Market Data

November 22, 2024

SMU Survey: Steel Buyers' Sentiment Indices rebound

Written by Brett Linton

Following months of fluctuations, SMU’s Steel Buyers’ Sentiment Indices rebounded this week, now at multi-month highs. Both of our Indices remain in positive territory and indicate that steel buyers are optimistic about the success of their businesses.

Every other week, we poll hundreds of steel buyers on their companies’ chances of success in today’s market, as well as business expectations for the next three to six months. We use this information to calculate our Current Steel Buyers’ Sentiment Index and our Future Sentiment Index, measures tracked since SMU’s inception.

Current Sentiment

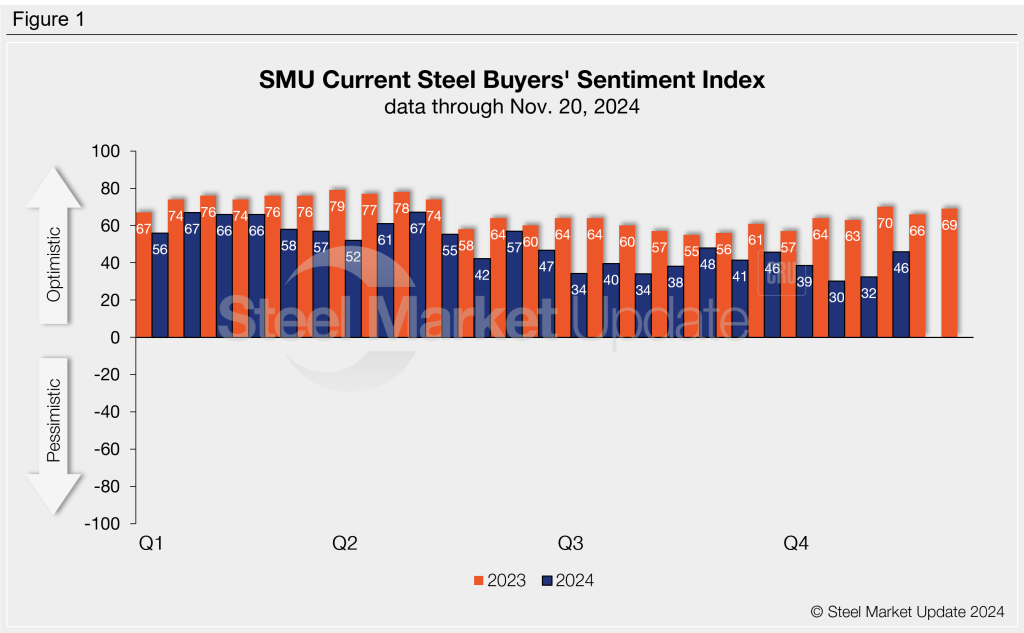

SMU’s Current Buyers’ Sentiment Index jumped 14 points this week, settling at +46 (Figure 1). This is the highest measure recorded since late September. Just one month ago, Sentiment had dropped to the lowest point since May 2020, surpassing the +34 low recorded in July of this year. This time last year Current Sentiment was significantly stronger at +70.

Current Sentiment has averaged +49 across the first 11 months of 2024, significantly lower than the +67 average seen in the same period of 2023.

Future Sentiment

SMU’s Future Buyers’ Sentiment Index bounced back 16 points this week to +72, now tied with late August for the highest reading of 2024 (Figure 2). This recovery follows a 15-point decline witnessed two weeks prior. Recall that in early August, Future Sentiment fell to a one-year low of +55, quickly recovering to a nine-month high just two weeks later. This time one year ago Future Sentiment stood at +75.

Future Sentiment has averaged +65 since the start of the year, two points less than the same time frame last year.

What SMU survey respondents had to say:

“We expect the construction and general manufacturing environment to improve later in Q1’25.”

“We are doing fine and expect to keep growing.”

“Market fundaments are not in balance. Too much domestic supply and too weak demand.”

“Need stronger demand environment, but we are adjusting.”

“Spot prices are too low to make any money.”

“As prices begin to drop at the end of the first quarter, we will squeeze margins to unload inventory.”

“Demand might increase, but high interest rates and higher costs will put a top on demand.”

“Q1’25 will begin an uptick in plate activity in several sectors.”

Moving averages

When analyzed on a three-month moving average basis, Steel Buyers’ Sentiment moved in opposing directions this week compared to early November (Figure 3).

As of Nov. 20, the Current Sentiment 3MMA eased to +39.04. This is now the lowest 3MMA recorded since August 2020. Current Buyers’ Sentiment has trended downward across most of 2024. Meanwhile, the Future Sentiment 3MMA continued to recover this week, rising to a six-month high of +66.44. This measure has gradually increased since falling to a one-year low in September.

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.