Market Data

January 10, 2025

SMU Survey: Steel Buyers' Sentiment Indices stable to start 2025

Written by Brett Linton

SMU’s Steel Buyers’ Sentiment Indices kicked off 2025 with not much of a bang. Both Indices showed only slight changes from our previous readings, remaining in territory they have been in for several months. Both Sentiment Indices remain in positive territory and indicate that steel buyers are optimistic about the success of their businesses.

Every other week, we poll hundreds of steel buyers about their companies’ chances of success in today’s market and their expectations for the next three to six months. This data is used to calculate our Current Steel Buyers’ Sentiment Index and our Future Steel Buyers’ Sentiment Index, measures tracked since SMU’s founding.

Current Sentiment

SMU’s Current Steel Buyers’ Sentiment Index shows that buyers maintain a positive outlook on business conditions, though they are slightly less confident than in the first half of 2024.

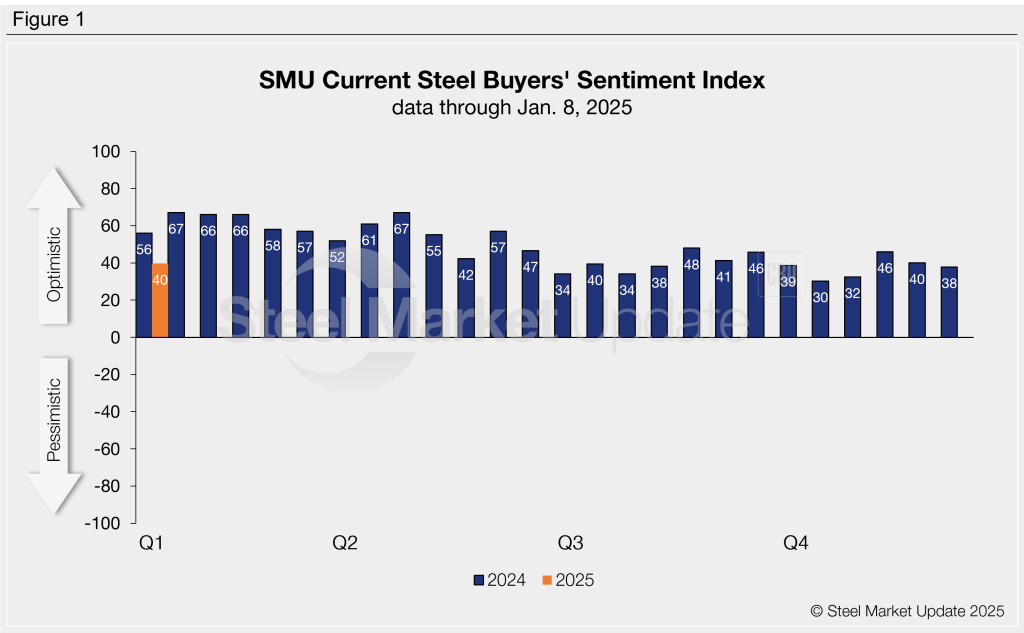

This week, Current Sentiment recovered two points from mid-December to +40 (Figure 1). Sentiment has generally remained within a few points of a multi-year low for over six months. Current Sentiment averaged +48 across 2024 and was significantly stronger this time last year at +56.

Future Sentiment

SMU’s Future Steel Buyers’ Sentiment Index shows that buyers have continued optimism for early 2025 business conditions, marginally better than they felt this time last year.

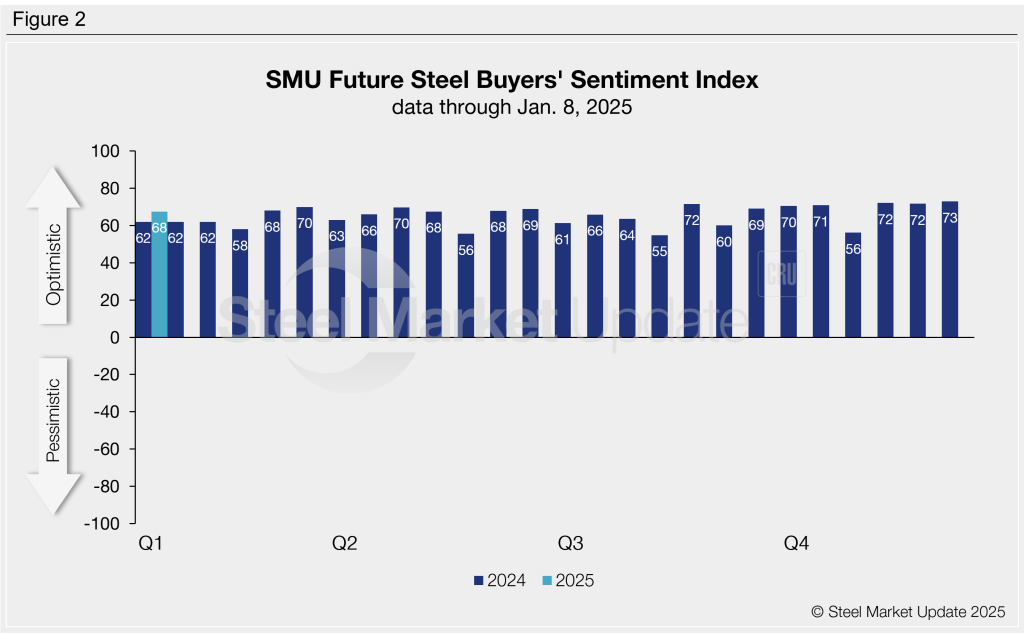

Future Sentiment eased five points this week to +68, the lowest reading recorded since early November (Figure 2). Recall that back in mid-December, Future Sentiment rose to a one-year high of +73. Future Sentiment averaged +65 across 2024.

What SMU survey respondents had to say:

“Spot prices are too low to do well; cost-price squeeze still underway.”

“We have already good backlog for projects later in the year.”

“Contract business is normalizing and spot business is starting to show signs of life.”

“Tarriff risk is creating a very weak environment for buying imports.”

“Optimistic for the future, despite tariffs; prices and availability will allow some additional imports.”

Moving averages

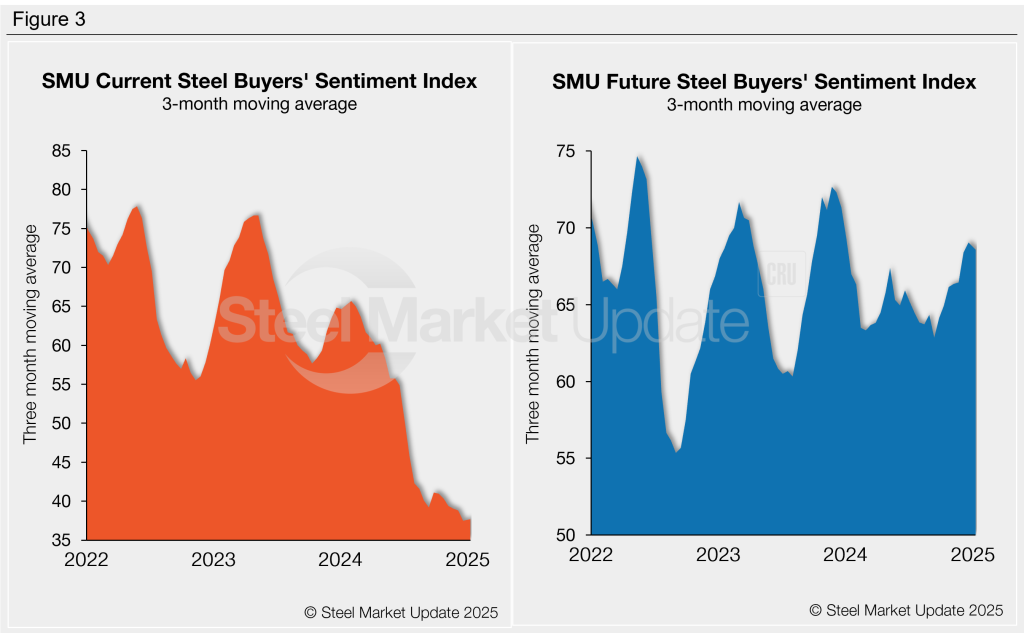

When analyzed on a three-month moving average basis, Steel Buyers’ Sentiment also moved in opposing directions this week compared to mid-December (Figure 3).

The Current Sentiment 3MMA rose to +37.71 as of Jan. 8, only a smidge higher than the four-year low recorded in mid-December. Current Buyers’ Sentiment has trended lower for the past 10 months.

Meanwhile, the Future Sentiment 3MMA broke its consecutive biweekly gains, receding from an 11-month high to +68.58 this week. This measure had trended higher since reaching a one-year low back in September 2024.

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.