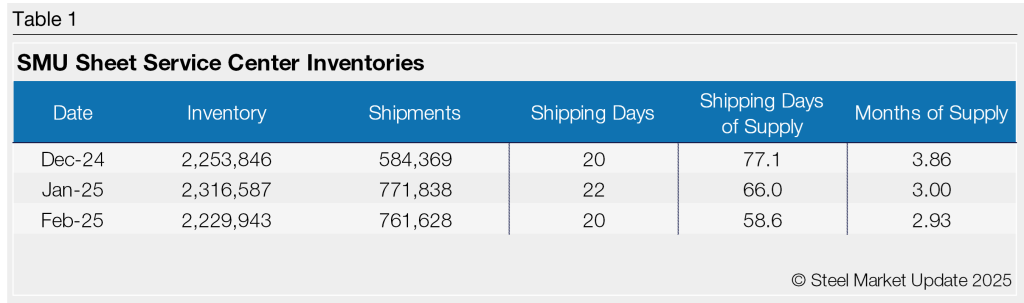

With the rapid run up in prices, US service centers saw a significant pickup in orders that caused flat-rolled steel supply to decline in February. At the end of February, service centers carried 58.6 shipping days of flat-rolled steel supply, according to adjusted SMU data. This represents a sizeable decline from the unusually high level of inventory seen in January, which represented 66 shipping days of supply.

Inventories are still higher than they were a year ago, when service centers carried 56.6 shipping days of supply or 2.7 months of supply in February 2024.

Flat-rolled steel inventories in February represented 2.93 months of supply, down from 3 months of supply on hand in January. February had 20 shipping days, compared to January’s 22. The daily shipping rate in February reached the highest level seen since April 2023, reflecting additional orders from end-users trying to get ahead of tariff-fuelled higher costs.

The latest SMU survey published March 7 showed hot-rolled coil lead times extending to 5.86 weeks from 4.93 weeks the month prior. With extending lead times and the general view that prices will continue to rise, the amount of material on order has risen as well.

At the end of February, service centers shipping days of supply on order moved up vs. January. The amount of flat-rolled steel on order also increased m/m.

With increasing seasonal demand as well as strong orders to get ahead of price increases, we expect intake and absolute inventories for flat-rolled steel to fall again in March.

Plate

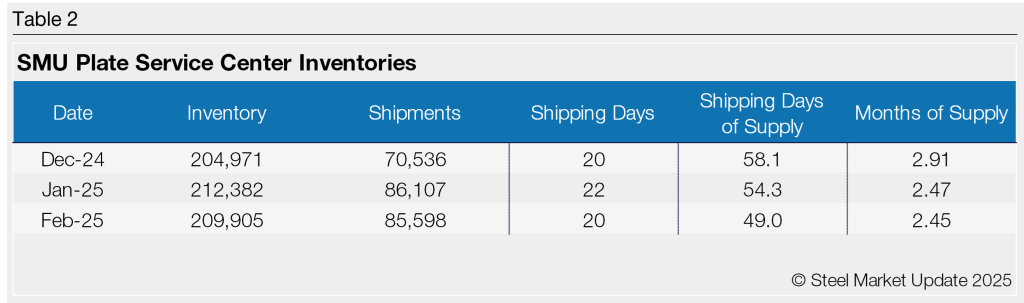

US service center plate supply also fell in February with a pickup in shipments. At the end of February, plate inventories at service centers represented 49 shipping days of supply on an adjusted basis. This is down from 54.3 shipping days of supply in January. Plate inventories represented 2.45 months of supply in February, nearly flat from 2.47 months in January.

In February 2024, service centers carried 58.8 shipping days of supply or 2.8 months on hand.

Plate inventories remain at extremely low levels, especially considering the stronger shipping rate. February’s daily shipping rate for plate hit the highest level seen since April 2023. Plate mill lead times have extended, though market contacts said that mills are controlling order entry. The latest SMU survey pegged plate lead times at 5.47 weeks, up from 4.56 weeks a month ago.

With sparse inventories and surging plate prices, the amount of material on order spiked in February.

Rising demand for plate with lean inventories should keep March inventories still low, even with the boost in material on order.