Market Data

December 3, 2024

SMU's November at a glance

Written by Brett Linton

SMU’s Monthly Review provides a summary of important steel market metrics for the previous month. Our latest report includes data updated through Nov. 30.

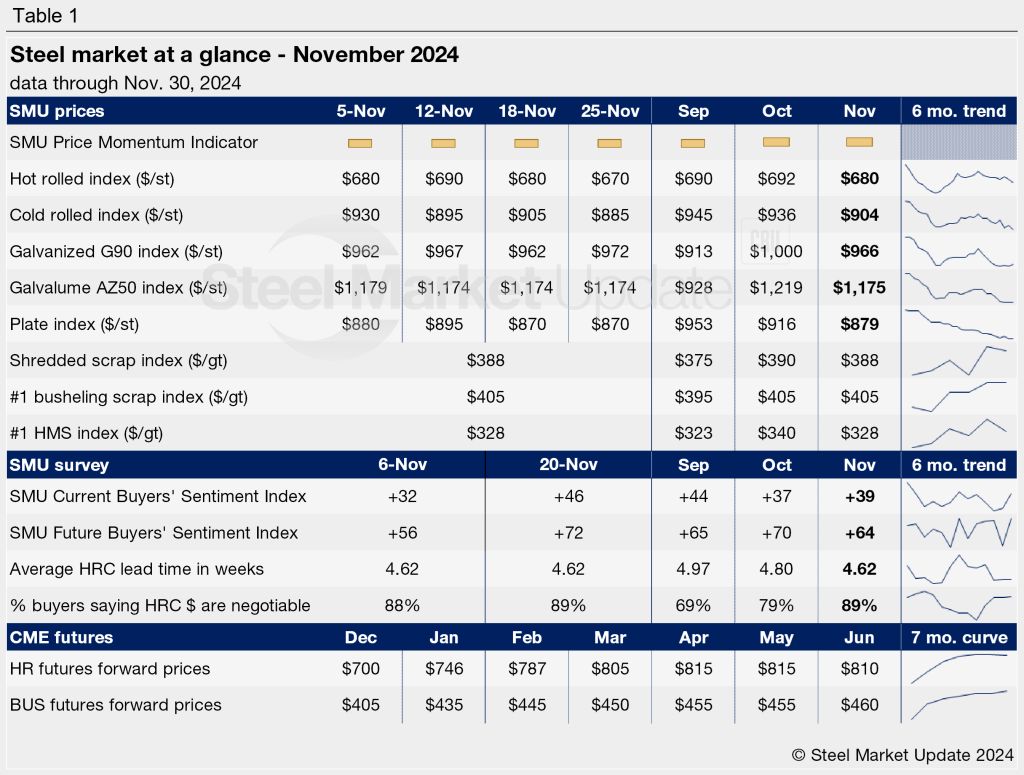

Sheet and plate prices trended lower across the month of November. As of last week, sheet prices remained near multi-month lows, similar to late July/early August levels. Plate prices continued to edge lower from their mid-2022 peak. The SMU Price Momentum Indicator remained at Neutral on both sheet and plate throughout November.

November scrap prices were stable to slightly down compared to October, with busheling holding steady and shredded and heavy melt scrap easing. Buyers are less than optimistic on rising prices as we enter the holiday season, expecting a sideways to down market this month.

Steel Buyers’ Sentiment recovered in November following the four-year low seen in late October. Current Sentiment increased to a two-month high by the end of the month, indicating that buyers are more optimistic about their businesses’ ability to be successful. Through late November, the Future Sentiment Index climbed to the highest measure of the year, suggesting buyers expect favorable business conditions into the new year.

Buyers continue to report short steel mill lead times, holding steady across last month. As of Nov. 22, production times were slightly shorter than levels witnessed three months ago.

By the end of the month, 85% of the steel buyers we polled reported mills are still willing to negotiate new order pricing. Negotiation rates have been high for the majority of 2024, recently peaking in late October.

See the table below for other key November metrics (click here to expand). Historical monthly review table can be found on our website.