Market Data

February 18, 2025

SMU price ranges: Sheet and plate on a rocket ship to the moon (or Mars)

Written by David Schollaert & Michael Cowden

Sheet and plate prices surged higher this week on a wave of what some called “panic buying” following the Trump administration’s announcement of stricter Section 232 measures last week.

There were also concerns about availability in some corners, especially with a wave of mill maintenance outages expected in March and April.

By the numbers

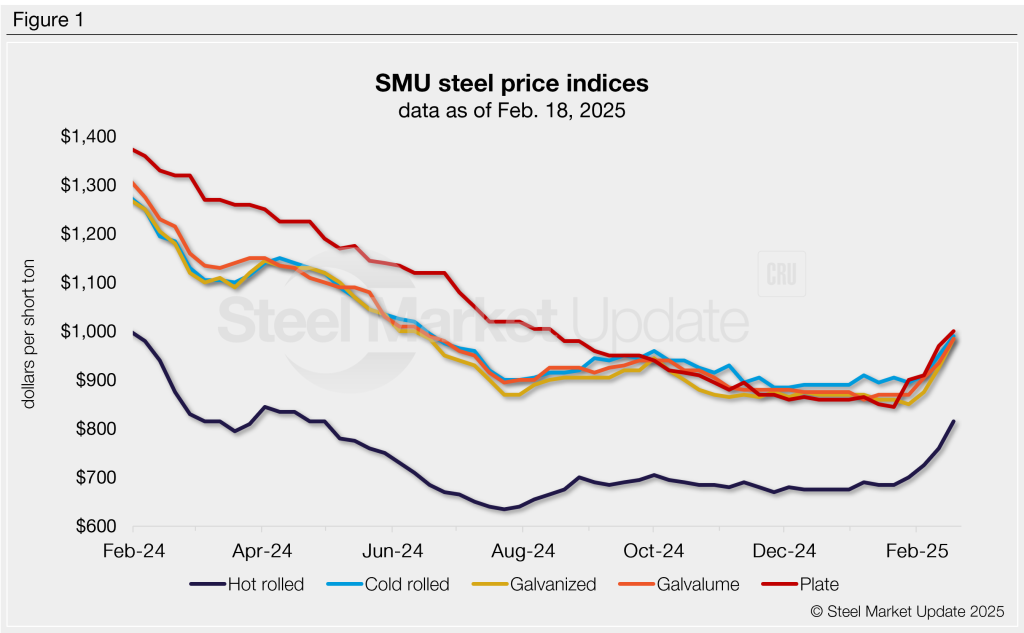

SMU’s hot-rolled (HR) coil price now stands at $815 per short ton (st) on average. That’s up $55/st from $760/st last week and up $140/st from $675/st at the beginning of the year, according to SMU’s interactive pricing tool.

HR prices have not been above $800/st since last April – 10 months ago.

While Nucor’s list price for HR is officially at $820/st, some market participants said they were unable to secure any tonnage above their typical requirements levels – even at that price.

Other mills were said to have increased HR prices to $850/st for HR, while still others were reported to be offering at $900/st or more. Meanwhile, certain mills have closed their March order book and not yet opened for April. There is speculation that when those mills do open for April, it will be at least $900/st for HR.

There have been no official announcements of the latest price hikes. Some sources speculated that it was because the market was moving so quickly, others that no one wanted to be called out for spurring inflation.

It was a similar story for cold-rolled and coated products.

SMU’s CR price now stands at $990/st on average (up $40/st week-over-week). Galvanized base prices are at $985/st (up $60/st) as are Galvalume base prices (up $50/st), according to our latest assessment. We assessed plate prices at $1,000/st on average (up $30/st).

As was the case with HR, mills were said to be raising prices in the absence of official announcements – with some now offering $1,100/st for cold-rolled and coated base prices.

Note that recent offers at $900/st for HR and $1,100/st for tandem products are not yet reflected in our prices ranges. That’s because such pricing is new and has not yet been picked up in transactions that we have tracked.

What they’re saying

Some market participants said the current market could have legs into late spring or early summer. Others think prices could fall back to earth should imports flood in with Section 232 quotas gone or should the Trump administration negotiate exemptions for traditional trading partners like Canada and Brazil. And still others said it was just as probable that the Trump administration, should it see a spike in import licenses, could double the S232 tariff to 50%.

“In the meantime, away we go – the panic buy is in full force,” one Midwest service center executive said.

“It’s like 2021 all over again, at least for a little while. The question is, how high does it go?” a second Midwest service center executive said. “I think $1,000/st is easily obtainable in the next month.”

But a rapid rise in prices could be followed by an equally sharp decline depending on how Section 232 evolves or should its downstream reach cause supply chain issues, he cautioned.

SMU takes no position on that matter. What we can say is that our momentum indicators for all sheet and plate products continue to point upward.

Refer to Table 1 for the latest SMU steel price indices and how prices have trended in recent weeks.

Hot-rolled coil

The SMU price range is $780-850/st, averaging $815/st FOB mill, east of the Rockies. The lower end of our range is up $60/st w/w, while the top end is up $50/st w/w. Our overall average is up $55/st w/w. Our price momentum indicator for hot-rolled steel remains at higher, meaning we expect prices to increase over the next 30 days.

Hot rolled lead times range from 3-7 weeks, averaging 4.9 weeks as of our Feb. 5 market survey. Updated lead times will be published on Thursday, Feb. 20.

Cold-rolled coil

The SMU price range is $930–1,050/st, averaging $990/st FOB mill, east of the Rockies. The lower end of our range is up $30/st w/w, while the top end is up $50/st w/w. Our overall average is up $40/st w/w. Our price momentum indicator for cold-rolled steel remains at higher, meaning we expect prices to increase over the next 30 days.

Cold rolled lead times range from 5-8 weeks, averaging 6.6 weeks through our latest survey.

Galvanized coil

The SMU price range is $920–1,050/st, averaging $985/st FOB mill, east of the Rockies. The lower end of our range is up $30/st w/w, while the top end is up $90/st w/w. Our overall average is up $60/st w/w. Our price momentum indicator for galvanized steel remains at higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,017–1,147/st, averaging $1,082/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-8 weeks, averaging 6.8 weeks through our latest survey.

Galvalume coil

The SMU price range is $940–1,030/st, averaging $985/st FOB mill, east of the Rockies. The lower end of our range is up $40/st w/w, while the top end is up $60/st w/w. Our overall average is up $50/st w/w. Our price momentum indicator for Galvalume steel remains at higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,234–1,324/st, averaging $1,279/st FOB mill, east of the Rockies.

Galvalume lead times range from 5-8 weeks, averaging 7.0 weeks through our latest survey.

Plate

The SMU price range is $950–1,050/st, averaging $1,000/st FOB mill. Our entire range increased $30/st w/w. Our price momentum indicator for plate remains at higher, meaning we expect prices to increase over the next 30 days.

Plate lead times range from 3-6 weeks, averaging 4.6 weeks through our latest survey.

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert